Better times ahead for China equities?

After significant weakness earlier in 2022, Chinese equity markets have bounced back strongly. But can this improvement be sustained?

After significant weakness earlier in 2022, both onshore and offshore Chinese equity markets have recently bounced back strongly.

In the period from the end of April to July 22, the Shanghai A-share Index outperformed the S&P 500 Index by 11% and the MSCI Emerging Markets Index by 15%. This rebound came after Chinese equities had underperformed for much of the previous year, following the Common Prosperity drive, which began in summer 2021.

The important question for investors now is: Can this improvement be sustained?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Drivers of earlier weakness

A challenging economic backdrop has weighed on Chinese equities since late 2021. The latest consensus expectation is that China’s economic growth will halve to 4.2% in 2022 from 8.4% in 2021.

(1)

This slowdown reflects the country’s ongoing real estate downturn and its zero-Covid policy, which has resulted in economically damaging lockdowns in major commercial centres including Shanghai and Shenzhen. China equity investors have also had to contend with unhelpful regulatory conditions, both home and abroad.

Easing headwinds

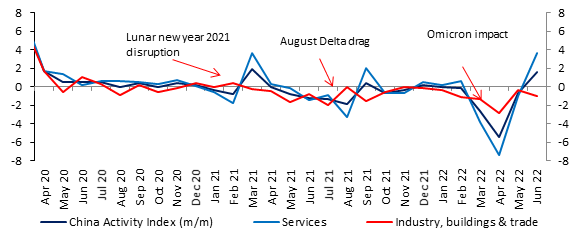

Moderation of some key headwinds has driven the the recent rally in China equities. On the Covid front, China’s zero-tolerance approach has been effective in reducing the number of new cases very significantly. The seven-day average of daily new cases was less than 1,000 as of July 24 — a small fraction of earlier this year, in mid-April, when there was a high of nearly 30,000 cases. This has enabled some controls to be relaxed, including less stringent quarantine rules. This has given way to an uptick in Chinese economic activity lately (Chart 1).

Chart 1: Recovering China economic activity

Source: Research Institute, abrdn, July 2022

On the regulatory side, there have also been clear signs of the new regime bedding down, allowing some easing of pressures. For example, in June, the government gave tentative approval for Ant Group, an affiliate of e-commerce giant Alibaba, to revive its initial public offering in Shanghai and Hong Kong.

Comparatively helpful policy backdrop

Another contributor to improved performance lately has been China’s comparatively much more helpful monetary and fiscal backdrop. Unlike virtually all other major central banks, the People’s Bank of China has not felt the need to join the global trend of sharply raising policy interest rates. On the contrary, since the start of 2022, it has eased policy on multiple occasions through a combination of interest-rate and reserve-requirement cuts. China has been able to adopt this markedly different monetary stance because, compared to the rest of the world, it's experienced very low inflation, which was running at just 2.5% year-over-year in June.

On the fiscal front too, policy in China is more supportive compared to the rest of the world. For example, our economists think infrastructure spending especially could get a significant boost from efforts to bring forward local government bond issuance.

Valuations not prohibitive for further outperformance

Despite the recent rally, the valuation of China equities remains more attractive compared to many global equity markets. For example, the MSCI China Index forward price-earnings (PE) ratio of 11.1 suggests significant cheapness compared to the MSCI US Index and MSCI All Countries World Index, which have forward PE ratios of 16.3 and 14.2, respectively.

(2)

Despite the recent rally, the valuation of China equities remains more attractive compared to many global equity markets.

At the same time, the forward earnings projections for China corporates seem more than adequate. For 2023, consensus estimates are for 7% revenue growth and 4.7% net margin, which would produce 15% earnings-per-share growth, relative to the expected lower base of 2022.

(3)

Risk factors

However, optimism regarding the outlook for China equities should be qualified by respect for some weighty risk factors. First, while restrictions have been incrementally easing in the past two months, the dynamic zero-Covid policy has not been discarded. This means that new restrictions are still possible, although we think that future lockdowns are likely to be much more targeted and adaptive.

Second, the important property sector, which by some estimates, together with related services, accounts for around 25-30% of China’s GDP, remains a headwind. Until further deleveraging is completed, the sector will probably remain vulnerable to adverse news flow. Recently for example, concerns have been rising that mortgage defaults could rise owing to a wave of homeowners joining a nationwide mortgage payment boycott for unfinished homes. However, given potential contagion risk, we expect the authorities to be very proactive in addressing this issue.

Putting everything together

Putting everything together, we think there are enough reasons to be relatively optimistic regarding the outlook for Chinese equities. In particular, the combination of these factors suggests scope for continued outperformance:

- Easing Covid restrictions

- easing regulatory pressures

- Accommodative monetary and fiscal policy

- Relatively undemanding valuations

However, investors would be wise to temper their optimism with due appreciation of the risks, especially regarding the dynamic Covid policy and unresolved stresses in the key real estate sector.

Overall, we think the present environment underscores the need for a selective investing approach that favours Chinese companies with attractive fundamentals, low exposure to the macro risk factors and undemanding valuations.

1 Consensus Economics, 11 July 2022

2 Global Index Briefing: MSCI Forward P/Es, Yardeni Research Inc., 19 July 2022

3 China Equity Strategy - Bullish 2H22 outlook on macro & micro, J.P.Morgan, 22 June 2022

IMPORTANT INFORMATION

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards, and political and economic risks. These risks are enhanced in emerging markets countries.

Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index.

Past performance is not an indication of future results.

Projections are offered as opinion and are not reflective of potential performance. Projections are not guaranteed and actual events or results may differ materially.

US-270722-178356-1

Other important information:

Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered Office: 10 Queen’s Terrace, Aberdeen AB10 1XL. Registered in Scotland No. 108419.

An investment trust should be considered only as part of a balanced portfolio. Under no circumstances should this information be considered as an offer or solicitation to deal in investments.

Find out more by registering for updates. You can also follow us on Twitter or LinkedIn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?