Why the dollar will get even stronger from here

The US dollar has been on a baffling run at a time when many might have expected it to falter. But the dollar is not like other currencies. Cris Sholto Heaton explains its extraordinary performance, and explores what it might mean for Asian economies.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"Sometimes I've believed as many as six impossible things before breakfast," the White Queen tells Alice in 'Through The Looking Glass

'. But even she'd struggle to understand what the US dollar has done over the past year.

Other countries which went on huge spending binges are now faced with huge debt burdens, crashed property markets and wrecked banking systems. Understandably, their currencies have plunged. Yet the US which faces all these problems has seen the dollar sail ever higher. It's risen against the euro, sterling and every Asian currency except the yen, the renminbi and the Hong Kong dollar.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Baffling as it may look, there is an explanation. The dollar is not like other currencies. Indeed, it's so exceptional that further gains are still perfectly possible while the crisis continues

The dollar's amazing turnaround since summer

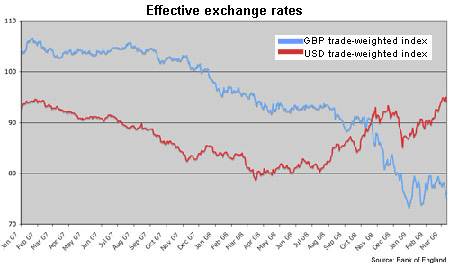

To see the scale of the dollar's outperformance, take a look at the chart below. It shows trade-weighted indices for the dollar and the pound. After declining together for well over a year, spot the difference since last summer.

Why is this? There are a number of factors at play. One is American investors dumping 'riskier' foreign assets and returning their money home, which of course involves selling foreign currencies and buying dollars. That's one reason why US markets fell by less than the rest of the world in the first part of the crisis.

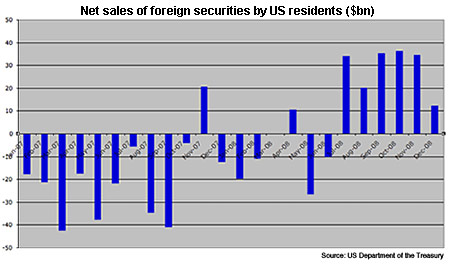

The more recent relative underperformance of the US to the rest of the world suggests that this trend may have partly run its course. Having dumped much of their international portfolio, the jumpiest and most leveraged investors are now having to dump domestic ones. The chart below shows net sales of foreign assets by US investors. As you can see, while they were still net sellers in December, the level of sales dropped substantially from the previous months.

A similar story would explain the strength of the yen despite a long string of dire data out of Japan. However, the recent slide there suggests that domestic investors who invested abroad may have largely finished selling their investments and repatriating cash (and similarly, the carry traders who borrowed in cheap yen to invest at higher rates elsewhere have finished unwinding their positions). This does not seem to be happening with the dollar.

The world always needs dollars

So why does the dollar remain strong? Because it's the global reserve currency the international unit of trade and finance. As a result, the non-US world always needs dollars to go about its business.

When there are plenty of dollars to go round, there's no difficulty in meeting this demand, so the dollar falls against the currencies of its trading partners. But when liquidity tightens, the dollar rises against other currencies and against commodities and goods that are traded in US dollar terms. Countries that have an especially large structural US dollar shortage in their economies see their currencies fall especially hard for example, South Korea, where more than 10% of bank funding comes from foreign currency borrowings.

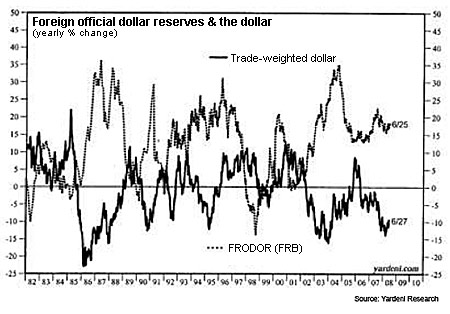

To see this on a broader scale, take a look at the chart below from Ed Yardeni, an independent economist who has done a lot of work on this. It shows the year-on-year change in the dollar trade-weighted index against the change in what he calls Frodor (Foreign Official Dollar Reserves US Treasuries and Agency Securities held at the Federal Reserve on behalf of other central banks).

As you can see, there is a fairly strong negative relationship between the two. As Frodor growth accelerates ie the supply of dollars to the rest of the world picks up - the dollar falls and vice versa.

The dollar will get even stronger

What does this mean? Well, despite the state of the US economy, it suggests that the dollar could stay strong for quite a while. As a result of the economy deleveraging and businesses and consumers spending less, the trade deficit is falling, as you can see in the chart below.

Since the trade deficit is the main route by which dollars have flowed into the global economy, fewer dollars are now being supplied to the rest of the world. And with dollars being scarcer, the price (the exchange rate) will be driven up.

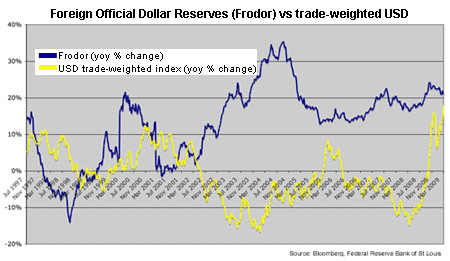

Indeed, the dollar's recent strength has been more impressive than you'd expect. In the chart below, I've updated the Frodor/dollar graph to last week. As you can see, while the rate of growth in Frodor has been roughly constant for a few months, the dollar has rocketed since everything fell apart in September.

Why is this? The soaring dollar reflected deleveraging of investment funds and repatriation of investments from abroad by US investors, which created a big drain in global dollar liquidity through investment channels. Large numbers of currency traders closing dollar short positions (ie they stopped betting against the dollar) once the trend turned against them probably added to the movement.

Meanwhile, Frodor growth remained high because the trade deficit remained wide until October and trade surpluses in some countries most importantly China - remained high. Indeed, China's trade surplus grew towards the end of last year as imports collapsed faster than exports (partly the result of falling commodity prices). But the latest number showed it collapsing very sharply, as you can see below (the series is not seasonally adjusted and there are big drops at this time every year but this one looks exceptional).

Of course, falling surpluses are what you'd expect given the fall in the US trade deficit we saw on the chart above. The story is similar in the latest trade figures for other key exporters such as Germany and Japan and of course for the oil exporters, who've seen the price of crude plummet.

If exporter surpluses are now set to shrink markedly, that means even if the contraction in global dollar liquidity from investment deleveraging comes to an end, the contraction from a smaller trade deficit will kick in. Frodor growth and other measures of dollar liquidity are likely to fall, and history suggests that will mean a strong dollar.

So when will the dollar slide?

So how might this come to an end? One possibility is that the Federal Reserve's quantitative easing eventually takes effect, overcoming the drive to deleverage and allowing the money supply to increase again. That could flow back to the world through an increase in the US trade deficit again (not very desirable, as that's one of the factors that led to the slump in the first place) or an increase in capital flows to international markets as investors' risk appetite grows (not likely while this panic continues).

If the Fed brings about a large general increase in inflation in the US relative to the rest of the world, this would have the same effect. There's no need for outward trade- or investment-related dollar flows to increase relative to the US economy, just relative to the rest of the world. Conversely, prolonged deflation in the US would tighten dollar liquidity further.

Another possibility is that the dollar loses its status as the global reserve currency. If that happens, deals and goods begin to be priced in other currencies. The dollar loses its unique position and a slowdown in the supply of dollars matters less to the world. There's no doubt some countries would like to see that happen: for example, Iran is trying to sell oil in euros and yen.

Long-term, this shift seems certain but with no obvious currency to replace the dollar and no consensus on building an international financial system that doesn't need a reserve currency, it's unlikely to happen overnight. And realistically, a sudden collapse in the status of the dollar would have some pretty nasty consequences including to the value of all those dollar reserves that America's trading partners have built up. Most of the world has a big incentive to stop this happening.

Thirdly, we could have a very severe slump in the world economy. What matters is not the absolute supply of dollars in the world, it's the change in the supply of dollars relative to the change in the need for dollars. If the global economy slows to the point where the growth in its need for dollars is less than the growth in the dollar supply, then there's no longer a shortage.

Expect the dollar to remain strong for now

In the medium term, the adjustment is likely to involve some element of all three of these. But it until it does, the dollar is likely to remain strong.

That means that we can expect emerging market currencies to remain weak for now especially those that have a shortage of dollars in their financial systems or relatively high levels of dollar-denominated debt. That includes Korea and Indonesia - and as you can see below, their currencies have been weakening again in the last couple of months (the Korean won is in white, the Indonesian rupiah in orange).

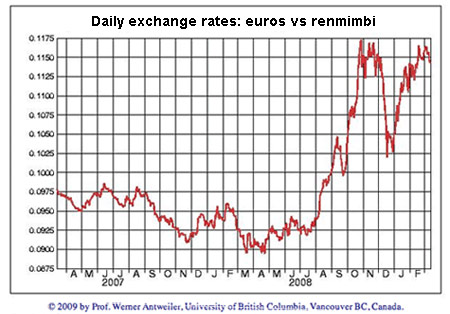

It also means that berating China for ending the rise in the renminbi against the dollar isn't really very helpful. With the dollar soaring, the renminbi is still gaining against the currencies of its other major trading partners, as you can see in the euro/renminbi chart below.

Revaluing the renminbi higher would just make this worse. Keeping it steady against the dollar in this situation is pretty much the most that can be expected of China.

Turning to this week's other news

TABLE.ben-table TABLE {BORDER-RIGHT: #2b1083 3px solid; BORDER-TOP: #2b1083 3px solid; FONT: 0.92em/1.23em verdana, arial, sans-serif; BORDER-LEFT: #2b1083 3px solid; BORDER-BOTTOM: #2b1083 3px solid}TH {PADDING-RIGHT: 5px; PADDING-LEFT: 5px; FONT-WEIGHT: bold; BACKGROUND: #2b1083; PADDING-BOTTOM: 10px; BORDER-LEFT: #a6a6c9 1px solid; COLOR: white; PADDING-TOP: 10px; TEXT-ALIGN: center}TH.first {PADDING-RIGHT: 2px; PADDING-LEFT: 2px; PADDING-BOTTOM: 5px; BORDER-LEFT: 0px; PADDING-TOP: 5px; TEXT-ALIGN: left}TR {BACKGROUND: #fff}TR.alt {BACKGROUND: #f6f5f9}TD {PADDING-RIGHT: 2px; PADDING-LEFT: 2px; PADDING-BOTTOM: 5px; BORDER-LEFT: #a6a6c9 1px solid; COLOR: #000; PADDING-TOP: 5px; TEXT-ALIGN: center}TD.alt {BACKGROUND-COLOR: #f6f5f9}TD.bold {FONT-WEIGHT: bold}TD.first {BORDER-LEFT: 0px; TEXT-ALIGN: left}

| China (CSI 300) | 2,205 | -3.6% |

| Hong Kong (Hang Seng) | 12,526 | +5.1% |

| India (Sensex) | 8,757 | +5.2% |

| Indonesia (JCI) | 1,327 | +3.2% |

| Japan (Topix) | 724 | +0.4% |

| Malaysia (KLCI) | 843 | -1.7% |

| Philippines (PSEi) | 1,856 | -3.3% |

| Singapore (Straits Times) | 1,578 | +4.3% |

| South Korea (KOSPI) | 1,126 | +6.7% |

| Taiwan (Taiex) | 4,897 | +5.2% |

| Thailand (SET) | 425 | +1.3% |

| Vietnam (VN Index) | 251 | +2.3% |

| MSCI Asia | 68 | +2.9% |

| MSCI Asia ex-Japan | 264 | +6.3% |

Chinese banks loans increased RMB1.1trn ($156bn) in February, after rising RMB1.6trn in January. Loans have now increased by more in the first two months of 2009 than in the whole first half of 2008. However, short-term bill financing accounted for 48% of February's increase, up from 42% in January and 3% a year ago, suggesting that much of the lending is working capital for cash-strapped firms rather than funds for new investment.

China's February trade data showed a 27.5% y-o-y fall in exports and a 24.1% y-o-y fall in imports that's even though both were flattered by the Chinese New Year holiday falling entirely in January this year. Amid other weak economic data, governments are increasing stimulus plans. Malaysia unveiled a MYR60bn ($16.3bn) package of business guarantees, tax breaks and infrastructure investment, equivalent to 9% of GDP, while Japan's prime minister said he was consulting on further measures.

There were possible signs of improvement in the latest export data for South Korea and Taiwan, both of which fell less than expected and were better than January (-17.1% y-o-y and 28.6% y-o-y respectively). Some Taiwanese electronics firms are said to have seen an improvement in orders. However, the Chinese New Year effect is certainly partly and perhaps fully responsible for all this.

This article is from MoneyWeek Asia, a FREE weekly email of investment ideas and news every Monday from MoneyWeek magazine, covering the world's fastest-developing and most exciting region. Sign up to MoneyWeek Asia here

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets