Why Boeing's shares will regain altitude

The aerospace giant’s 737 Max model has been grounded. But Boeing shares should bounce back.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

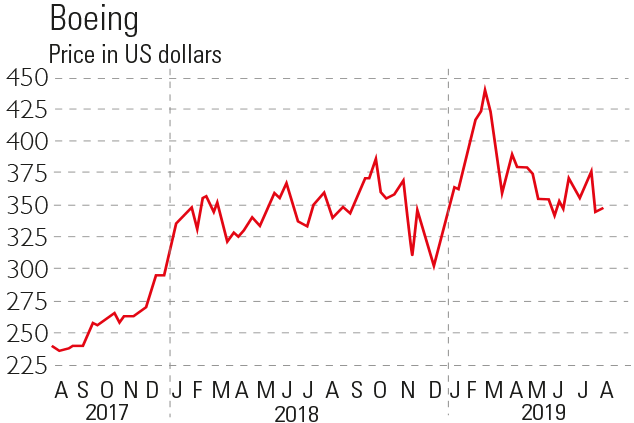

It's said that when things go wrong at highly rated companies investors can be unforgiving. Except, it would seem, if the firm in question is Boeing (NYSE: BA), the world's largest aerospace group. It has lost two of its 737 Max aircraft in fatal crashes and the model is now grounded indefinitely. It can't deliver a big backlog of orders. Yet the shares are still up 7% this year and 13% above December's lows.

Such share-price composure in a major crisis suggests a belief for now at least that Boeing will turn things around and recover. To achieve this, it needs to incorporate modifications to the 737 Max sought by regulators and get it approved for commercial flight sooner rather than later. It must then present a timetable that sees the planes back in airline schedules by the new year.

The obstacles ahead

When the plane flies again commercially depends on practical issues, such as airline rescheduling and manning, not to mention aircrew re-training, which takes time and is a sensitive regulatory issue. Reflecting this, Dallas-based Southwest Airlines, for example, the largest US domestic carrier and the biggest buyer of the 737 Max, has just dropped it from its flight schedules until the new year. A consensus is developing around this timescale.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Assuming everything does fall into place, bank analysts are, by and large, shifting 2019 numbers into 2020. The current year becomes something of an exception, with next year showing very strong profitability, especially if production is ramped beyond previous levels to 57 planes a month. Despite losing a few buyers, Boeing still has a formidable 737 Max order backlog of over 4,400 aircraft worth some $400bn. With current issues contained, 2020 could well be Boeing's most profitable year ever.

Passengers will return

What is for certain is that more people want to fly, and airlines need planes. Global passenger numbers are rising faster than the world economy and Boeing sees demand for 44,000 new planes over the next 20 years. It is one of just two major manufacturers, each with long waiting lists. So for airlines to switch supplier would mean more costly delay. It's in their interests as well as those of suppliers and politicians to work with Boeing to get the 737 Max flying.

Nonetheless, without a clear timetable for the Max's return, Boeing remains a speculative stock. Delays could extend further even if the plane flies eventually. More cautious investors should watch for regulators to give the all-clear.

A top-notch record

Boeing businesses put together the Apollo Lunar Module and built the Space Shuttle. So the company should overcome software issues with the 737 Max and satisfy air regulators.

This is an important point because there's more to Boeing than the 737, hugely successful though it's been despite this year's problems. The group is a vital part of US defence capability and space plans. Commercial aerospace and defence combined are expected to be an $8.7trn market in a decade. Boeing produced the B-52 bomber, the UK's Harrier jet, and the Minuteman intercontinental ballistic nuclear missile. It recently received orders for two modified 747s. They will form the new US presidential Air Force One airborne command and communication platform.

On the commercial side revenues are also diverse. Last month British Airways parent IAG signed a letter of intent to buy 200 737 Max jets, a major boost for Boeing. And beyond the single-aisle planes, in the wide-body segment, 777 and 787 sales remain steady. The new 777X is being pre-flight tested, with orders for 364 already in place. This year's forecasts have been dented by the 737 Max problem, for which the company has now taken nearly $7bn of charges to reflect related costs, including customer compensation.

Consensus net profits for 2020 are estimated at around $13.2bn, up from $10.5bn in the more comparable 2018. This implies earnings per share of $23 (up from $17.7 in 2018), implying a forward price/earnings ratio of 15 with a dividend yield of 2.6%. This is a reasonable price to pay assuming the 737 Max issue is under control for estimated long-term percentage earnings growth in the low-to-mid teens in an expanding market with above-average growth characteristics and little competition.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how