Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Everyone knows that the key to successful investing involves going against the herd. But finding overlooked opportunities can be difficult. Enter Dylan Grice of Socit Gnrale. He has examined herding among analysts by gauging levels of research coverage relative to a stock's value. Using global data going back to 1987, it's clear that "the sectors most loved by them underperform those which are most neglected by them".

Grice found herding is most pronounced in the construction and clothing sectors. Analysts' least-loved sectors are the defensive ones MoneyWeek has been recommending for some time, including tobacco, energy, drinks and drugs.

Japan is another unloved area worth a look, says Tom Stevenson of Fidelity International in The Sunday Telegraph. In September, according to the Investment Management Association, the biggest net outflows were "once again" from funds invested in Japan. Yet the new government has fuelled hopes of structural reform, while Japan has a "unique position as a back-yard exporter to the world's fastest-growing region". It's also the cheapest big market in terms of book value.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

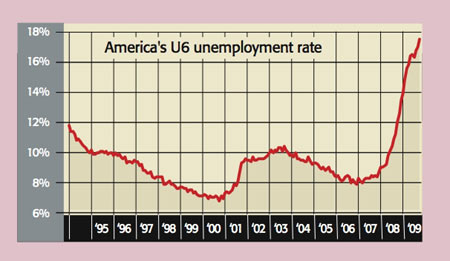

The big picture: the mother of jobless recoveries

A sustainable recovery requires an improving labour market. Yet there's no sign of that. The unemployment rate has jumped to a 26-year high of 10.2%; the post-1945 record is 10.8%.

Add part-time workers who would rather work full-time, and those who've given up looking for a job, and the broadest measure of unemployment ('U6') stands at a record 17.5%.

The average working week is at a record low of 33 hours. This suggests employment won't recover fast, as firms will increase workers' hours before hiring new staff when things improve. Expect "the mother of jobless recoveries", says David Rosenberg of Gluskin Sheff.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how