Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

China spent 15 years fighting tooth and claw to corner the market in rare earth metals. Now it's gearing up for battle over a new metal, this time in the desolate salt-flats of south-western Bolivia. It is wrestling with Japan for rights to mine the region's vast deposits of lithium a mineral used in batteries that power everything from laptops to electric cars.

A reliable source of lithium would allow the Japanese to continue producing batteries for the world's laptops, digital camera and mobile phones. China on the other hand spies an opportunity to seize control of the electric-vehicle market as the US and German car industries struggle with the recession.

But president Evo Morales is in no mood to relinquish rights to such a prize resource.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Salar De Uyni salt plain is home to half the planet's known reserves of the metal, so he can afford to wait for the best deal. According to Leo Lewis in The Times, Beijing's efforts to butter up the authorities in La Paz have already included a donation of cash to help build a school in the town where Morales was born and a gift about 50 military vehicles.

The loser will almost certainly be forced to scour the earth for other lithium deposits. With the auto-industry looking to bring lithium-powered cars to market over the next two years, the handful of outfits who control the market in this scarce metal could have a field day.

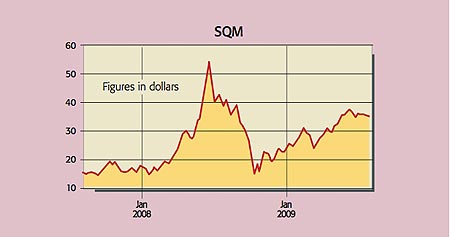

"There are enormous possibilities for profits," says Steve James on Reuters. Sociedad de Chile (NYSE: SQM) based in Santiago, Chile is a world leader in the production of lithium carbonate and a number of other speciality chemicals, and leads the world in lithium production, too, with a more than 30% market share.

It's not cheap valued on forward p/e of 20 and offering a 2.5% dividend but given its prime position in this important market, it looks worth having some at least some exposure to.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets