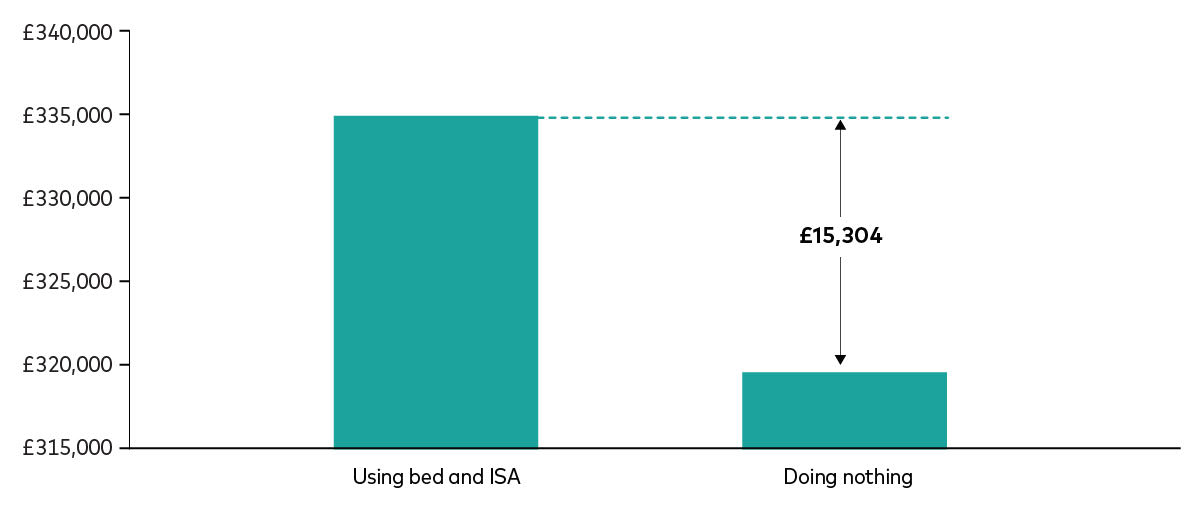

How ‘Bed & ISA’ could save you £15,000 over a decade

Moving your investments into a tax-free wrapper through ‘Bed & ISA’ transactions could save you thousands over the long run by cutting your tax bill

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

‘Bed & ISA’ – it’s a strange name but a useful transaction that could cut your tax bill significantly. Getting clued up on how it works is particularly important in light of recent tax hikes.

In the Autumn Budget, chancellor Rachel Reeves announced changes to capital gains tax (CGT) rules – part of an attempt to balance the state’s books and fund spending and investment plans.

From 30 October, Reeves increased the lower rate of CGT for basic-rate taxpayers from 10% to 18% and the rate for higher earners from 20% to 24%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It comes after CGT allowances have already been slashed in recent years – from £12,300 in 2022/23, to £6,000 in 2023/24, to £3,000 in 2024/25.

Investment platforms had already reported an uptick in ‘Bed & ISA’ transaction volumes in the lead-up to the Budget in anticipation of a CGT hike.

It was the busiest summer ever for broker Interactive Investor, which reported a 27% increase in activity between 1 June and 31 August compared to a year ago. Transactions were up 99% compared to the summer of 2022.

On Hargreaves Lansdown’s platform, transactions are up 44% so far this tax year.

This trend is likely to continue going forward, potentially ramping up in early 2025 as we approach the end of the tax year on 5 April.

But what exactly is ‘Bed & ISA’ and how much could it save you?

Recent analysis from investment platform Vanguard suggests an investor with £200,000 in assets (split between a regular investment account and an ISA) could save around £15,000 over the course of a decade. We take a closer look.

What is ‘Bed & ISA’?

A ‘Bed & ISA’ transaction involves transferring existing assets from a regular account into an ISA wrapper, where any future capital growth or income will be sheltered from the taxman.

All adults have a £20,000 ISA allowance which resets each year. Any returns generated in an ISA are free from income and capital gains tax.

An ISA is a valuable tool which protects not only your capital gains but your dividends.

Once you exceed your annual dividend allowance (£500), dividends are taxed at 8.75% for basic-rate taxpayers, 33.75% for higher-rate taxpayers and 39.35% for additional-rate taxpayers.

It is not possible to move assets directly from a regular stocks and shares account to an ISA account. As such, a ‘Bed & ISA’ transaction involves selling your original investments and repurchasing them within the ISA wrapper. A provider can manage this on your behalf.

Crucially, by selling your assets gradually and realising gains in £3,000 instalments, you can avoid paying any capital gains tax at all.

If you need to realise your gains in larger chunks than £3,000, you will only pay capital gains tax on the portion which exceeds this allowance. See our separate piece on how to cut your capital gains tax bill.

How much could ‘Bed & ISA’ save you?

Analysis from Vanguard shows that an investor with £200,000 in assets could potentially save £15,000 over the course of a decade by using ‘Bed & ISA’ transactions.

In Vanguard’s example, the investor starts off with a general investment account and an ISA, each valued at £100,000. Each portfolio returns 5% per year over a period of 10 years. At the end of the 10-year period, the investor decides to sell the investments.

- Scenario 1: In the first scenario, the investor sells the assets in the general account in one hit and pays capital gains tax at the new higher rate of 24%. The investor is only able to use their annual £3,000 CGT allowance once. Any gains above this threshold are taxed.

- Scenario 2: In the second scenario, the investor depletes their general investment account gradually over a period of five years by moving £20,000 a year into their ISA. This allows them to make use of their annual £3,000 CGT allowance five times.

Vanguard’s analysis shows that the second scenario leaves the investor with £15,304 more, despite holding the exact same investments.

A £200,000 investment over 10 years – using 'Bed & ISA' versus taking no action

Source: Vanguard. The hypothetical portfolio is made up of 75% shares and 25% bonds and returns 5% a year after fees. The calculations are based on a CGT rate of 24%. The investments are sold at the end of the final year.

“Bed and ISA is an effective tool that could be making investors that additional amount to reach long-term goals. This is one example of where paying attention to allowances can significantly deliver for investors,” says James Norton, head of retirement and investments at Vanguard Europe.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.