Will cost-cutting catalyse growth?

Across a broad range of metrics, the UK market looks better value than it has for decades. Laura Foll, Co-Fund Manager of Lowland Investment Company, discusses whether widespread corporate structural cost-cutting, and the resultant earnings enhancements, will trigger the re-ratings necessary for that value to be realised.

UK investors are unlikely to look back on 2020 with enduring affection. In March, as the COVID-19 pandemic took hold, forcing governments worldwide to impose draconian 'lockdown' measures on their electorates, UK PLC found itself staring into an abyss as the wheels of domestic commerce ground to a halt. Despite a Q2 rally – the FTSE All-Share Index rose 25% between its year-end low in March and the end of June – the UK now languishes at the bottom of the pack, all other major regional indices having achieved positive year-to-date returns: as at Christmas Eve, the All-Share was 12.7% down while the FTSE 100 Index has fared worse still, down 14.5%. Even the MSCI Europe (ex UK) Index, which has been one of the worst performers this year, managed to record a positive year to date (YTD) return.1

This lacklustre performance will have come as little surprise to those informed commentators familiar with the many contributory factors coming into play. Without attempting to rank them in order of significance, they include: the strong value bias within UK large caps; substantial weightings to incumbent banks and oil and gas stocks; insignificant weightings to technology and e-commerce businesses seen as 'COVID winners' (particularly when viewed in the light of mega cap tech dominance in the US, for example); the UK government's arguably poor handling of the unfolding crisis; a record number of dividend cuts, a significant proportion of which were imposed by regulatory decree; and the uncertainty engendered by the approaching Brexit transition deadline.

Following a record fall of 19.5% in April 2020, October 2020 GDP is now 23.4% higher than its April 2020 low. It remains 7.9% below the levels seen in February 2020 however, ahead of the full impact of the coronavirus pandemic.2 Forecasts for the decline in UK GDP for the year as a whole average in excess of 11%3, the severest contraction of any of the G7 economies.4

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Government intervention – both fiscal and monetary – at unprecedented levels has undoubtedly limited the scarring however. The final bill will remain uncertain until the crisis is behind us but it will be substantial: in November, the Office for Budget Responsibility (OBR) estimated that the public sector net borrowing requirement would be £394bn for the current financial year (to April 2021), the highest figure ever seen outside wartime and circa 19% of GDP. To put that into context, prior to the crisis the government was expecting to borrow about £55bn for the financial year. With many questions remaining about how the country's escalating debt levels will ultimately be funded, and large tax rises widely anticipated, investors await with bated breath 2021's Spring Budget to begin to get a sense of where Rishi Sunak's axe will fall.

"Stock prices have reached what looks like a permanently high plateau," wrote Irving Fisher, one of the most celebrated economists of his time just nine days before the Wall Street crash of 1929. This now tarnished pronouncement delivers proof, if it were needed, that the forecasting of equity markets is a precarious business. There is light at the end of the tunnel, however. With adversity comes opportunity, and it is materialising in a number of forms:

- Pfizer's announcement in November that its vaccine, developed in conjunction with BioNTech, built an immunity to the disease marked a turning point in the battle against COVID-19, markedly lifting the mood of investment markets. Impressive efficacy results from trials of the Oxford/AstraZeneca and Moderna vaccines have served further to bolster prospects for economic recovery.

- While a number of important issues remain unresolved, an ‘eleventh hour’ post-Brexit agreement on trade – just one week before the transition period between the UK and the European Union came to an end – avoids the disruption of a no-deal Brexit in the middle of the pandemic, and marks a new era after more than 40 years of UK membership of the EU. By avoiding no-deal, the two sides have ensured that UK/EU trade will not be routinely subject to tariffs or quotas, as would otherwise have been the case, and the resulting higher costs to business and consumers in both territories have as a consequence been averted. Ignoring the jingoism propagated by the media, it is a deal for which both sides were genuinely desperate … although there is surely no greater winner than domestic UK companies.

- Operational efficiencies may well accelerate. Office closures and mandatory remote working have compelled firms to eschew old habits and to invest in the organisational overhauls necessary to unlock the potential of new technologies – particularly in the fields of digitisation and automation – while also making better use of existing assets. Ironically, the pandemic, despite the extensive economic damage wrought, has made a productivity boom more likely.

