Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

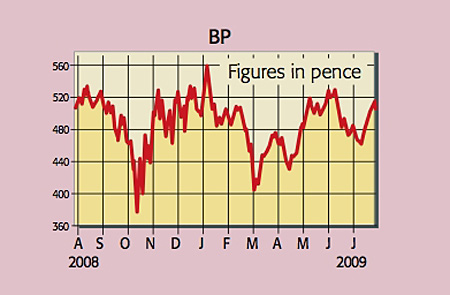

Oil giant BP has announced a 53% year-on-year drop in second-quarter profits. That's due to falling oil prices and weak refining margins. The average oil price for the company's sales in the quarter was just $53 a barrel, compared to $110 last year. Chief executive Tony Hayward reiterated his view that $60-$90 is a "sensible" price for oil, but given "little evidence of any growth in demand" oil prices look set to trade in the bottom of the range for now.

What the commentators said

The challenge for BP, as for all oil companies, said Lex in the FT, is to balance the books when oil prices are low, while spending on exploration in order to top up supplies and maintaining the dividend. The latter comprises an eighth of all FTSE 100 payouts expected this year.

BP is aiming to balance cash flow at $60. But despite hacking $2bn out of costs in the first half thus meeting its full-year cost-cutting target it's not there yet. In the third quarter money out exceeded money in by $1bn. Enter another $1bn of targeted cost savings.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Deflation in BP's supply chain amid the downturn should help there, said Nils Pratley in The Guardian. Suppliers of equipment are having to accept lower prices. Meanwhile, oil is well above BP's average price in the second quarter and the full benefits of axing 5,000 employees should kick in the second half. All in all, Hayward's plan to "make BP fit for action at $60 looks credible".

BP: 507p; 12m change -3%

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson