UK inflation little changed in May

The inflation rate in the UK was little changed in May, compared to last month. Here, John Stepek looks at what's been happening to prices in the UK.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The inflation rate in the UK was little changed in May, compared to last month.

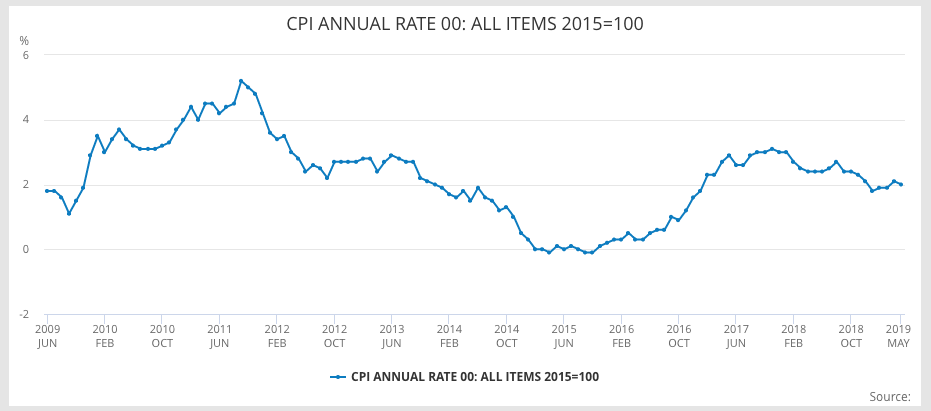

As measured by the consumer prices index (CPI), inflation came in at an annual rate of 2% (which is bang on the Bank of England's target inflation rate). That's a little lower than April's figure of 2.1%.

Transport costs helped to pull the rate down, as prices fell sharply between April and May, particularly prices of flights, compared to last year, when prices rose sharply. That's simply down to the timing of Easter (prices shoot up during the Easter holidays, as any parents out there know only too well).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Pushing the rate upwards was a rise in the cost of computer games and toys, plus hotel stays (all of which rose in price more rapidly between April and May this year than they did last year), as well as food and non-alcoholic drink costs, which rose between April and May this year, but fell a year ago.

Here's how CPI has changed over the last ten years, courtesy of the Office for National Statistics.

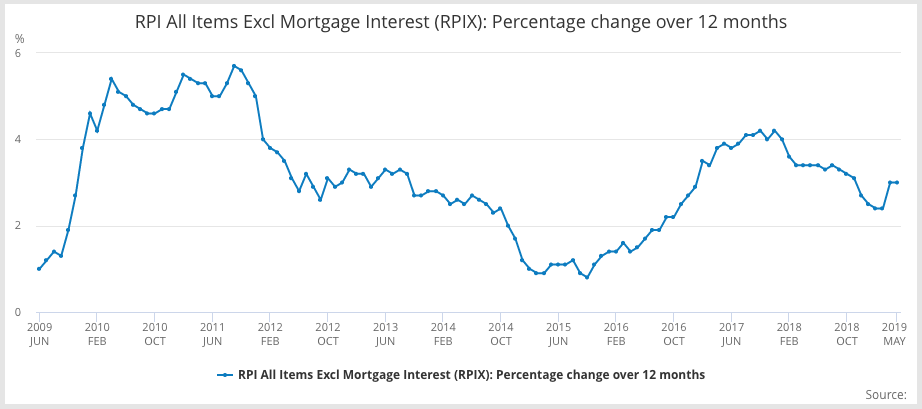

As measured by the retail prices index, excluding mortgage costs (RPIX which was the Bank's target up until 2003), annual inflation came in at 3% (a bit above the old 2.5% target measure). That was the same as April.

Here's what's happened to RPIX over the last ten years.

If you want to know more on the difference between these measures, check out my colleague Merryn's popular explainer.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI will change our world in more ways than we can imagine'

'AI will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China