Small Business

The latest news, updates and opinions on Small Business from the expert team here at MoneyWeek

-

'Expect more policy U-turns from Keir Starmer'

Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from

By Matthew Lynn Published

Opinion -

Reeves's business rates hike will crush the British economy

Opinion By piling more and more stealth taxes onto businesses, the government is repeating exactly the same mistake of its first Budget, says Matthew Lynn

By Matthew Lynn Published

Opinion -

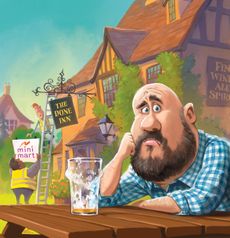

Last orders: can UK pubs be saved?

Pubs in Britain are closing at the rate of one a day, continuing and accelerating a long-term downward trend. Why? And can anything be done to save them?

By Simon Wilson Published

-

Cyber insurance is crucial to your business

The impact of a cyber attack can be devastating, so start researching now for cyber insurance

By David Prosser Published

-

Little-known way inheritance tax pension raid could put thousands of businesses at risk – ‘issue is flying under the radar’

Changes to inheritance tax rules could wipe out 15,000 businesses where owners put their premises in their pension, experts have warned

By Laura Miller Published

-

Trade unions to gain muscle under Labour's new employment laws – what does it mean for SMEs?

New employment laws will make it easier for workers to take collective action. Here's what it could mean for SMEs.

By David Prosser Published

-

What sole traders and landlords need to know about Making Tax Digital with one year to go

Sole traders and landlords will have to start reporting their earnings digitally on a quarterly basis to HMRC from April 2026 – here is what you need to know

By Marc Shoffman Published

-

How British businesses can tackle Trump's tariffs

The majority of British businesses are likely to take a hit from the chaos caused by Trump’s tariffs to reorder global trade. Companies in the firing line face some difficult decisions, says David Prosser

By David Prosser Published

-

Return to the office: is working from home coming to an end?

More and more employers want their staff to return to the office. Is it a good idea?

By David Prosser Published