Big Blue promises big gains

Cloud computing is the next big thing in tech, and IBM is an excellent way to bet on it, says Stephen Connolly.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Cloud computing is the next big thing in tech, and IBM is an excellent way to bet on it.

The shift by businesses away from expensive and inefficient in-house information technology to "cloud-based" computing and software is still in its infancy. Firms find it more practical and cost-effective to rent or buy IT services or software or store data on the internet rather than deal with computing infrastructure and software (and the staff that may come with it) themselves.

The trend has a long way to go, however. With most companies only a fifth of the way there, according to consultants McKinsey & Co, this is still an early-stage opportunity to back a technology shift with significant growth ahead.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Research groups are projecting that the cloud industry is expanding anywhere between 15% and 30% a year, potential gains that have been attracting enough investor money to help turn cloud providers like Amazon and Microsoft into the world's biggest companies. Some may balk at the premium share prices despite the cloud's high growth profile, but there are other ways to invest.

A cheaper way in

International Business Machines (NYSE: IBM)

In a bold move to get back on a growth track, IBM paid $34bn this year for Red Hat, a profitable software business founded in the early 1990s. It generated sales of $3.4bn last year and will boost IBM's group revenue and margins from 2020. But what makes Red Hat special are its top-rated and in-demand capabilities and applications built around Linux a computer operating system that happens to underpin most of the cloud.

This significantly strengthens IBM's capabilities at the centre of the cloud migration trend and, in particular, in its focus on serving the "hybrid" cloud, where businesses seeka flexible mixture of cloud usage, using multiple platforms as well as keeping some functions in-house.

Simply migrating onto a single platform is always an option but, for numerous reasons, the hybrid approach is generally preferable. Businesses don't want to be chained to one platform owned by a powerful technology giant. And increasing regulation can require data to be held locally within a country rather than more broadly. So multiple solutions and providers are required locally and internationally. Red Hat brings the expertise to deliver this so that clients can traverse many different and unconnected platforms seamlessly.

This ultimately makes IBM something of a unique multi-channel cloud player, seeking less to compete with larger rivals and more to complement them, using their platforms as clients require. Red Hat has partnered with the likes of Amazon and Microsoft in this way for years. Protecting such existing relationships means maintaining Red Hat's independence. At the same time, however, IBM can leverage its presence in nearly 200 countries to help extend Red Hat's reach while exploiting synergies.

The 20% progress most companies have made to cloud migration so far is likely to include a lot of the easier work. It will get harder as older systems and applications, as well as legal and security issues, all need complex solutions, which is when Red Hat really comes into its own. With IBM shares far cheaper than the overall market and yielding 4.8%, they look worth a punt.

A supertanker gradually changing course

The financial record isn't pretty. Exceptfor a few upticks in quarterly sales last year which were falsely heralded as a returnto sustained growth,it's been a case of continuous sales and profit declines for years.

The group is trying to capture fast-growing business opportunities but at the same time rationalise existing operations. It has dated, legacy businesses in its labyrinthine structure that aren't delivering. Acquisitions like Red Hat seek to reverse this.

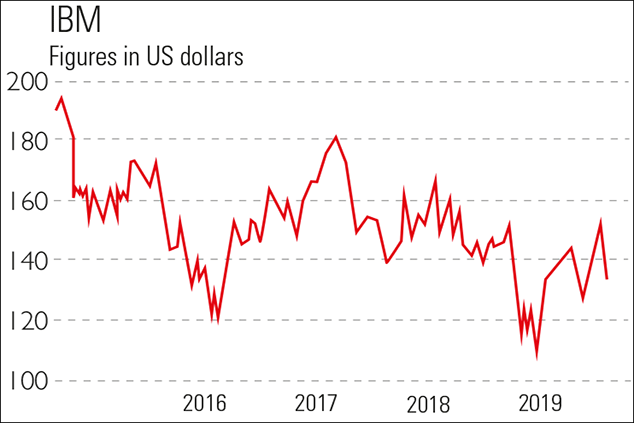

The shares are currently trading at about $133 and have beaten the S&P 500 this year. However, they suffered during the big market falls last autumn caused by US-China trade worries and so although they have bounced, they're still below the price range of $140-$150 a year ago.

Given that IBM still has it all to prove with Red Hat and its general rationalisation programme, most analysts are on the sidelines, rating the shares a "hold" (although they are becoming a bit more positive). Nevertheless, the consensus share price target is $155 (17% upside), and sales, profits and cashflows are all forecast to rise after 2019.

As far as investors are concerned, although it's early days, IBM does offer an intriguing play on the high-growth cloud migration trend and a very reasonably-priced one to boot. The stock is on a forward price/earnings ratio of just ten, a significant discount to the market. Meanwhile, the covered dividend yield of 4.8%, which is expected to grow faster than inflation, should offer considerable support.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.