Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

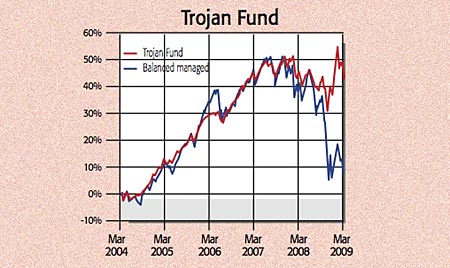

Sometimes it pays to be bearish. Convinced that the debt-fuelled boom couldn't last, Sebastian Lyon hasn't held a bank in his £198m fund, the Troy Asset Management Trojan fund, for more than five years. Indeed, up until recently, as little as 25% was invested in equities. "We saw the 2003 to 2007 move in the markets as a bear-market rally," says Francis Brooke, a director at Troy. It was a good move. The fund rose 1.1% in 2008, against a 29.9% drop for the FTSE All-Share.

Given this sceptical outlook on stocks, it's notable that by the end of last year, 69% of the fund was invested in them. "If you look at the return on equities over the last four decades, the huge premium built up in the 1990s has now been eroded." Stocks look quite reasonably valued when compared to cash and other assets, says Lyon, with big consumer and energy stocks, such as Tesco, Centrica and National Grid, the most likely to rally when the market does. "We don't buy mid-cap or recovery stocks."

The fund can skip between equities and other asset classes as it sees fit so it isn't limited to following its favourite themes. Chief among them is gold, which the fund has held for four years. Just over 8% of the fund is invested in a gold exchange-traded fund, Gold Bullion Securities, which is physically backed by the metal. Despite its recent highs, Brooke says it still looks attractive particularly as, with interest rates scraping 0%, the opportunity cost of holding gold rather than getting interest on cash has fallen sharply.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Contact: 020-7499 4030.

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

Troy Asset Management Trojan fund's top ten holdings

| Lyxor Gold Bullion | 8.01 |

| BP | 5.12 |

| Royal Dutch Shell B Ord | 4.53 |

| Alliance Trust Plc | 4.34 |

| British American Tobacco | 3.85 |

| Reynolds American Inc | 3.86 |

| Centrica | 3.37 |

| Johnson & Johnson | 3.38 |

| Tesco | 2.49 |

| National Grid | 2.20 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How should a good Catholic invest? Like the Vatican’s new stock index, it seems

How should a good Catholic invest? Like the Vatican’s new stock index, it seemsThe Vatican Bank has launched its first-ever stock index, championing companies that align with “Catholic principles”. But how well would it perform?

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up