Summary

- Donald Trump’s second term as US president is underway.

- Trump won the election for his second term in November.

- On day one, Trump threatened 25% tariffs on imports from Canada and Mexico.

- Trump has also announced Stargate, a $500 billion artificial intelligence initiative.

- Experts fear that some of Trump's policies could be inflationary, both for the US and the global economy.

Good morning, and thanks for joining our live blog. Dan McEvoy and Katie Williams here to take you through what promises to be an eventful day for global markets, as Donald Trump is inaugurated as US president for the second time.

The Trump timeline

Before we get going on the analysis of what Trump’s second term in the White House could mean for markets, let’s have a look at some key milestones that we’re expecting today. All times are GMT unless specified otherwise.

There will be a service at St John’s Church followed by tea at the White House with the Bidens in the morning, though the Trump-Vance inaugural team have not confirmed precise timings for these.

However, the next item on the agenda – the swearing-in ceremony in the US Capitol – always takes place at midday on the US East coast – so 5pm in the UK.

There will likely be some big moves as Trump takes office, even though there will be no policy passed today. Previous inauguration speeches have given indications of the direction of travel for an administration, and this is likely to be especially so for Trump.

The S&P 500 opened 1.5% for Joe Biden’s inauguration in 2021, but fell back 0.1% during the day from there. With US markets closed for Martin Luther King day today, however, we’ll have to wait until tomorrow to see how the index reacts this time around.

READ MORE: Is the US economy set for success?

Tariff turbulence

The market turbulence that could accompany Trump’s inauguration is in no small part related to the inherent unpredictability of his administration, indeed of the man himself.

“UK investors should brace for some volatile patterns of trading on the financial markets,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown. “Some of the turmoil we’ve already seen on financial markets is likely to continue as speculation swirls about Donald Trump’s trade policies once he’s back in the White House.”

Some of Trump’s stated aims – like reducing corporation tax and streamlining the government’s bureaucracy – are ostensibly business-friendly.

However, his proposal of levying steep tariffs on imports across the board have spooked markets.

“US exporters are likely to be hit by higher tit-for-tat duties in return if Trump introduces widespread tariffs,” says Streeter. “It’s likely that a fresh round of trade wars will be inflationary as the higher tariffs feed through to higher prices for goods in American shops. This, in turn, may add to clamour for higher wages. Already concerns that this will drastically limit the Federal Reserve’s capacity to reduce interest rates has rattled bond markets, pushing up government borrowing costs.”

READ MORE: Will Trump's tariffs trigger high inflation in the US?

The art of the deal

It’s far from guaranteed that Trump will be able to enact tariffs, or that he’ll even try to, on the scale that has been rumoured.

The Washington Post reported in early January that Trump’s aides were discussing a pared-back tariff regime that would only apply to critical imports. While Trump was quick to dismiss the rumours, the story plays into a general perception that Trump’s bark is often worse than his bite.

Trump has as good as confessed, in his book Art of the Deal, that he often adopts a seemingly-ridiculous stance at the outset of a negotiation, in order to obtain a better price. Having promised to take a heavy-handed approach to foreign policy, Trump’s bluster about tariffs could all simply be a negotiating tactic in order to eke out more from the global leaders he will be speaking to early in his tenure than he might otherwise.

“No-one, but no-one, knows what Trump is going to do,” Russ Mould, investment director at AJ Bell, told MoneyWeek.

There is also the fact that any policies he tries to introduce will need to be negotiated through Congress. With a tiny Republican minority in the House, that’s not a given, even for a veteran dealmaker like Trump.

With all that in mind, Mould suggests that investors shouldn’t try too hard, just yet, to protect their portfolios against potential Trump tariffs.

“We still don’t know whether Congress will help or hinder [a tariff regime],” he says. “Until we know what Trump is proposing and what is actually implemented, it is very hard to form a view, either way.”

Trump-friendly funds

While some experts advise against trying too hard to play the Trump presidency, t’s good to have an idea which investments could provide a measure of protection against any negative fallout, whether that’s to add to a portfolio now or to keep an eye on as the administration’s agenda unfolds.

“Trump will have a lot on his plate when he returns to the White House, facing challenges ranging from a heavily indebted America with a soaring budget deficit to two major conflicts on the global stage,” says Alex Watts, fund analyst at interactive investor. “Beyond the volatility that these challenges may bring, investors can start to identify areas and sectors that might benefit from the policy direction of Trump 2.0.”

Watts picks out the Artemis US Smaller Companies Fund, the FTF Clearbridge Global Infrastructure Fund and the Neuberger Berman US Multi-Cap Opportunities Fund as funds that could benefit from Trump’s domestic focus and particularly his intention to rebuild US infrastructure.

Watts also picked out digital assets, particularly Bitcoin, as an asset class that responded positively to Trump’s election win, largely as Trump is expected to be friendly to the space.

