Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

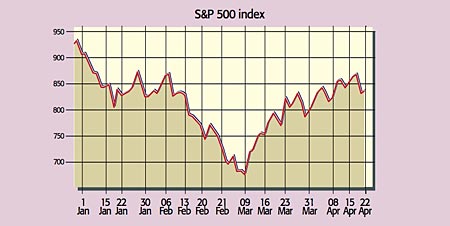

Over the past few weeks, investors have "slipped on their rose-coloured glasses", says Alan Abelson in Barron's. US stocks have had their best six-week stretch since the 1930s, with the S&P up by 30% and the FTSE 100 gaining 17% by the end of last week, as economic data deteriorates at a slower pace. But as Nouriel Roubini of New York University, who predicted the crisis in 2006, points out, over the past two years the stockmarket has "predicted six out of the last zero economic recoveries".

A sustainable recovery is hardly likely until the financial system has been sorted out. Investors were brought back down to earth on Monday by bad news from Bank of America. "It hardly helps the great bank-recovery story when the US's biggest financial firm by assets comes out with ugly results," says Peter Eavis in The Wall Street Journal.

Non-performing loans jumped by 42% from the fourth quarter to the first, a reminder of more losses to come as the economy continues to slide. Mike Mayo of Calyon Securities recently estimated that residential mortgage losses are halfway to their peak, while credit card and consumer loan losses are only a third of the way there. So further "financial shocks" are on the cards, while hopes of a return to 2% growth next year are over-optimistic, heralding further earnings disappointments, says Roubini. "I'm still cautious and bearish." With house prices still plummeting, credit tight and consumers only just beginning to work off their debt load and rebuild savings, that makes sense.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This is a "globally synchronised recession combined with a vicious financial bust", says Lex in the FT. An International Monetary Fund (IMF) study shows that recessions accompanied by financial busts are usually twice as long and deep as normal downturns. That implies it will be at least a year before the recession ends. "Not even stockmarkets are that forward-looking." Concern that banks may need more bailouts has also been fuelled by the fact that the stress tests US banks are undergoing to assess their capital strength look "stress less", says James Montier of Socit Gnrale.

The worst-case scenario includes unemployment hitting 10.3% next year, a level looking likely to be exceeded. We've "got ahead of ourselves... the recent rally has been insane", says David Buik of BGC Partners. The next few months will be "brutal" for the economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson