India – the investor blind spot?

Kevin Carter, CIO | EMQQ Global

How could a country that is rapidly emerging as a global economic powerhouse remain largely overlooked by so many investors?

India has historically flown under the radar of global equity investors. Its undeveloped capital markets were difficult to access, expensive, and top heavy. But the launch of the country’s National Stock Exchange in 1992, coupled with government deregulation and a recent surge of tech-stock IPOs, has dramatically shifted the investment landscape.

The barriers that once held back global capital are falling, revealing an investment opportunity that has largely gone untapped.

This year, India is set to surpass Japan as the world’s fourth-largest economy and is on track to pass Germany by 2027. It can no longer be ignored – it's time for investors to take a closer look at this dynamic and fast-growing market.

How India is lifting millions out of poverty

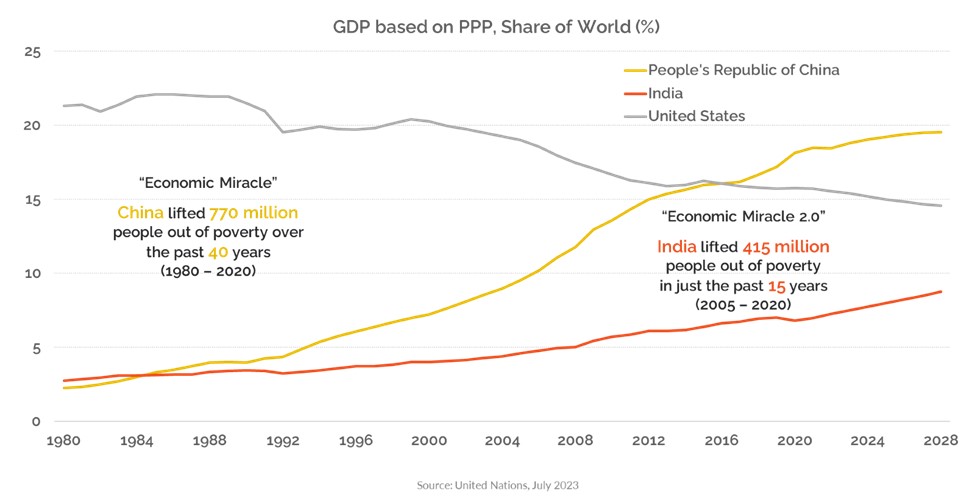

India is experiencing what could be the fastest and largest period of economic growth in history. China’s economic development that started in the early 1980s was dubbed an “economic miracle” as premier Deng Xiaoping embraced capitalist reforms, lifting 770 million people out of poverty and into the middle class over the following four decades.

But now India is setting a pace that outstrips even China’s rise in terms of speed and scale. In just 15 years, 415 million people have been lifted out of poverty – and the trend is accelerating.

India’s historic economic achievement

With its rapidly expanding middle class, a young and dynamic workforce, and a growing tech ecosystem, India is undergoing one of the most transformative economic shifts in modern times.

Global investors have largely missed out on this growth so far. But we believe 2025 will mark an inflection point that will spark a greater awareness of India’s re-emergence on the world stage and of its potential for investors’ portfolios.

India vs China: a tectonic shift begins

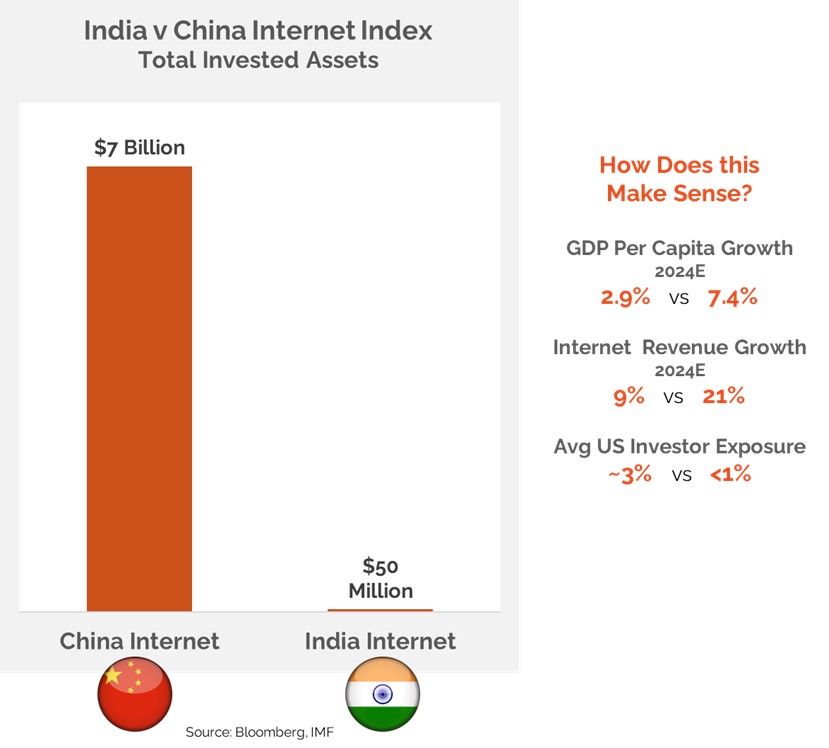

With global investors forced to navigate an increasingly complex geopolitical and financial minefield when dealing with China, India is set to be one of the main beneficiaries.

The shift has already begun and the scale of opportunity is huge. One of the largest China-focused investment vehicles in the world, KWEB (China Internet ETF), had $7bn of assets under management (AUM) as of September 2024. In stark contrast, its Indian counterpart, INQQ (India Internet ETF), had just $60m of AUM – a fraction of KWEB’s size.

This disparity highlights a key moment of transition: the beginning of a shift in investment allocations. As India’s economic renaissance accelerates, it is only a matter of time before investors begin to recalibrate their portfolios, giving India the attention it has long deserved.

Tapping into India’s moment

This tectonic shift is no longer on the horizon, it is already underway, and India’s growth story will continue to unfold in 2025. The Modi government’s pro-growth policies and long-term vision for 2047 have set the foundation for sustained growth, given added momentum from a combination of demographic advantages, market reforms, and significant infrastructure investments.

There are still challenges to overcome – particularly around scaling infrastructure, maintaining stability and fostering inclusive growth. But we believe that the India opportunity is one that global investors can no longer afford to overlook. As India continues to modernise and its economic influence grows, it is becoming a key player in the global investment landscape. Investors paying attention now are in a good position to benefit from the transformation of this emerging market.

While uncertainties remain, India’s potential, particularly in the internet and e-commerce space, is undeniable – and it's certainly worth considering for those looking to diversify their portfolios this year.

One way to access India’s investment potential is through an India-focused ETF like INQQ. Contact your financial adviser or search ‘India Internet ETF’ to find out more.

For professional investors only. Capital at risk. For information on India internet ETFs, contact your professional financial adviser.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how