Although Paul Angell, AJ Bell head of investment research at AJ Bell, echoes Mould’s view that investors shouldn’t “twist and turn with the wind” of political shifts or attempt to “second guess what the next four years could mean for global stock markets”, he does offer up four funds that “may remain on the radar of investors as the US undergoes a change in presidential administration”: Artemis US Select, Artemis US Smaller Companies, iShares Core S&P 500 ETF and JP Morgan US Equity Income.

Victoria Hasler, head of fund research, Hargreaves Lansdown, meanwhile, recommends that investors consider Artemis US Smaller Companies and Rathbone Global Opportunities – which offers global exposure alongside “expert” active management from James Thompson – and Troy Trojan, a defensive fund that offers “some shelter in turbulent times”.

Ripples from across the pond

What have Trump’s policies got to do with the pound in your pocket? Given that the US is our largest trading partner, accounting for 22% of UK exports and 13% of UK imports in 2023, the answer to that question is: quite a lot.

“Donald Trump threatened to introduce universal tariffs of 10-20% on all imports (and up to 60% in the case of Chinese imports),” says Jason Hollands, managing director at Bestinvest, the online investment platform. “If such measures are quickly introduced, this would prove a significant financial shock.”

The impact of any direct tariffs imposed on the UK isn’t the only thing you need to consider. Supply chains are intricate, global webs of interdependence. This means businesses and consumers would also feel the effects of a wider trade war, including measures imposed on the likes of China and the EU.

By disrupting global trade, tariffs would push up costs for businesses throughout their supply chain and add to inflationary pressures felt at home in the UK. Inflation is already expected to pick up again in 2025 thanks to other pressures, like rising energy prices and tax changes announced in the Autumn Budget. Wide-ranging tariffs could compound the issue further.

Trade secretary: UK in “greater” danger than some other countries

Trade secretary Jonathan Reynolds has expressed concern about the possibility of a trade war, arguing that the UK could be particularly vulnerable. “The UK is a very globally-oriented economy so the exposure and the danger to the UK is actually greater than even some comparable countries,” he said.

Despite this, he told Sky News that Trump was more focused on China and the EU as a result of trade deficits with those regions. He also expressed optimism about opportunities to further improve US-UK relations.

“We’re well prepared for this, we’ve got a good argument to make, and I think there is a chance, actually if we play this right, to get an even better relationship out of some of these things that have been put forward,” Reynolds said.

FTSE 100, gold and Bitcoin up

The FTSE 100 has gained 0.3% this morning, approaching a new intra-day high in the process.

“After reaching an all-time high on Friday there seems little to spark a pull-back, with US markets shut for Martin Luther King Day,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown. “With the UK no longer in the eye of the storm when it comes to market turmoil, it’s helping improve investor sentiment.”

“However, all eyes will be on Donald Trump’s inauguration later as the 47th President of the United States and his comments are likely to hold sway on markets.”

His signalling vis-à-vis any potential tariff regime is likely to be the biggest factor here. The uncertainty around Trump’s plans for the US and, by extension, the global economy has pushed gold up 0.1% this morning, as investors make for the safe haven asset in the face of an unpredictable few months.

Bitcoin is also making strides: the cryptocurrency is up 2.9% this morning and 15.4% in the year to date, to record highs of around $108,000, as investors expect the new administration to take a crypto-friendly stance.

Dollar nears new highs

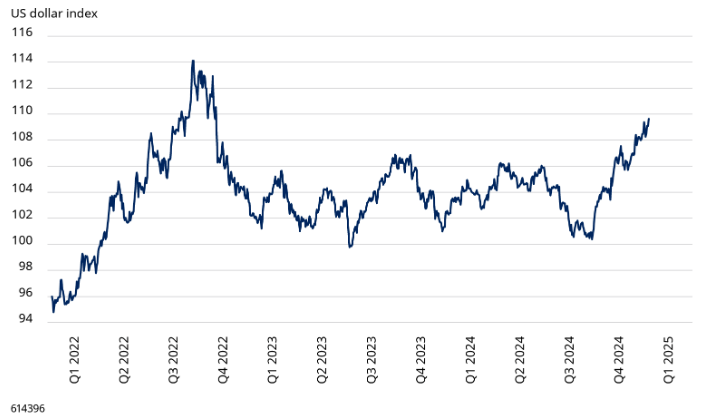

Besides their more digital incarnations, regular currencies have made some significant moves in the run-up to Trump’s inauguration.

The US dollar has neared new highs in recent weeks, as expectations rose for higher interest rates and superior growth in the US, compared to other regions.

The US dollar index is a measure of the value of the US dollar relative to a basket of foreign currencies. Past performance is not a guide to future performance and may not be repeated.

