Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

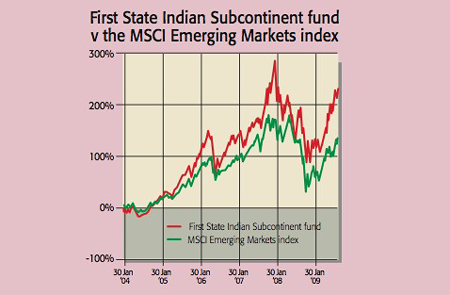

It's been a good year for investors in India. The stockmarket is up 88% over one year against a 63% return for the Chinese stockmarket. First State Indian Subcontinent Fund has kept pace: it's up 92% over the same period. But can it keep rocketing?

"We're relatively cautiously positioned", says David Gait, the fund's manager. A lot of hot money has piled into the market, which should be a warning to investors. "A third of foreign inflows into India last year were through ETFs, which means there is a lot of lower-quality capital with shorter time horizons." Valuations are not what they were, which means you have to look "off piste" for attractive companies.

Consumer staples with good franchises, competitive advantage and brands built up over time are a favourite. So Gait likes Dabur, which makes everything from toothpaste to health drinks. It's developed a toothpowder poorer Indians can put on their fingers and wash with a boon in rural areas with poor access to water. He also likes Bharti Airtel, which generates good cash flow even if it is not growing as rapidly as it once did. "We're obsessed with the quality of management, and look at everything from corporate governance to long-term strategic vision."

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But he dislikes big infrastructure plays: "Wherever you have large contracts with opaque pricing structures, companies are tempted to cut corners." Investing across India, Pakistan, Sri Lanka and Bangladesh, "the fund is a fairly new offering, having only turned three on 15 November", says Sheridan Admans, investment adviser at The Share Centre. But its "first three year's performance of 49.35%... outperformed its sector return of 4.84%." Impressive stuff for a newcomer.

Contact: 020-7332 6500

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

First State Indian Subcontinent Fund top ten holdings

| Bharti Airtel | 5.7 |

| Hindustan Unilever Ltd | 5.6 |

| Marico | 5.4 |

| Tata Power Co | 5.2 |

| Dabur India | 4.3 |

| Housing Development Finance Corp | 3.8 |

| Acc Ltd | 3.4 |

| Infosys Technologies | 3.4 |

| Nestl India | 3.3 |

| Thermax Ltd | 2.1 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?