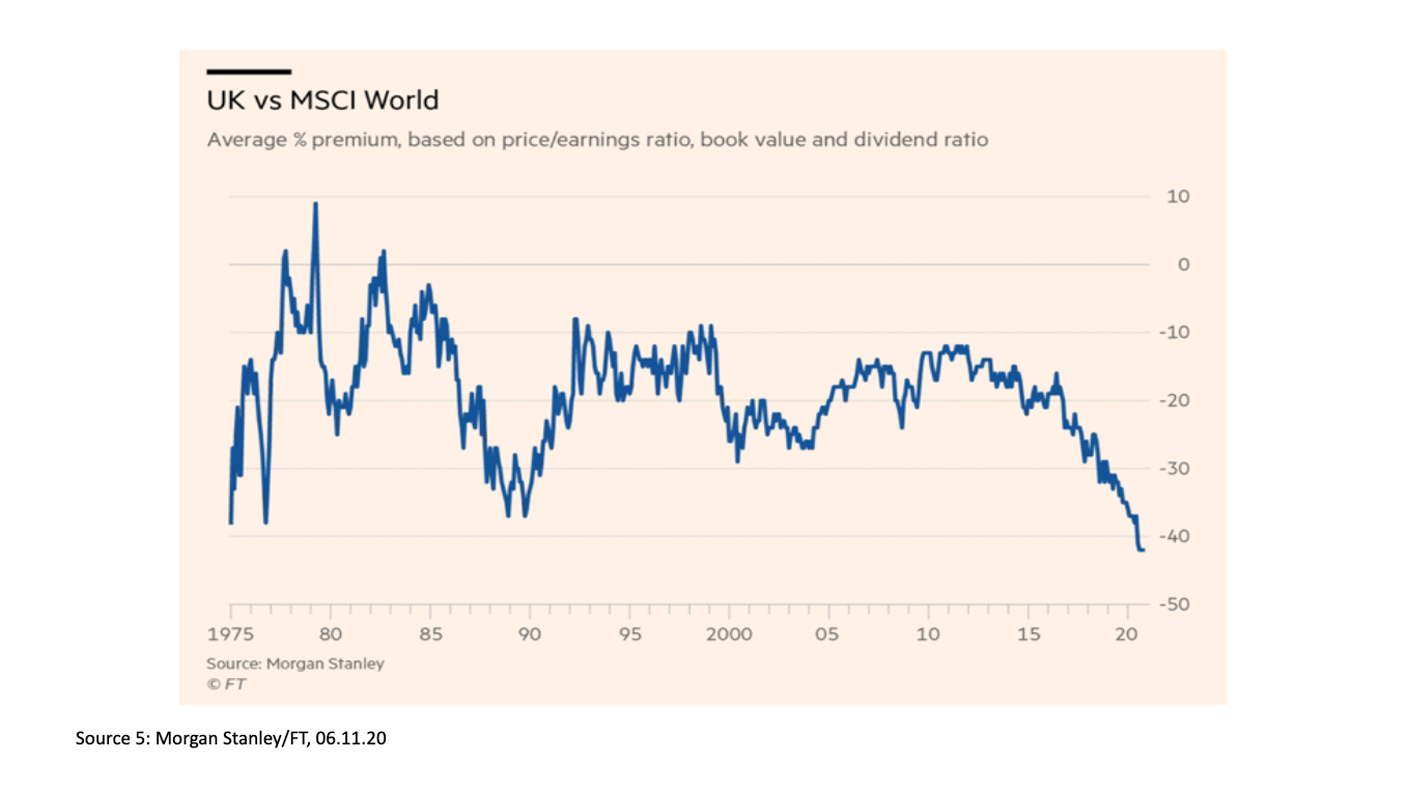

- The UK market looks good value across a broad range of metrics. According to the Financial Times, UK shares are at their lowest valuation relative to the MSCI World Average for nearly 50 years, as measured by a combination of price/earnings, price/dividend and price-to-book ratios5. Not since 1973, when the UK was reeling from an oil price shock, global economic dislocation, widespread strikes, fuel shortages and power cuts, has there been a comparable valuation environment.