“Any imposition of tariffs would tend to be supportive of the dollar because it would go some way towards equalising out the impact of tariffs on trade and activity,” says David Rees, senior emerging markets economist at Schroders. “We also expect support from interest rate differentials to re-emerge, so a stronger dollar is likely to remain for a while longer.”

However, the US dollar index has fallen 0.3% this morning, while the pound has gained approximately the same amount against the dollar.

More than 200 executive actions expected today

Trump is expected to sign more than 200 executive actions today. The BBC reports that this will include executive orders, which are legally binding, as well as other directives like proclamations, which are not.

The incoming president has previously indicated that trade tariffs could be among his “day one” policies. Other areas of focus could include immigration and the US border, reversing Joe Biden’s climate policies, and dissolving existing diversity, equity and inclusion policies.

An early winner

One early winner from the Trump presidency is ByteDance, the Chinese-headquartered firm that owns video-sharing app TikTok.

A Biden-era ban on the app was temporarily enforced on Saturday, blocking US users from the app.

By Sunday, however, Trump had vowed to reinstate the app, and access was resumed.

It’s a little surprising, especially for anyone that thinks a protectionist, anti-China stance will offer a straightforward categorisation of Trump’s agenda. Meta (NASDAQ:META) shares gained 2% on Friday, as ByteDance’s appeal against the ban was unanimously rejected.

Meta’s CEO Mark Zuckerberg has recently signaled his support for Trump by removing factcheckers across its platforms, including Facebook and Instagram – much as close Trump ally Elon Musk did when he took over Twitter (now ‘X’).

Trump has seemingly turned down the first chance to return the favour, though, in reinstating one of Meta’s biggest social media rivals.

“As of today, TikTok is back,” the incoming president declared at a “victory rally” in Washington DC on Sunday.

What did the S&P 500 do in Trump’s first term?

US markets are closed today in observance of Martin Luther King Jr. Day, which is a federal holiday. But what might we expect from the S&P 500 based on Donald Trump's previous term in office? In short, the outlook appears positive. During the first 12 months of Trump's first administration, the S&P 500 increased by 19.4%, on the back of a 5% rally during his first 100 days in power. During the whole of Trump's first term, the S&P 500 jumped almost 70%.

Tesla’s “Trump bump”

Tesla has enjoyed a significant “Trump bump” in recent months. The share price is up more than 70% since the start of November, a remarkable turnaround for a company that spent much of 2024 in the red. Retail investment platform Interactive Investor reports that Tesla has been the third most-bought investment on its platform since Trump’s election win on 6 November.

The share price hit a new all-time high in mid-December, before losing some of these gains in the final two weeks of the year. It has been picking up again over the past couple of weeks in the lead-up to the inauguration.

The latest share price moves are perhaps unsurprising. Tesla’s chief executive Elon Musk has a close relationship with Trump and has been given a key advisory role at the heart of Washington, leading the new Department of Government Efficiency. The New York Times reports that Musk is expected to use office space in the White House complex, giving him “significant access” to the incoming president.

Do tariff concerns miss the point?

As always with Donald Trump, the big statements have garnered the most attention. From promising the biggest mass deportation of migrants in US history to hinting he might invade Greenland, he is never far away from a controversial declaration.

As such, his promise to impose swingeing tariffs have dominated the financial discourse ahead of his inauguration.

In the view of David Coombs, head of multi-asset investing, Rathbones Asset Management, this distracts from some of his more substantial objectives.

“There’s a risk that Trump’s touted policies (big tariffs on trade, big tax cuts for households and businesses, and a clampdown on both legal and illegal immigration) will send inflation higher,” he says. “We think people are putting too much weight on these areas and ignoring his ambitions on slashing government spending.

“Trump often talks big at the outset, only to negotiate a compromise at the end. To that end, some of the tariffs may be much smaller or not happen at all. Similarly, tax cuts may not be as large as some hope. But if he and Elon Musk’s Department of Government Efficiency manage to slash a significant amount of federal spending, the tax-cuts’ net effect on inflation may be negligible.”

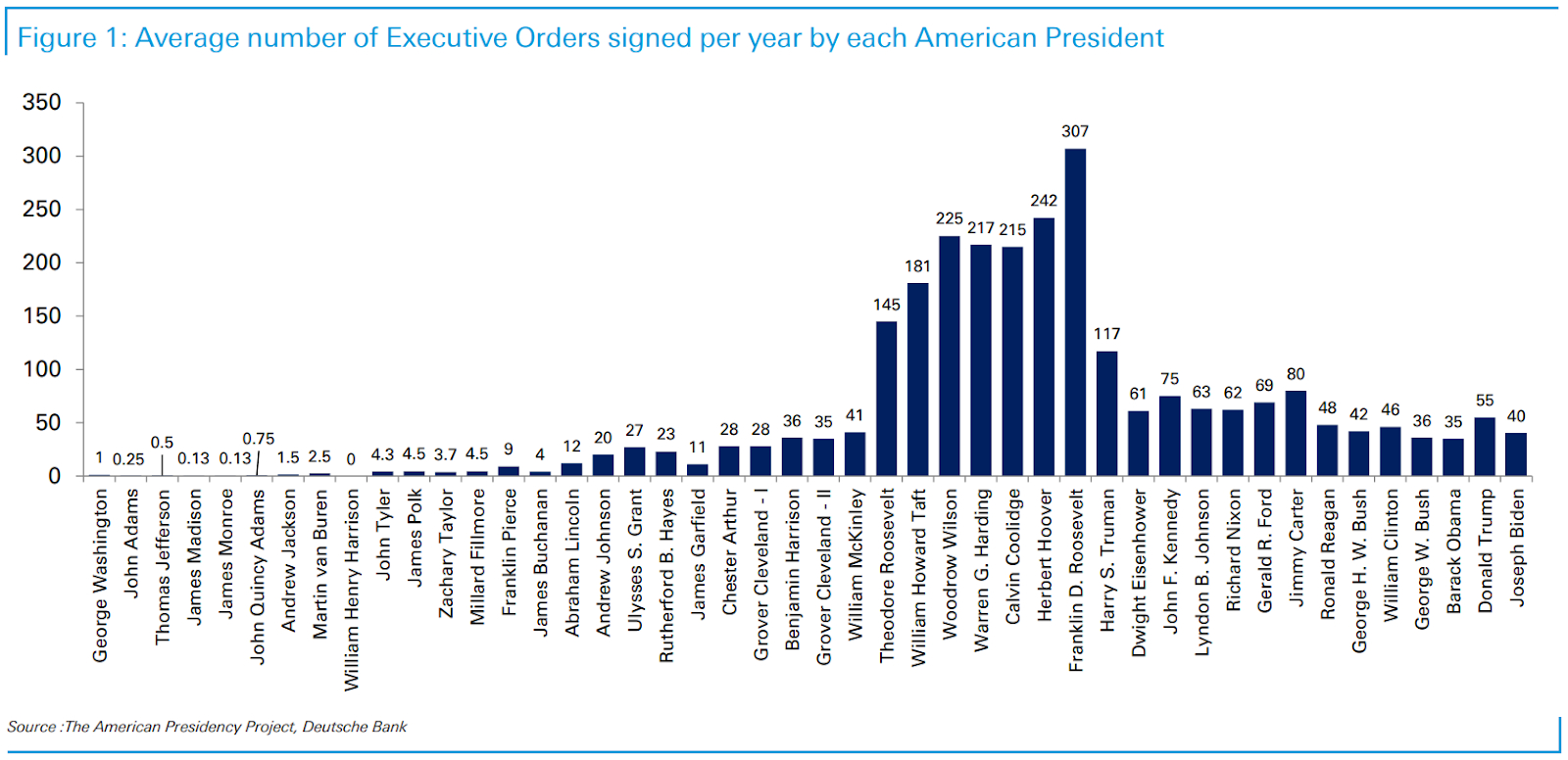

Executive orders: how does Trump compare to previous presidents?

Donald Trump has said he will sign “dozens of executive orders, close to 100” within “hours” of taking office.

The figure the BBC is reporting is 200 executive actions – although this is expected to include things like proclamations as well as legally-binding executive orders.

In his first term as president, Deutsche Bank analysis shows that Trump signed 55 executive orders per year, on average. This is the highest number from any president since Jimmy Carter.

The all-time record came from Franklin D. Roosevelt in the 1930s and 40s, who averaged 307 executive orders per year.

“Theodore Roosevelt’s presidency marked the start of a ‘progressive era’ with activism in antitrust enforcement and conservation which bypassed a gridlocked Congress,” says Jim Reid, research strategist at Deutsche Bank.

Reid thinks Trump 2.0 could “easily” result in “the highest number of EOs issued since the first half of the 20th century”.

Average number of executive orders signed per year by each American president

Cathie Wood: equities bull market will broaden

Renowned disruptive technology investor Cathie Wood, CEO of ARK Invest, thinks that Trump’s presidency won’t just benefit the megacap big tech stocks.

Instead, she believes, the incoming president’s tax-cutting, regulation-slashing agenda will play out to the benefit of small- to mid-sized companies.

“The bull market in equities is likely to broaden out from just a few cash-rich, large cap stocks to a broad swath of stocks that have been hampered by the supply shocks, the record-breaking burst in interest rates, and the rolling recession that have characterized the last four years,” she says.

Bond markets ought to be calmed by the prospect of lower deficits, and while “the consensus view today is that rapid deal growth will case inflation… history suggests otherwise”, she says.

However, the transition from the Biden to the Trump regime could be an uncertain time for the market, adding to the “wall of worry that has kept the markets on edge recently.

“Will tariffs trigger another bout with inflation? We think not: instead, those tariffs should be selective and incremental, their discrete effects ultimately displaced overwhelmingly by tax cuts, deregulation, and dollar appreciation. Indeed, we believe the market is likely to discount a successful Trump Administration, which could turn out to be one of the most successful administrations since the Reagan Revolution,” says Wood.

Trump has now arrived at the US Capital for the inauguration ceremony, which will begin at 17:00 GMT (12:00 EST).

Tesla: what can investors expect when markets open tomorrow?

We previously pointed out that Tesla has been one of the biggest beneficiaries of Trump’s election win. The share price is up more than 70% since the start of November. US stock markets are closed today, but what can we expect when the market opens tomorrow?

“Investors might anticipate a positive start for Tesla shares on Tuesday due to the recent bullish sentiment around its association with the incoming Trump administration, potential regulatory ease, and expectations of growth in autonomous vehicle technology,” says Sam North, market analyst at investment platform eToro.

“However, specific performance will also hinge on broader market sentiments and any news or developments over the long weekend. With all that said, it would be a shock to see Tesla trading significantly lower on Tuesday,” he adds.

Investors could be set for disappointment over the longer term, though. Once Trump’s election win is old news, sentiment will almost certainly die down and the focus will return to Tesla’s financials. The company’s next earnings call will take place on 29 January.

We take a closer look at the stock in: “Should you invest in Tesla?”

No day one tariffs

The Wall Street Journal has reported that Trump won’t impose any new tariffs today. The dollar has weakened slightly as a result.

Trump is instead planning to issue “a broad memorandum on Monday that directs federal agencies to study trade policies and evaluate US trade relationships with China and America’s continental neighbors,” the journal said.

Trump’s inaugural address

Trump has just delivered his inaugural speech.

“During every single day of the Trump administration, I will very simply put America first,” he said shortly into it. But what exactly does that mean – and what are the implications for your money?

"Drill baby, drill"

“I will direct all members of my cabinet to marshall the vast powers at their disposal to defeat what was record inflation and rapidly bring down costs and prices,” Trump said.

He blamed the inflation crisis on “massive overspending and escalating energy prices” and said he was declaring a “national energy emergency” to help fight inflation.

“We will drill baby, drill,” he added.

What isn’t mentioned is that inflation has been a global phenomenon, with prices spiking in the wake of the coronavirus pandemic as economies ground back into action after unprecedented disruption.

“We will revoke the electric vehicle mandate”

Trump also used his inaugural address to confirm he will revoke the “electric vehicle mandate”. It will be interesting to see if (and how) Elon Musk responds.

Tesla’s share price has surged since Trump’s election win. Investors hope the close relationship between the two will translate into a more friendly regulatory environment as Tesla looks to launch initiatives like autonomous robotaxis.

However, this particular move is bad news for electric car specialists. It seems likely Trump is referring to the Environmental Protection Agency rules which would have required manufacturers to radically reduce their greenhouse gas emissions on certain vehicles by 2027.

Shares in European carmakers that are trading today, like Volkswagen (GER:VOW3) and Stellantis (PAR:STLAP), jumped earlier this afternoon, as news that Trump could cancel the mandate emerged. Traditional carmakers like these have been struggling to meet the kinds of EV numbers that the mandate requires.

That’s everything on the live blog for this evening. Join us again tomorrow for more updates and analysis as Trump’s second term begins – as well as the all-important reaction of the US stock market.

Good morning, and welcome back to our live coverage of the start of Donald Trump’s second term as US president.

The (money) headlines overnight:

- Trump has threatened to impose tariffs of up to 25% on imports from Canada and Mexico as early as 1 February;

- Having postponed the ban on TikTok by 75 days, Trump also threatened to levy 100% tariffs on Chinese imports unless at least 50% of the app is sold to a US company;

- He has also suggested that EU imports will be hit with large tariffs unless the bloc buys more US oil;

- Trump revoked Biden’s 2023 executive order on artificial intelligence (AI), which required AI developers to share safety tests with the US government before releasing new products to the market;

- An executive order freezing government hiring and a directive exhorting federal agencies to combat inflation, specifically by expanding the housing supply and cutting the regulatory cost of housebuilding, have also been signed, according to the BBC.

We’ll bring you all today’s comments and analysis as Trump’s second day in the White House unfolds.

A new Reagan?

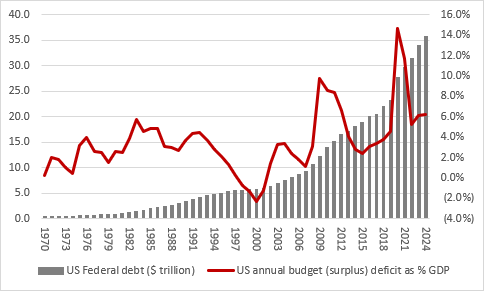

While Cathie Wood thinks that Trump’s second term could be the most successful since the Ronald Reagan era, there are some differences in the macro backdrop that each president will have to contend with.

