Coface offers excess profit in an unloved sector

Coface is a world leader in trade-credit insurance with key competitive advantages in a niche market

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Most people have never heard of trade-credit insurance, but without it a large segment of the global economy would cease to function. Trade-credit insurance protects firms against the risk of customers failing to pay, particularly when selling goods or services on credit with extended payment terms, such as 30 or 60 days. If the customer runs out of money or simply refuses to pay, insurance can help cover some of the loss. This risk-absorbing buffer isn’t just a necessity for companies, but also for the economy as a whole. If one large customer goes bust and doesn’t pay its suppliers, the cascade effect on the rest of the economy can be hugely damaging.

The collapse of construction group Carillion is an excellent case study. When it collapsed in 2018, it owed around £2billion to its 30,000 suppliers. The week after it foundered, the Association of British Insurers said just £31million of this was covered by trade-credit insurance. Other suppliers, many of which were small businesses with an average debt of £141,000, had to swallow the loss. The collapse sent shivers through the UK construction sector and pushed thousands of small businesses over the edge.

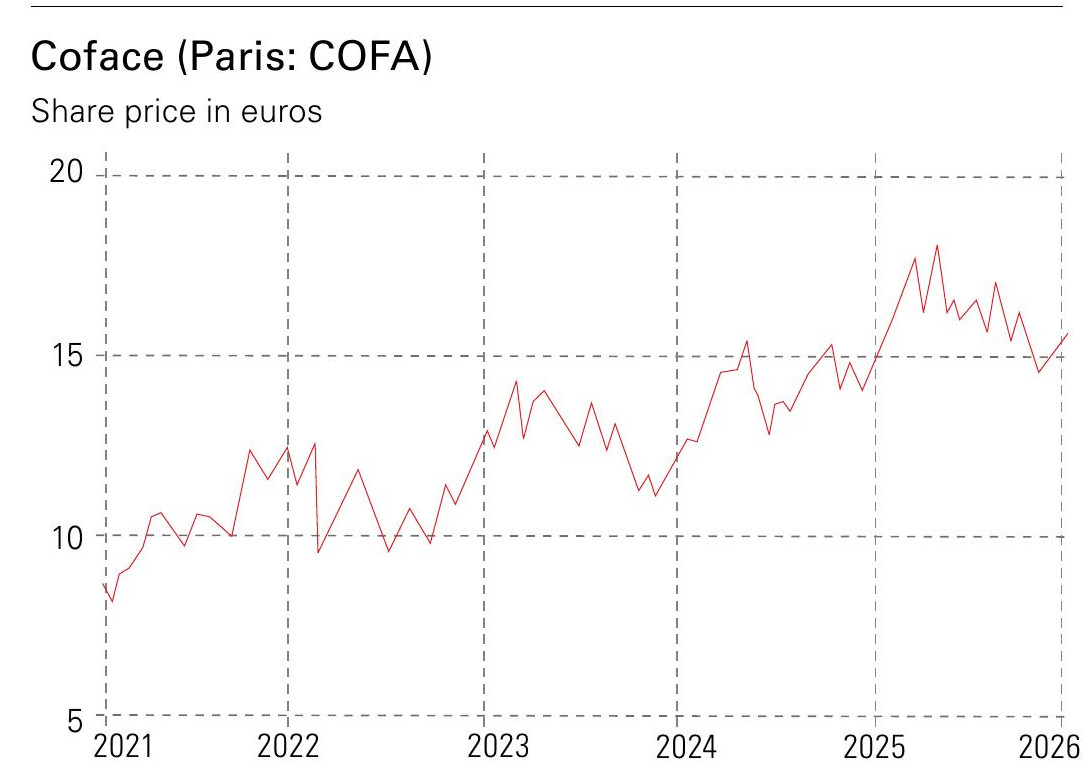

The market for this type of insurance is dominated by an oligopoly, with the “big three” companies controlling 75% of the global market and a number of smaller, state-backed players making up the remainder. Compagnie Française d’Assurance pour le Commerce Extérieur, or Coface (Paris: COFA), was founded in 1946 by the French state to provide a state-backed guarantee for exporters. Over the following decades, the group transitioned from being a state entity to a publicly listed global player, becoming the third largest of the big three. It currently sits behind Atradius and Allianz Trade. The latter has a market share of around 34%.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In today’s globalised world, operating an international trade-credit business requires a large volume of data, proprietary data, and an understanding of international trade risks. Coface operates directly in 100 countries and covers 200 countries through its partners. State backing in its early days helped it build the data needed to underwrite profitably and efficiently around the world. Today, the group has the size and the scale to maintain its competitive advantage, with more than 70 million corporate datasets. Over the past five years, Coface has doubled down on its data advantage.

How Coface uses business intelligence

In 2017, Coface’s management team launched a new product to further monetise the group’s vast corporate credit database. The company launched a business information unit to cross-sell the data it gathers in the normal course of business. Data on the financial health of different businesses is particularly helpful for large global corporations, which can use the information to test the resilience of their supply chains. Customers can also use the data to determine whether they should buy trade-credit insurance in the first place or manage the risk in-house. This might look as if the company is giving away the crown jewels, but the additional gathering, analysis and distribution of data has helped it enhance its own databases.

Analysts at investment bank Berenberg point to Coface’s underwriting margins as a sign of its expanding competitive advantage. During the first nine months of 2025, the company reported a combined ratio (a key profitability metric for insurers) of 71.9% net of reinsurance, below Allianz Trade’s 82.1%, suggesting it is far better at underwriting risk than its larger peer (anything below 100% means the company is underwriting profitably). To put these numbers into perspective, the global reinsurance market as a whole reported a combined ratio of around 90% last year, with the ratios for personal lines and property and casualty closer to 97%.

Since 2017, the data services business has grown to 4% of group revenues and the number of staff employed has grown to around 16% of the group’s 4,800 employees. Initially, management pencilled in 2027 as the break-even year for this division, although it’s now pushing that back as it ramps up investment. Berenberg estimates that revenue here could grow by as much as 15% per annum, driven by growing demand for credit data and the existing size of the market. While trade-credit insurance will remain the company’s most significant revenue line for the foreseeable future, this business of selling and collecting data could become a significant money-spinner for Coface from recurring fees and limited risk.

Should you invest in Coface?

Coface is an established player with key competitive advantages in a niche market. It’s also backed by Arch Capital, a large global reinsurer with a market capitalisation of $33billion (more than ten times that of Coface) and $70billion of assets. Arch bought a 29.5% stake in Coface from Natixis in 2020, a vote of confidence amid pre-Covid uncertainty. The stability provided by having Arch as a shareholder has undoubtedly helped the company compete with Allianz Trade, which is backed by the Allianz parent group with $1trillion in assets.

Despite all of these attractive qualities, Coface is trading at a relatively undemanding valuation. The shares are trading on a price-earnings (p/e) ratio of just 9.4 for 2026 and a price-to-book (p/b) ratio of 1.2. A p/b of around 1.5 times would be more appropriate for such a highly profitable insurer. It has also set a dividend payout ratio of 80% and, on average, has distributed 90% of its earnings since 2020, according to Berenberg’s analysis. Based on current projections, the yield could hit 9.2% in 2026.

Trade-credit insurance might not be the most exciting product around, but it’s a vital part of the economy and, for Coface, it’s a very profitable business. Investors should take note.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom