Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

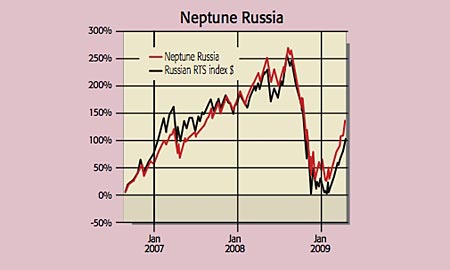

The Russian market is back in favour. After falling 67% in the nine months to March, it's since rallied 80% as global risk appetite has increased and the oil price has rebounded. Whether this recovery is permanent is another matter. But if it is, the Neptune Russia and Great Russia Fund, managed by Robin Geffen, is one of the best ways to play it.

Often tipped as the "next Anthony Bolton", Geffen puts his own capital on the line, investing in the fund himself. A graduate from Keble College, Oxford, he believes it's not too late to benefit from the Russian revival. He cites stocks such as oil giant Gazprom, which trades on a "ridiculously cheap" 3.5 times earnings. The energy group is his fund's biggest holding, accounting for 10% of assets. With oil north of $55 a barrel, "the rally looks solid and there is renewed confidence in the Russian consumer".

Indeed, Geffen is a big fan of consumer stocks. The top end of the country might like their Mercedes saloons and Cartier watches. But the middle class, which has risen in size from 8% to 24% since 2000, is beginning to plump for Russian over foreign brands when they head to the supermarket. In that regard, the strikingly-named Wimm-Bill-Dann, one of Europe's biggest dairy products companies, is also a firm favourite. It is 20% owned by Danone.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There's another reason to buy though: "it's the only unit trust investing solely in Russia", says Mark Dampier at IFA Hargreaves Lansdown. "I have it in my own self-invested personal pension and it's my favourite way of playing the market."

Contact: 0126 844 3920.

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

Neptune Russia and Greater Russia top ten holdings

| Gazprom ADR | 11.3 |

| Norlisk Nickel ADR | 8.63 |

| Wimm-Bill-Dann Foods ADR | 8.14 |

| Polyus Gold ADR | 7.85 |

| Lukoil ADR (UK listed) | 6.39 |

| Rosneft Oil GDR | 6.01 |

| Surgutneftegaz ADR (US listed) | 5.27 |

| Uralkali | 5.21 |

| Mobile Telesystems ADR | 5.01 |

| Vimpel-Communications ADR | 4.01 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

Average income tax by area: The parts of the UK paying the most tax mapped

Average income tax by area: The parts of the UK paying the most tax mappedThe UK’s total income tax bill was £240.7 billion 2022/23, but the tax burden is not spread equally around the country. We look at the towns and boroughs that have the highest average income tax bill.