Reagan “won two terms, from 1981-1985 and then 1985-89 and his reforms won huge plaudits from investors as America shook off the inflationary economic malaise of the 1970s,” says Russ Mould, investment director at AJ Bell. He was helped in doing so by “a large dose of interest rates and tight monetary policy from the US Federal Reserve.

“Whether this iteration of the Fed, under chair Jay Powell, has quite so much appetite, or room, for maintaining such a monetary squeeze is open to debate,” Mould adds. The Fed is now more interventionist than it was during the 1980s, with its frequent injections of liquidity a source of frustration for Trump during his first term.

Further, the level of the US deficit is now far higher than during the Reagan administration. “The US Federal deficit was barely 30% of GDP in 1981, compared to 120% now, [which left] Reagan with so much more room for fiscal manoeuvre,” says Mould.

Source: FRED – St. Louis Federal Reserve database via AJ Bell

Finally, the valuations at which the S&P 500 is trading as Trump enters office give it less room for further growth.

“When Reagan took office on 20 January 1981, the cyclically adjusted price earnings (CAPE) ratio was 9.3 times, not 37.0 times as it is now,” says Mould.

“Any unexpected shocks, such as those suffered during the Nixon, Carter and Bush presidencies, or simply a divergence from the current preferred narrative of cooling inflation, a soft economic landing and lower interest rates, could therefore have a sizeable impact, and not necessarily a positive one.”

How will US markets open?

While the US markets were closed yesterday for Martin Luther King day, US stock market futures indicate a positive reaction to Trump’s inauguration. S&P E-mini Futures contracts have risen by more than 0.5% over the past 24 hours, while Nasdaq 100 futures are making strong gains this morning.

Tesla shares are up more than 2% in pre-market trading according to Nasdaq data.

Has immigration overshadowed trade policy?

“For someone who has talked repeatedly about wanting American companies to buy American goods and to deter foreign countries from profiting from the US, it was a surprise to see tariffs take a back seat as Trump put his new powers to use,” says Russ Mould, investment director at AJ Bell, on the president’s inauguration day.

While the new president did find time to threaten 100% tariffs against Chinese imports, “Chinese markets took this threat in their stride, with key equity indices holding firm. This suggests investors don’t believe Trump would be so bold as to take the nuclear option on tariffs”, according to Mould.

Instead, Trump’s day one focused more strongly on immigration, and this could have major implications for the US economy. “The one area where Trump took decisive action was illegal immigration and this poses a big threat to labour costs in the US. It threatens to reduce the pool of workers for construction and agricultural industries, meaning companies might have to pay more to attract staff.

“Trump promised to lower prices for the American public, yet already on day one we’ve got policies in action that have inflationary consequences. Companies presented with extra costs will simply pass them on to the customer through higher prices,” says Mould.

A few other potential big movers to keep an eye out for when the US stock market opens in about two hours:

- Apple (NASDAQ:AAPL), down over 2% in pre-market trading;

- Broadcom (NASDAQ:AVGO), up around 1.4% pre-market;

- Rocket Lab (NASDAQ:RKLB), a space exploration firm that has performed joint missions with Elon Musk’s SpaceX, is up 6% pre-market.

US Stock market opens

The S&P opened 0.29% up in its first session since the inauguration of Donald Trump. The Nasdaq 100 opened around 0.54% up.

Tesla shares are plummeting – down almost 3% in the opening minutes of trading. Trump’s social media platform, Trump Media & Technology Group, has also fallen nearly 10%.

Rocket Lab is up around 15% – presumably following Trump promising to send astronauts to Mars during his term.

MicroStrategy, frequently seen as a proxy bitcoin play, is down over 5% as crypto was left out of yesterday’s flurry of executive orders.

The best and worst US presidents (according to the stock market)

Our sister site Kiplinger has published some analysis on which US presidents the US stock market performed best under.

Herbert Hoover (1929-1933) is in last place, with an eyewatering annualised loss of -30.8% (S&P 500, price only data). He took office just before the historic Wall Street crash of 1929, which was followed by the Great Depression.

Topping the list is Calvin Coolidge (1923-1929), with an annualised stock market return of 26.1%. This is based on the Dow Jones Industrial Average rather than the S&P 500 due to data availability.

“A cynic might point out that Coolidge was extraordinarily lucky to have taken office just as the 1920s were starting to roar… and to have retired just as the whole thing was starting to fall apart,” says Kiplinger’s Charles Lewis Sizemore.

