Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

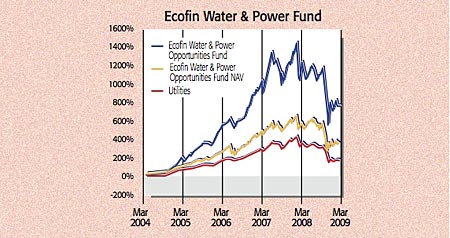

Even in a falling market, the firms that generate our power and keep our water pumping should beat other stocks. After all, we can't do without these services. Yet the Ecofin Water & Power Opportunities Trust, run by Bernard Lambilliotte, has fallen 26.4%, against a 32.3% drop for the FTSE All-Share over one year. So is this utilities fund really a defensive bet?

Wins Investment Trusts believes so. There are short-term hurdles to overcome, not least falling electricity demand as the global economy slows, but Wins believes that "long-term growth in demand for energy" and "the huge investment required to make up for years of under-investment" should support the sector, says Investors Chronicle. Over half of the firms in the Ecofin portfolio are based in the UK or Europe, with around 27% in US assets, such as ITC Holdings. This is a holding firm that invests in other firms involved in electricity transmission projects across America. That should put it in a good position to benefit from Obama's plans to boost the economy through national infrastructure, says Ecofin.

While 70% of its holdings are in electricity firms, they're not all big utilities like British Energy. It recently took a 10% stake in Hansen Transmissions, which makes gearboxes for wind turbines and has contracts with four of the biggest global wind-turbine manufacturers. Gearboxes are highly customised, so for a wind-turbine maker, changing suppliers is a costly and time-consuming business. That means Hansen should be fairly resilient to a slowdown in the sector, given the high barriers to entry. Trading on a discount of 7.7%, and yielding 3.8%, the fund looks good value.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Contact:020-7451 2929

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

Ecofin Water and Power'stop ten holdings

| Electric Power Development | 10.7 |

| British Energy Group | 6.8 |

| ITC Holdings Inc | 6.6 |

| Distrigas | 5.5 |

| EDF | 4.2 |

| Centrica | 3.2 |

| Iberdrola Renovables SA | 3.0 |

| E.ON AG | 2.7 |

| Acea Spa | 2.6 |

| Iberdrola SA | 2.6 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge