PayPoint: a promising stock for income-seekers

PayPoint, a household name across Britain, is moving away from its traditional roots toward a digital future. Investors after a steady stream of income should buy in, says Jamie Ward

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

PayPoint (LSE: PAY) is a household name across the United Kingdom, and its yellow brand signs are a staple of the local corner shop. Most people recognise the company for its role in helping customers pay utility bills or top up pre-payment meters with physical cash. However, the business is changing as it moves away from its traditional roots toward a digital future.

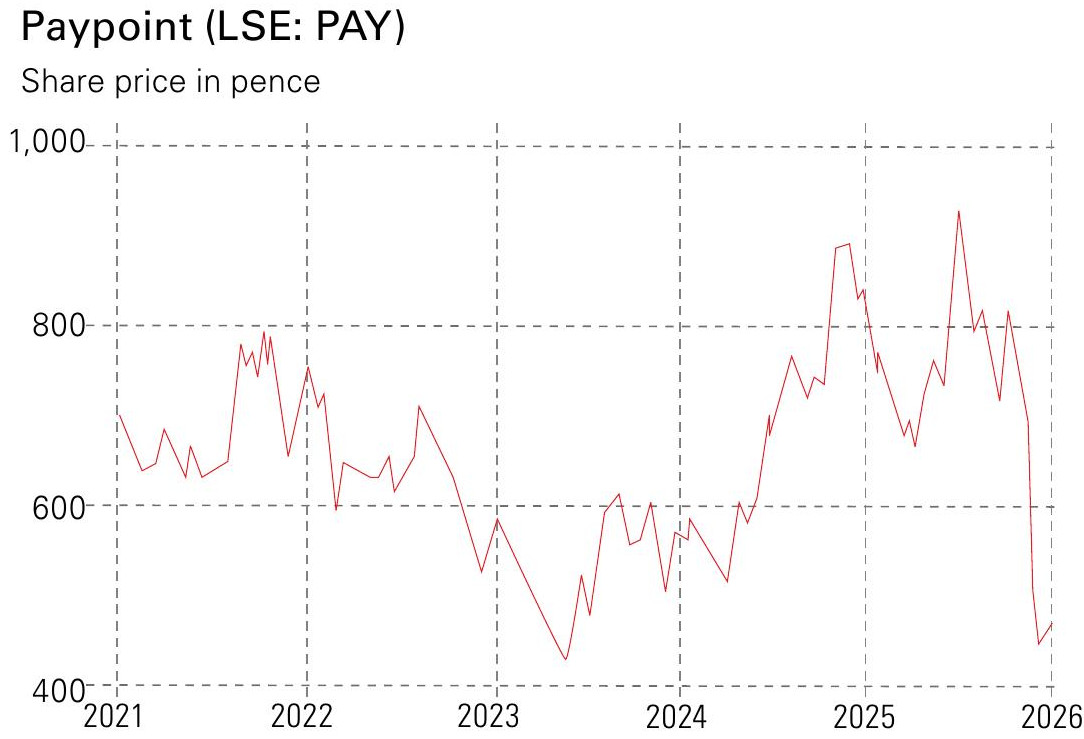

The company is offering other services in an effort to remain relevant in a digital world where cash use is on the decline. The shares’ high dividend yield is attractive to income-seeking investors. However, last year the shares were among the weakest on the UK market, which may present an attractive entry price. But buying is not without risks – the company has to manage its shift from cash to parcels and digital payments wisely.

PayPoint is building community hubs

PayPoint was founded in 1996 and built its business by enabling cash-paying households to top up gas and electricity pre-payment meters in local shops. The company’s ubiquitous “yellow box” terminals became a familiar fixture on British high streets and formed the backbone of its early revenues. This was a successful model during the era when the UK energy market was expanding and many households used pre-payment meters. As we moved more toward digital payments, however, the leadership team realised that relying solely on cash transactions was a risk.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In recent years that team has sold off parts of the business that were not a good fit for the new strategy, while buying companies that would allow for growth. Today, PayPoint operates solely in the British Isles, having sold its Romanian operations. This move allowed the group to focus entirely on the UK and Ireland, and provided the funds to buy Love2shop and to invest in open banking technology.

PayPoint operates through four core divisions, which together support more than 65,000 retail partners. The shopping division supplies shopkeepers with advanced payment terminals, enabling everything from card payments to local banking services through its BankLocal operation. E-commerce leverages the same retail network to handle parcel collection and returns through Collect+, allowing customers to pick up and drop off packages locally. The payments and banking division helps utility providers and charities collect money in the form of both physical cash and digital payments. Finally, Love2shop focuses on gift cards and employee-reward programmes.

Collectively, these divisions drive footfall into local shops by turning them into multiservice community hubs. BankLocal, for example, allows independent retailers to function as local bank branches in areas where high-street banks have withdrawn. This creates a clear incentive for retailers, as customers using PayPoint’s services often make additional purchases while in the store.

The business model itself is highly attractive. PayPoint owns the software and the network, rather than the physical shops or delivery vehicles. As a result, it avoids heavy capital expenditure, keeps operating costs low and generates strong, consistent cash flows.

This cash generation is the reason the company can offer a high dividend yield of more than 6.5% to its shareholders. The company also pays special dividends when it sells assets or performs well. For example, a special payment of 54p per share was made this summer following a deal with Royal Mail. The management team aims to grow these returns further by buying back 20% of the company shares by 2028.

How PayPoint is leaping market hurdles

However, the road has not been entirely smooth and the share price has faced significant pressure recently. One major issue was that the company reported lower profits despite seeing a small rise in revenue. The market was also unhappy when management pushed back a key target of reaching £100million in underlying earnings.

These delays caused the shares to fall by nearly 20% in a single day. There were also operational problems in the parcel division, where merging different delivery networks caused more disruption than expected. Some of the newer parts of the business, such as the open banking service, have also been slower to make money than many had hoped.

The company must also deal with the long-term decline of cash as more people use cards and mobile phones for everything. PayPoint has tried to turn this into an opportunity by offering services for digital banks, but the competition from financial technology firms remains intense. Newer companies such as Square and SumUp, which provide retailers with affordable card readers and point-of-sale technologies, are fighting for the same small-business customers with low-cost payment tools. This puts the business on the back foot as it seeks to evolve. That said, the firm does have the advantage of its large network of retailers already using its services.

PayPoint has also had to settle a legal issue with the energy regulator, which allowed more competitors to enter its traditional market. These risks partly explain why the share price has remained at a lower level, even though the company continues to pay out a lot of money to its investors.

Should you invest in PayPoint?

PayPoint is a business that is trying hard to remain relevant in a changing world. It has moved from being a simple cash-payment service to becoming a technology partner for retailers and a logistics hub for parcels. The management has shown that it is willing to take decisive actions to avoid being stuck in the past.

While there are clear risks from competition and the move away from cash, the business remains very efficient at generating money. For an investor building a portfolio of stocks that pay a high income, this company offers a unique blend of traditional reach and modern services. For investors looking for a steady stream of income, who can look past the recent volatility, PayPoint might be an interesting investment.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jamie is an analyst and former fund manager. He writes about companies for MoneyWeek and consults on investments to professional investors.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton