Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

You can call Ben Bernanke an idiot, a policy wonk, or just another government stooge... but the new uptrend in the commodities complex loves the guy.

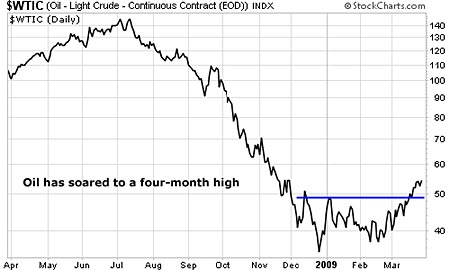

Commodities are direct beneficiaries of inflation. Two weeks ago, Bernanke announced a plan to inflate the US money supply by over a trillion dollars. Commodities celebrated. Oil and copper both broke out to new four-month highs. The Swiss, British, and Japanese governments are also pursuing inflationary policies. As the world's most important money issuers destroy their currencies, commodities could explode.

Let's take a closer look at the two most senior commodities: copper and oil. The news for these two hasn't been this bad since the Great Depression...

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Bureau of Labor Statistics reports the economy has lost almost 2.5 million jobs over the last five months, and the unemployment rate has risen to 7.6%... the highest level since June 1992. The "capacity utilisation" rate for total industry has fallen to 72%, the lowest level since 1983. All this means the industrial economy is collapsing. That's terrible news for both copper and oil, which are important industrial commodities.

According to the US Department of Transportation, Americans drove seven billion fewer miles in January, a 3.1% decline from last year. This should be terrible news for oil.

Homebuilding is one of the biggest users of copper. In January, only 23,000 new homes were sold 2009 in the US the lowest level for January since the Census Bureau started tracking sales in 1963.

I could go on, but my point is, when the price of a commodity breaks to new highs amid terrible news, it's begging to rise even more. Both oil and copper have just broken out to new multi-month highs.

Nothing's ever certain in the stock market, but if you had to bet on an asset rising tomorrow, would you bet on the one that's already rising or the one that hasn't moved? I'd say the one that's already rising is far more likely to continue in that direction.

Right now, global trade is collapsing. We're in the deepest recession since the 1930s... and yet copper and oil are "breaking out", and commodities are swamping our best-performer lists. The Fed is inflating the money supply and commodities are showing incredible strength.

This article was written by Tom Dyson for the free daily investment newsletter DailyWealth and was first published on 30 March 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.