Why I’m still bullish on oil for the long run

The oil price has been trending down for months, now. Technically, it's in a bear market. But whatever the short-term trend, everybody should have some in their portfolio, says Dominic Frisby. Here, he picks the best way to invest.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today I wanted to look at the world's most important commodity: oil.

I say it's the most important commodity because, despite the huge advances made in alternative energy, it remains the single most important source of global power. Roughly one third of global energy comes from burning oil.

Indeed, roughly 85% of global energy comes from burning hydrocarbons in some form or other. Even for something nominally clean, such as an electric vehicle, that means there is an 85% probability that the source of their energy is dirty.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

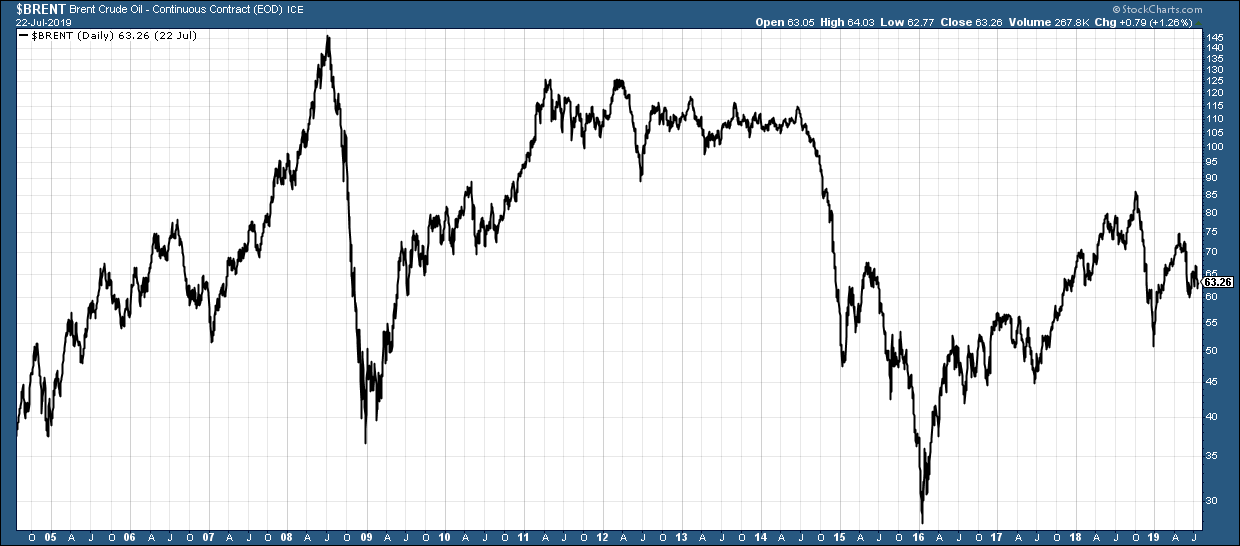

Let's start with a long-term chart of oil so you can see where we are in the grand scheme of things.

Oil has done well since 2016, but now it's in no-man's land

Below is a chart showing Brent crude oil going back 15 years.

You can see the huge run-up in the 2000s which climaxed with oil going above $145 a barrel. Then the collapse which came with the financial crisis of 2008. (Some still maintain that the cause of financial crisis was oil going above $145.)

Then we got a rebound rally, which took us back above $100 to $126 in 2011. Four years of range trading around the $100. Then the two-year collapse which began in 2014 and sent the price all the way back down below $30 by January 2016. What a buying opportunity that was! We called it the opportunity of the lustrum a lustrum being a five-year period.

Ever since then, oil has been in an uptrend of sorts, with the high coming in late 2018, at $86. Today Brent crude oil sits at $62 a barrel.

We are pretty much in the middle of the long-term range and the intermediate-term range sort of in nowhere land.

Given that the high was some nine months ago, you could quite easily take the view that oil is now in an intermediate-term downtrend. Or to give it its common name, a bear market.

The May high at $74 was lower than the October 2018 high at $85. And the recent rally to $67 on the back of seized oil tankers in the Middle East was lower still. Lower highs mean one thing. A bear market.

Calling short-term gyrations in the oil price is little more than guess work, but I'd say there is support around $60 and $57. With the next big line in the sand at $50 the 2018 low.

In the long run, I'm bullish on oil

I'm a long-term oil bull. I think this might be some kind of bias hammered into me by experience. I grew up in the 1970s, and I recollect albeit vaguely the various shocks that went on.

While I welcome the potential of clean energy, I think there is a lot of sophistry surrounding it. A lot of it isn't as green as it would have you believe. A lot of the inefficiencies are masked by government subsidy. Those same subsidies have created a quagmire of lobbying and special interest groups whose goal, first and foremost, is the bounty of further subsidy.

In other words, mankind is still highly dependent on oil. It remains the predominant energy source, and the dependence is not going anywhere soon.

The fact that today you can buy oil for the same price you might have paid in 2005, and not far off what you might have paid in the 1980s, despite the unprecedented inflation of the money supply which has happened over the past generation, is verging on the incredible, as far as I'm concerned.

Then when you consider all the oil that has been burned over the period 93 million barrels per day is the current rate, I gather and that the world's fossil fuel reserves are finite, you start to think today's prices are almost anomalous.

Certainly, fracking and other technological developments have made previously uneconomic reserves economic and boy, do we have a lot to thank those industry pioneers who brought us these new technologies for.

But the paucity of major new discoveries still makes me suspect that the "peak oil" arguments that were so pronounced in the 2000s that there world is running out of oil, basically will one day come back and rear their head in the most brutal of fashions.

If you think Britain is unprepared for a no-deal Brexit, go and take a look at how unprepared the developed world is for oil prices above $100.

As I say, I think I am suffering from some kind of bias, but I maintain my fundamental case that oil at $62 is cheap, and whatever the short-term trend is even if we were to go back below $50 everybody should have some exposure in their portfolio. It should be a core position. The risk of not owning is greater than the risk of owning.

If you're an entrepreneur looking to make a lot of money, let me show you a way: invent an investment product that gives you proper exposure to the oil price.

The conventional portfolio manager's answer is to buy BP or Shell. The dividends are attractive, but you get very little growth when oil goes on one its runs.

As for the exchange-traded funds (ETFs), I don't like them. Those that track the oil price get hit by the vagaries of the futures markets backwardation and contango. Those that track the companies such as the iShares Oil and Gas Exploration and Production ETF (LSE:SPOG) give you all the downside of a falling oil price and not enough of the upside.

So you fall into the risk of backing individual companies, and taking on individual company risk, when what you really want is exposure to the oil price.

My preferred vehicle is, oddly, not known as an oil producer, but as a miner, even though oil happens to be its single biggest product. It's BHP Billiton (LSE: BHP). We called "buy" on it back at 700p in 2016. It's now around 2,000p. It's done well, and we are not selling.

It does what the ETFs should do. The risk is that when metals prices take a hit, so will BHP. But until some entrepreneur comes up with a better vehicle to track the oil price, this is what I'm going with.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how