Does your trading mindset hold you back?

To be a successful trader, you have to know yourself and stick to your strategy. John C Burford illustrates the point using the Dow and gold markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I write occasionally in these posts about how critical trading psychology is to your success in the markets.

This is a much-neglected area that most traders push to one side to focus on trading technique or the news. This is a big mistake, as I hope to show you.

Who really wants to be bothered discovering often uncomfortable facets of their personality, and making necessary adjustments to it? Studying price charts and playing with technical indicators is far more fun!

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As is reading all the opinions of the famous experts, of course. But my theory is that when a trader is heavily influenced by the opinions of others, he or she is on a road to nowhere.

In reality, most of us only read opinions that align with our own view. This is what creates a herd.

The good traders I know spend little time reading the opinions of others (other than to judge market sentiment, which is something I use extensively in my work more later).

I know many traders are on a quest to uncover the perfect trading method. "If only I can find that ideal system or indicator, I will be rich!" is their belief.

I have bad news for such traders there is no such perfect system out there.

It is often said by experienced traders that if they had the choice between having a great system and poor discipline to apply it, and a mediocre system and great discipline, they would choose the latter every time.

Discipline matters above all else.

The discipline to enter a trade only when your methods tell you, and the discipline to limit your potential maximum loss, is the mark of a good trader.

Successful traders come in many guises from high-strung gun-slingers all the way through to steady Eddies. Each one has figured out the style that suits them best and every one has strict money-management rules that they apply day in and day out in every trade.

When an aspiring trader asks me how they can succeed, I always ask them what type of personality they have. Many are unable to say without further probing.

I believe any lack of success is largely a result of not knowing yourself not truly understanding your strengths, and especially your weaknesses.

This is a huge area, and is one I explore in my trading workshops, where attendees are asked to complete a basic trading personality test. Many have been surprised by the results!

Successful traders rarely run with the herd and especially not when the herd is gargantuan!

Here are a few current examples:

Gold

When the market hit $1,800 last October, the daily sentiment index reading was a hugely lop-sided 97% bulls/3% bears reading. That was a truly gargantuan bullish herd (over 30 bulls for every bear)!

Who would not want to go long then? After all, virtually all of the pros were exceedingly bullish and who would be foolish or brave enough to go against these experts? Surely, they must know more than me a lowly small trader up against the hedge funds who employ the smartest brains money can buy.

If your psychology is such that you are tempted to join the herd, then you have a problem. Many only become fully committed to a view when all the evidence is in, or when the chorus of opinion shouts only one theme.

But, as usual, the market had other ideas, and a trader who understood the counter-intuitive way the market works (there is a lack of safety in numbers), would be in profit, while those that joined the herd would not be quite so happy, and feeling betrayed.

And as the bullish excess was erased into the late June lows, the bullish herd became transformed into its polar opposite an equally large herd with only 3% bulls and 97% bears.

The news was so negative then, and who would not want to be short gold? It was the majority opinion the obvious position. Many articles appeared explaining how gold was going to $1,000 or even lower.

But right on cue, the market found a low and rallied sharply as many shorts scrambled for cover as bulls were only at 3%. It was a mirror image of the $1,800 high.

The market ran out of any more bulls to convert to bears. That is the key dynamic at work at these market tops and bottoms.

Today, the rally has carried to over $1,400 a target I had in place a few weeks ago and the bullish reading is 87%; still a very lop-sided market. I've recently read many articles forecasting $1,600 gold and much higher.

These are the signs that seasoned traders will be looking at in order to position short gold and silver, as they know the relief rally has likely done its job of reversing majority opinion ready for the next leg down.

Dow

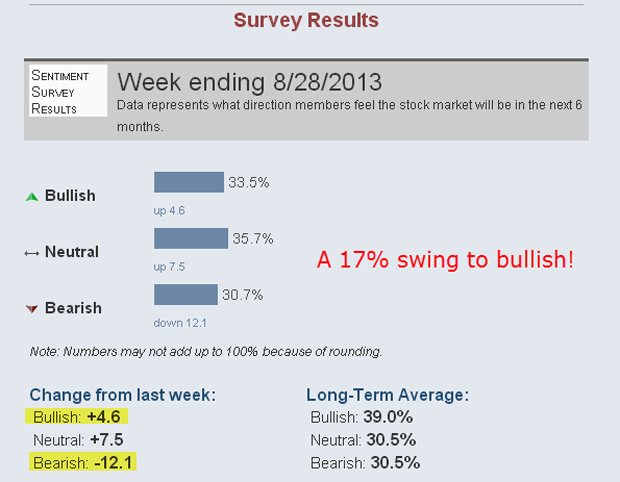

I have been following the US small investor sentiment readings on aaii.com throughout the rally and except for brief periods, the bullish readings have been muted until very recently. Here is the latest data:

Source: aaii.com

At the 28 August reading, when the Dow had declined to the 14,800 level (a sharp fall of 850 points), the public suddenly saw the error of their ways and started buying equities. They did not want to miss the boat again (having missed it for over four years!).

Their timing was perfect. The herd of retail investors now believe either the Fed will continue to support stocks, or the economy will get back on its feet with less Fed support needed. They believe stocks are in a no-lose position they can only go up, whatever happens.

But the latest commitments of traders (COT) data shows a divergence, with the hedgies (non-commercials) reducing their longs as the market fell, as did the small traders (non-reportable). The COT data refers to futures traders, while the AAII data polls retail equity investors two different animals.

Hedge funds evidently are not buying the dips.

| (Contracts of $5 x DJIA index) | Row 0 - Cell 1 | Row 0 - Cell 2 | Row 0 - Cell 3 | Open interest: 103,065 | ||||

| Commitments | ||||||||

| 30,046 | 8,449 | 492 | 56,235 | 80,790 | 86,773 | 89,731 | 16,292 | 13,334 |

| Changes from 08/20/13 (Change in open interest: -5,745) | ||||||||

| -8,273 | 108 | -434 | 5,346 | -7,092 | -3,361 | -7,418 | -2,384 | 1,673 |

| Percent of open in terest for each category of traders | ||||||||

| 29.2 | 8.2 | 0.5 | 54.6 | 78.4 | 84.2 | 87.1 | 15.8 | 12.9 |

| Number of traders in each category (Total traders: 91) | ||||||||

| 26 | 15 | 5 | 37 | 20 | 66 | 37 | Row 8 - Cell 7 | Row 8 - Cell 8 |

To me, the interesting feature is that hedge funds did not increase their short positions a sure sign they do not believe a new bear market has begun. But they are still an overwhelming 3.6to-1 bullish.

If, like me, you are comfortable selling into rallies when majority opinion is heavily bullish (and vice versa), you have a winning psychology. But that must be accompanied by having the discipline to enter your trade when you find a low-risk entry and entering your protective stop accordingly.

If you are cautious, you either need to train yourself to overcome your natural tendency to procrastinate, or adopt a slightly different strategy.

But one thing I do know, my best trades are often taken when I feel danger. When I feel confident, that is often a sign my trade may turn out to be a loser. Trading is often a counter-intuitive activity!

So trading is more a struggle against yourself, than against the markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King