Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

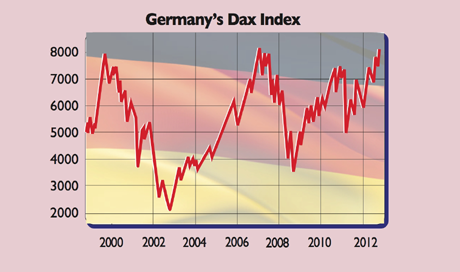

Germany's benchmark Dax index (see chart) has surged ahead of its major European rivals over the past two years and has climbed through the 8,000 level for the third time. The last two times this happened, in 2000 and 2007, it promptly slumped. Will it have better luck this time?

Probably. Ludwig Donnert of Tao Capital, for one, sees scope for a rise to 8,700 by the end of the year. The firms that make up the Dax index are in excellent shape. In 2012, sales hit a record, while seven of the 30 firms in the index, including BMW, Henkel and Volkswagen, posted record earnings. German firms in the Dax, the midcap index MDax and the smaller TecDax are collectively paying out a record €34.4bn in dividends.

This success is not a result of a surging domestic economy, but a reflection of Germany's reliance on exports. Germany "is torn left and right by the global cycle", says David Milleker of Union Investment. Its economy is a geared play on the world economy. The Dax firms make around three-quarters of their sales abroad. "If the global cycle is OK, Germany is doing well. If the global cycle is bad, Germany does extremely badly."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Right now the global economy is doing all right, even if it is hardly booming and may be cooling. The Dax's valuation is reasonable. But all this doesn't matter as much as it has in the past. Stefan Keitel of Credit Suisse says that "the main drivingforce" is central-bank liquidity, reinforced by a lack of investment alternatives.

The yield on German bonds is negative in inflation-adjusted terms and recent reforms make German property funds less appealing.

So while the outlook is fair for now, the Dax's sensitivity to the global economy means that it tends to be more vulnerable than most markets when economic data or risk appetite deteriorates. A key threat is a flare-up of the euro crisis, says Thomas Harms of Ernst & Young, which "hangs over Europe's economy like the sword of Damocles". Dax firms are globally orientated, but they can't completely shake off European turbulence. Most German exports still go to the eurozone.

But this shouldn't put investors off some of the country's blue chips, says Wirtschaftswoche. The German weekly likes insurer Allianz and chemicals group BASF. The latter, which has just raised its dividend, yields 3.5%; Allianz, 4%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.