Indeed, it is worth remembering that politicians aren’t generally the main drivers of markets. Factors like underlying economic growth, inflation and interest rates tend to play a bigger role. Where politicians can have an impact is through things like taxation and regulation, both of which Trump has promised to cut.

What’s happening with the Bitcoin price today?

The Bitcoin price surged to around $109,000 yesterday as Donald Trump was inaugurated, but has since fallen back slightly and is around $106,000 at the time of writing.

“Bitcoin has gone bananas after Trump launched his own cryptocurrency on Friday,” said Russ Mould, investment director at AJ Bell. “It’s got crypto fans fired up in the hope that digital currencies will go mainstream.”

The Bitcoin price has also risen in recent months based on the belief that Trump will usher in a more relaxed regulatory environment.

Gary Gesler, the former chair of the US Securities and Exchange Commission (SEC), stepped down yesterday and was replaced by Republican SEC member Mark Uyeda to act as interim chair. Gesler was known for his tough stance on crypto.

A report from Reuters says that acting chair Uyeda and another SEC commissioner, Hester Peirce, are “expected to kick-start a cryptocurrency policy overhaul as early as this week”.

Longer term, Trump has said he will nominate crypto-friendly Paul Atkins to fill the role of SEC chair.

Good morning, and welcome back to day three of Donald Trump’s second tenure as US president.

The overnight headlines:

- Oracle (NASDAQ:ORCL) shares gained 7.2% yesterday as chief technology officer Larry Ellison joined Trump in announcing a joint venture with OpenAI and SoftBank (TYO:9984) to build out AI infrastructure in the US;

- Trump Media & Technology Group (NASDAQ:DJT) fell 11.1% on Trump’s first trading day in office;

- Trump has halted over $300 billion worth of US green infrastructure funding.

More news and analysis coming soon.

Where is gold going?

Gold prices have climbed around 2% so far this week, with gains accelerating yesterday morning.

The uncertainty that has accompanied Trump’s return to the White House, particularly the disruptive nature of many of his early actions, could provide a tailwind for the traditional safe haven asset.

“Trump’s plans include a stronger US economy and lowering the US deficit, which would lead to a stronger dollar,” Joe Cavatoni, senior market strategist, Americas at the World Gold Council, tells MoneyWeek. This would imply weakness for gold, given that gold prices are expressed in dollars.

However, this is balanced against the potentially inflationary aspects of Trump’s agenda. “If potential tax cuts, higher spending and tariffs come to fruition, there may be an impact on the Fed's rate cycle that influences gold price performance throughout 2025,” says Cavatoni. “We'll know more about how the Trump administration may affect prices in the next three to six months once there is more clarity on policy.”

How likely are tariffs on Canada and Mexico?

Before the inauguration it was difficult to assess how serious Trump was about any given policy. As anyone who has ever followed politics knows, campaign promises are rarely worth the paper they’re written on (see Labour’s commitments not to raise taxes on working people).

Trump is particularly hard to read, given his penchant for starting very high in anything resembling a negotiation.

However, now that he’s entered office, a clearer picture is starting to emerge. While a mooted 10% universal tariff doesn’t seem to be on the immediate agenda – “we’re not ready for that yet,” he said on day one when asked about it – steep tariffs on imports from Canada and Mexico do seem to be high on his to-do list.

“I think we’ll do it February 1st,” he said of a 25% levy on imports from both countries.

“President Donald Trump’s latest threat against Mexico and Canada raises the possibility that tariffs come even earlier than we expect,” writes Stephen Brown, deputy chief North America economist at Capital Economics in a research note.

The implications of such a policy coming into effect are huge. “Exports to Canada and Mexico account for 38% of the [US] total, so there would be greater costs to the US of potential retaliatory tariffs,” says Brown. Moreover, “since imports from Canada and Mexico account for 35% of the total, the impact of a 25% tariff on those countries would be only slightly smaller than a 10% universal tariff and would temporarily boost CPI inflation by close to 1%.”

These inflationary impacts – particularly hitting imports of energy and food – could be “unpopular with voters”, according to Brown – but it doesn’t seem like that will stop Trump.

Will “cautious optimism” last for the pound?

Big talk of tough tariffs might have boosted the dollar, but it hasn’t been so straightforward during Trump’s first few days in office.

After initially gaining to a three-year high, the Dollar Index (DXY) “has shown signs of retreat, indicating that much of the expected negative impact from Trump's policies might already be reflected in the exchange rates,” says Sam North, market analyst at eToro.

This has seen the pound gain around 0.9% against the dollar this week.

However, North warns that we shouldn’t get too comfortable with this dynamic.

“This cautious optimism around the pound could be short-lived, depending on further clarifications on trade policy from the Trump administration,” he tells MoneyWeek.

Trump and tech

The Stargate AI project is one of the more eye-catching announcements of Trump’s first few days in charge as far as the stock market is concerned.

According to Ben Barringer, global technology analyst at Quilter Cheviot, the project “sets the tone for AI progression over the coming years.

“The expected $500bn backing is hugely significant and marks an escalation in the AI arms race… Companies involved in supplying the technology and infrastructure for Project Stargate are well-positioned to benefit significantly.

“For investors in the AI space, this announcement highlights a wealth of opportunities as the competition to dominate the sector intensifies, adds Barringer.

Positive results from Netflix (NASDAQ:NFLX) have given an additional lift to US tech stocks in Trump’s first week. However, Sam North, market analyst at eToro, warns that there could be something of an over-concentration into tech stocks as things stand.

“Market breadth remains narrow, with gains largely concentrated in tech and communication services, while most other sectors lag, indicating a sector-specific rather than a broad market rally,” he says.

That concludes our live coverage for today, thank you for joining us. We will return tomorrow to keep you updated with the latest analysis as further policy details are revealed.

Good morning, and welcome back to the live blog.

Markets have made more cautious moves this morning. The FTSE is trading sideways, as markets await more decisive updates from Donald Trump's new administration.

"Investors are still weighing Trump’s tariff talk, though history suggests his bark often echoes louder than his bite," says Matt Britzman, senior equity analyst, Hargreaves Lansdown. "Investors [are] gradually shrugging off his strong tariff rhetoric as a calculated bargaining ploy."

Stargate: a shot in the arm for AI

Lets bring a little more detail on Stargate, one of the more eye-catching announcements of Trump’s tenure so far, especially for anyone with one eye on AI investments.

John Higgins, chief markets economist at Capital Economics, explains that “Stargate will be a new private company that intends to invest $500 billion over the next four years building new AI infrastructure for OpenAI in the US.

“The initial equity funders will be Softbank (with financial responsibility), OpenAI (with operational responsibility), Oracle, and MGX. Whether that much will ultimately get spent remains to be seen.”

The investment will largely be poured into new data centres to train AI models, as well as increased spend on component products such as semiconductor chip facilities (with a view to bolstering the country’s domestic supply) as well as new power plants (data centres being power-hungry beasts).

Higgins expects AI to make a quick impact on the S&P 500, albeit a slower one in the wider economy. “The new president seems much less keen than his predecessor on imposign checks and balances on the spread of AI. Since taking office, Trump has already revoked, among others, Biden’s Executive Order (EO) 14110 (Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence).

“Donald Trump’s ringing endorsement of Stargate is another shot in the arm for Artificial Intelligence (AI) in the early days of his second presidency,” he writes.

Musk and Altman clash over Stargate

Stargate has caused something of a spat between two of the people that might reasonably have been expected to be closest to it.

Tesla CEO Elon Musk – arguably the face of big tech within the new Trump administration – and Sam Altman, CEO of ChatGPT developer OpenAI, the AI company at the centre of the new $500 billion AI infrastructure venture – clashed yesterday over Musk’s somewhat surprising criticism of the initiative.

Musk, who co-founded OpenAI before stepping down in 2018, wrote on Tuesday that he had it “on good authority” that SoftBank had secured less than $10 billion to invest in the project. “They don’t actually have the money,” he posted on X in response to OpenAI posting about the initiative.

Altman replied on Wednesday that Musk’s claim was “wrong, as you surely know”.

What could happen to crypto?

Bitcoin prices surged in the immediate aftermath of both Donald Trump’s inauguration and, back in November, his election win. Investors expect the new US president to take a more crypto-friendly stance than any previous president, but what could that actually mean in practice?

Richard Werner, a partner at law firm BCLP with experience in the crypto and NFT domains, tells MoneyWeek that legislative changes could include a narrowing of the Securities and Exchange Commission’s focus to centre entirely on fraud, and that “the likelihood of a legislative package for the regulation of digital assets being passed by the US Congress has greatly increased”. At present, the US Federal government has no clear categorisation of cryptocurrencies, something which crypto advocates argue is standing in the way of more widespread adoption.

However, Werner cautions against speculating on future good news in crypto. “The history of Bitcoin is one of extreme price volatility. There is little reason to think this won’t continue and other digital assets, such NFTs during their 2021-22 heyday and meme coins more recently, have, if anything, been even more unpredictable.”

Underscoring this, perhaps, is the fact that the price of the Official Trump meme coin ($TRUMP) has more than halved since its peak on Sunday, the day before its real-world manifestation took office. Bitcoin has also lost most of its gains since Monday, with official announcements on crypto regulation in short supply so far.

Thanks for following our reporting on the inauguration of Donald Trump, and the major policy announcements from his first few days in office.

We’re going to end the live blog here, but we’ll be returning stateside next week for in-depth coverage of the stock market, as the Magnificent 7 start to announce their earnings.