Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

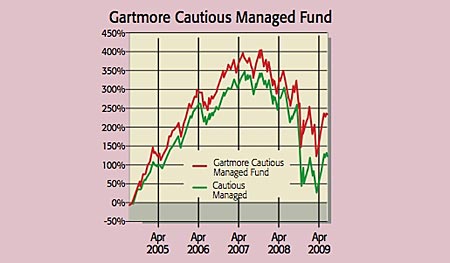

Chris Burvill, 50, hasn't always been bearish. "But I've seen very little over the past three years to make me think otherwise", says the manager of the Gartmore Cautious Managed Fund. Firms were loaded with too much borrowing and debt-fuelled economic growth looked unsustainable to him even as far back as 2006. So he cut his exposure to equities and moved some money into gilts. It worked over the past five years, the fund is up 26% against a 3% drop for the FTSE 100.

Unlike most fund managers, Burvill doesn't have a raft of analysts at his disposal. He prefers "to manage the fund primarily on his own", says Morningstar, drawing on conversations with long-term broker and economist contacts to make his decisions. Up to 60% of the fund can be held in equities, but currently it's just 37%, reflecting his continued bearishness.

The few stocks he does hold are defensive blue chips, such as Vodafone and GlaxoSmithKline, which haven't risen in the current "bear market rally", as he puts it. Fixed-interest securities (corporate debt and gilts) account for 55% of the portfolio, and cash for the remaining 8%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Burvill is bullish on index-linked bonds, as he believes government policy will lead to a renewed bout of inflation. And he thinks we are only half way into the recovery for corporate debt.

Although he has taken profits on some corporate bonds, "there are still plenty of BBB, investment-grade bonds yielding between 9% and 11%", he says their higher "fair value" suggests the yield should be 7%-9%. "So there's still plenty to go for, although things aren't as exciting as earlier in the year."

Contact: 0800-289336.

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

Gartmore Cautious Managed Fund top ten holdings

| European Inv Bk 4.375% Emtn 08/07/15 | 5.8 |

| Treasury 1.875% Idx Lkd Tsy Gilt 22/11/22 | 5.0 |

| Treasury 4% Stk 7/09/2016 | 4.4 |

| European Investment Bank 5.5% 7/12/09 | 3.7 |

| Treasury 2 1/2% Index-Linked Stk 2011 | 3.6 |

| Treasury 5% Stk 2014 | 3.4 |

| BP | 3.3 |

| Royal Dutch Shell B Ord | 3.2 |

| Vodafone Group | 3.2 |

| Treasury 4.75% Stk 2015 | 3.1 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.