My Dow signals are contradicting each other – it’s no time to be trading

In recent days, the Dow has been a nightmare to figure out. At times like these, it's best to let the market alone, says John C Burford.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Traders are always itching to have a trade on if they do not have one. It's as if they feel naked being out of the market. Giving in to the urge to overtrade can lead to many small losses that can really add up.

I confess I was guilty of this sin when I started out it is a common problem.

An over-trader will see every small swing as significant, looking for a signal to take a position before the market runs away.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Most of the time, it is best to let the market alone. As traders, we all want to get on board the next big trend, but in reality, markets spend far more time in consolidation mode than they do making vigorous thrusts in a particular direction. But it is the directional thrusts that provide us with the profitable setups.

Trading in a consolidation zone most often leads to whipsaw losses. You believe the market is moving up. You take a long position, expecting the market to move up out of the zone in a thrust. But the market bounces back down into the zone and hand you a loss.

I love trading the Dow but I'm steering clear right now

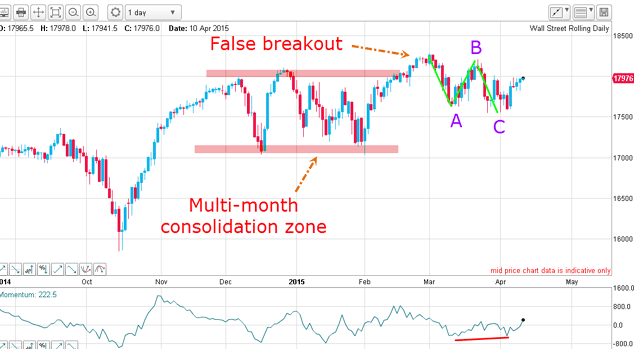

My daily chart is below. From last November to February, the market has traded within the zone contained roughly by my pink bars. Then in late February, the market moved up out of the zone, and it appeared that the upward trend would continue.

Many traders had positioned short in this period and would be expected to have protective buy stops above the zone. These buy stops, plus buying from traders who saw the breakout, would normally provide the rocket fuel for a more vigorous rally leg.

But in March, powerful selling overcame this force and the market retreated back inside the zone. That is normally a bearish sign. But the decline formed on a three-wave A-B-C pattern (corrective) with a small positive momentum divergence at the C wave low. That was a conflicting bullish sign.

So in early April, we had two opposing signals which one would win out?

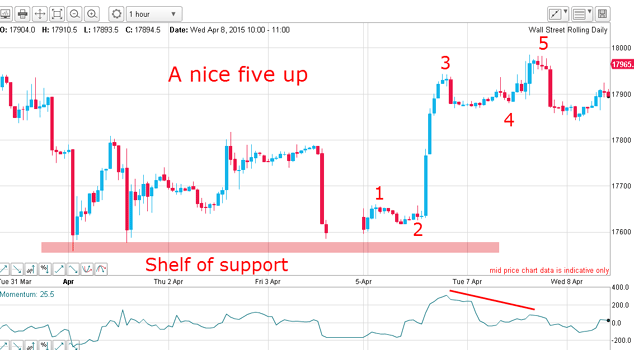

Here is the hourly chart showing the rally starting early this month: the rally has a lovely five-wave form complete with a huge momentum divergence at the wave 5 high:

The equally-valid alternative scenario was for the wave 5 high to represent wave 1 of a larger five-wave affair (or even wave A of a larger A-B-C). This would imply a further move up.

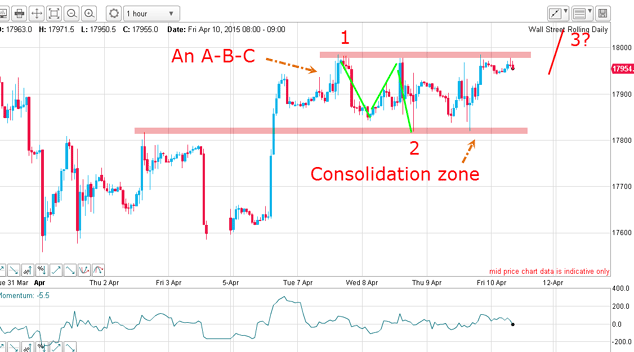

Has the mist cleared this morning?

This makes the above scenario slightly more likely a thrust above the zone in either a wave 3 or a C wave.

But the wave 5/wave 1 high has not yet been decisively broken to the upside.

Because the odds of a break down and a rally from here (Dow at 17,950) appear to be evenly matched, I will stay out of the market until I see the fog clear.

This is no time to be over-trading!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

The ‘mirror will’ flaw which could mean your savings end up with strangers – how to protect your legacy

The ‘mirror will’ flaw which could mean your savings end up with strangers – how to protect your legacyWriting a will lets you pass your wealth onto your loved ones. But couples with a so-called ‘mirror will’ could unintentionally leave their family exposed to being cut out.

-

Saba comes for Edinburgh Worldwide’s board... again

Saba comes for Edinburgh Worldwide’s board... againSaba Capital Management has announced fresh plans to displace the board of Edinburgh Worldwide despite having been decisively beaten in a recent vote