While the UK government has little if any current scope to cut its expenditure, one of the more seminal factors giving cause for optimism at the corporate level is the widespread strategic restructuring of cost bases currently being undertaken by businesses of all kinds – a phenomenon observed and welcomed by Laura Foll, Portfolio Manager of the Lowland Investment Company, a UK-focused investment trust within the Janus Henderson stable. The trust's recent performance has been strong, with the share price and net asset value both well ahead of its FTSE All-Share benchmark over the last six months on a total return basis.6

In her view, good management teams are those which, when tested, can demonstrate an innate ability to deal with the unexpected. Capital spending by corporates is likely to remain low – the OBR forecasts business investment rising less than 2% next year – and so the economic downturn has rather forced executive teams to take a more forensic look at their companies’ spending and to embark on a fundamental rethink of their business models in order to navigate the turmoil of the pandemic. Laura has been impressed to observe how many of the companies within the Lowland portfolio have confronted the challenges of COVID-19, and she has made further investments in companies already in the portfolio where management teams are tackling the problems they face robustly, such that they can be well-positioned to emerge from the downturn with a stronger product or service proposition.

Many have accelerated cost reduction plans, that would have taken up to three years, to as little as 12 months. While some of these cuts are expected to be temporary, others – such as the closure of manufacturing sites, or a smaller real-estate footprint as employees increasingly work from home and customers migrate to online purchasing – are permanent and will therefore yield long-term savings. Given that business closures reduce competition, she is also keen to reiterate the observation that those businesses which do survive the worst ravages of the pandemic will emerge into an environment in which they find themselves benefitting from the 'double whammy' of a subdued competitive landscape and a leaner cost base. Therefore, when sales recover (and it is a 'when' in Laura's view rather than an 'if'), the drop-through to earnings could surprise positively, at a time when valuations are low.

While cost-cutting is a widespread phenomenon, Laura cites the industrials sector as well placed to benefit from rising margins as sales recover: "The level of cost savings is particularly encouraging in that sector. We've seen a large number of companies use the pandemic to look very hard at the cost base and, in a number of cases, close facilities that will not be re-opened. These permanent cost reductions should mean that, when sales recover, the cost base will be lower than expected and, as a direct consequence, earnings should recover more rapidly than expected."

To conclude, the portfolio manager's view, taken in the round, is that the UK could perform well in the context of a sustained global economic recovery in 2021. A recent notable pickup in UK takeover activity validates this view; in recent weeks there have been bids across a broad range of sectors, with both small and large companies targeted by a mixture of industry and private equity buyers. If the equity market is not willing to put UK companies on valuation multiples comparable with international peers, perhaps there are other buyers that will.

Discover the latest research and insights on investment trust investing from Janus Henderson

102.01.20 to 24.12.20

2Source: Office for National Statistics, 10.12.20

3Source: HM Treasury, Forecasts for the UK economy: a comparison of independent forecasts, December 2020

4Source: OECD Economic Outlook, December 2020

5Source: Morgan Stanley/FT, 06.11.20

6Source: Morningstar, as at 30.11.20

Glossary

Cost bases: the costs involved in operating a company or making a product

Large capitalisation: a company with a market capitalization value of more than $10 billion

Price/earnings ratio: the ratio of a company's share price to the company's earnings per share.

Price/dividend ratio: the ratio of the price of a share to the dividends per share paid in the previous year, used as a measure of a company's potential as an investment.

Price-to-book ratio: compares a company's market value to its book value. The market value of a company is its share price multiplied by the number of outstanding shares. The book value is the net assets of a company.

Not for promotional purposes. Not for distribution in European Union member countries; past performance is not a guide to future performance.

Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. [Past performance is not a guide to future performance]. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. [Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change]. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. [We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.]

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Capital International Limited (reg no. 3594615), Henderson Global Investors Limited (reg. no. 906355), Henderson Investment Funds Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

[Janus Henderson, Janus, Henderson, Perkins, Intech, VelocityShares, Knowledge. Shared and Knowledge Labs] are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how