Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

With income hard to come by, many investors are looking to global income funds for decent dividends. One in particular should be on their shopping list.

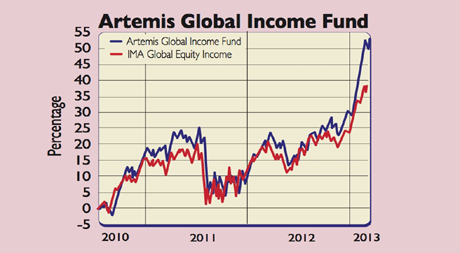

Of the 26 unit trusts investing globally for income, "none has done better over the past year than Artemis Global Income", says Jeff Prestridge in The Mail on Sunday. The fund, worth £110m, generated a 25% return over 12 months. It is a relatively new unit trust and has delivered a return of 51% since its launch in 2010.

Unlike some of his peers, the fund's manager, Jacob de Tusch-Lec, enjoys a "full global remit" and invests in 80 companies across 20 countries, says Prestridge. Financial adviser Brian Dennehy notes that it was also one of thefew equity income funds to increase its payout last year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, success in 2012 was boosted by a "risk rally" in cyclical stocks, particularly in the European periphery, says FTAdviser.com, and the fund still has a large European exposure.

Tusch-Lec fears he may struggle to deliver the same return this year as the markets have "rallied too far" while the underlying economies are still in poor shape. He has sold off stocks that have peaked, such as Italian toll-road operator Atlantia and French construction firm Bouygues.

Meanwhile, Tusch-Lec has been adding to holdings in Asian real-estate investment trusts (Reits), such as Mapletree Logistics, which may benefit from low interest rates when inflation rises. He is also bullish on the US housing market, which he believes shows signs of recovery. Overall, this is still a solid fund for income-seekers.

Contact: 0800-092 2051.

Artemis Global Income Fund top ten holdings

| Macquarie Group | 2.6 |

| Ryder System Inc | 2.4 |

| Gjensidige Forsikring ASA | 2.4 |

| Blackstone Group | 2.3 |

| EDP Renovveis SA | 2.3 |

| JP Morgan Chase & Co | 2.2 |

| Silverlake Axis | 2.2 |

| Origin Enterprises | 2.1 |

| TAL International | 2.0 |

| Smurfit Kappa | 2.0 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how