The charts that matter: the great bond bubble revisited

A slide in bond yields this week has driven the yield curve lower. John Stepek looks at how this has affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. Big news this week I've mentioned a couple of times in the last week or so that you should keep 22 November free this year. That's because Merryn and I want to see you at the MoneyWeek Wealth Summit that day.

We're nailing down the line-up even as I speak. It's all very hush hush for now, but I can tell you that we'll be addressing all of the big political issues of the day (I suspect that the Brexit debate despite the Halloween "deadline" and the threat of a Corbyn government will still loom large), as well as highlighting the biggest, most potentially profitable long-term investment trends out there.

The tickets will be on sale very soon. To be the first to hear about it and to get updates on the line-up as and when we lock it down sign up for our free updates, right here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

No new podcast for you this week but if you missed last week's, we covered Theresa May's replacement, Jeremy Corbyn's odds of running, and what it all might mean for the pound catch up here.

And if you missed any of this week's Money Mornings, here are the links you need:

Tuesday: The European elections mattered a lot more than you think

Wednesday: What will it take for us to value real stuff again?

Thursday: Italy's debt is in the news again. You can ignore it but only for now

Friday: Bond yields are back at record lows why are investors so scared?

Also, be sure to read this week's Currency Corner (in association with currency broker OFX): What's next for the Canadian dollar? And if you enjoy Currency Corner, here's a reminder that, on 11 June at 1pm, Dominic Frisby and I will be hosting a webinar with currency specialist Alex Edwards of OFX.

We'll be discussing how the slowing of global trade and the swings in sterling and other major world currencies could impact on your business and we'll be taking questions during the webinar. Register now FREE to watch it live here or to watch the recording later.

And if you don't already subscribe to MoneyWeek, do it now you get your first six issues free when you sign up.

Now, to the charts.

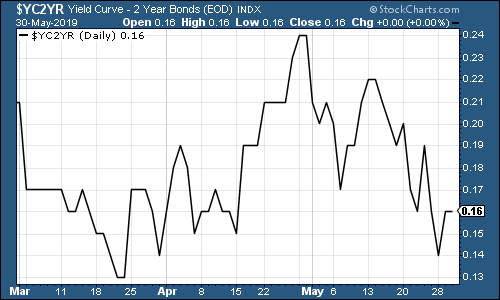

A slide in bond yields this week saw the yield curve (remind yourself of what it is here) creep ever lower. The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted, which almost always signals a recession (although perhaps not for up to two years).

The curve between the three month and the ten year is now inverted, and it increasingly looks as though this one is going to follow suit.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

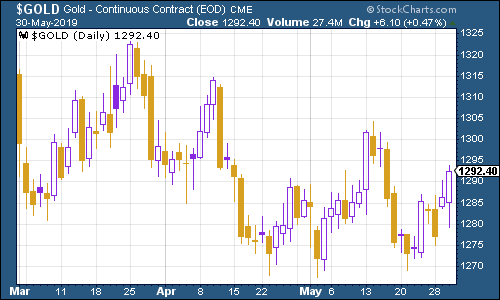

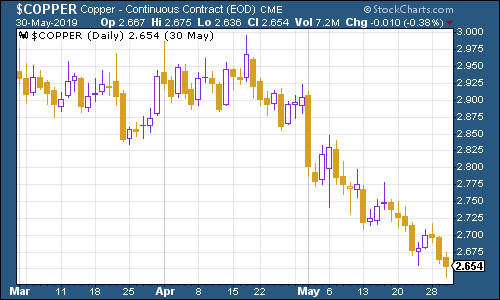

Gold (measured in dollar terms) was among the few assets that had a fairly tame week. It's climbing again as investors start to fret about global stability and political tension. In passing, it's worth noting how differently gold performs to most other commodities (including silver). While it's broadly flat on the week, the likes of copper and oil have slid hard.

(Gold: three months)

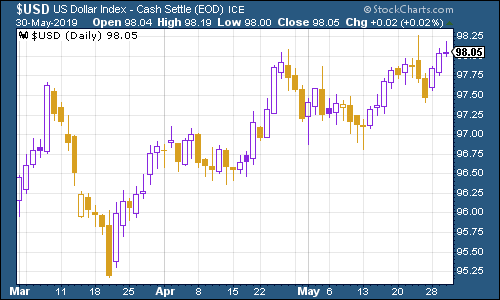

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners just keeps on climbing as protectionism and fears of recession push investors into "safe havens".

(DXY: three months)

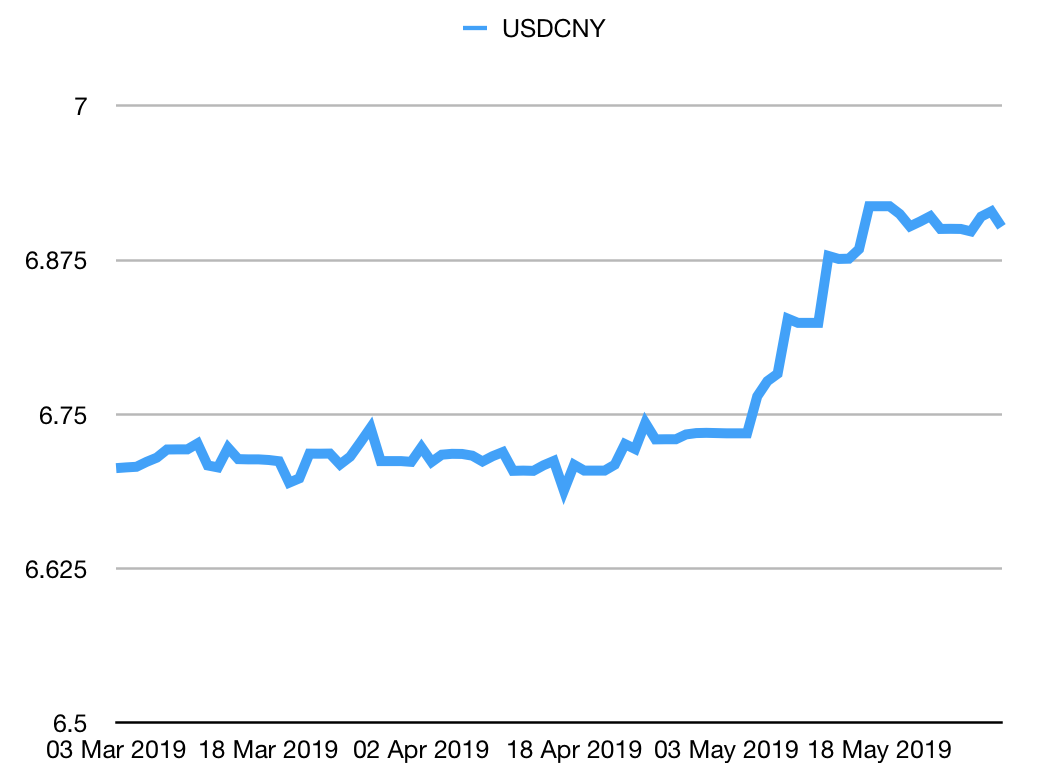

The number of yuan (or renminbi) to the US dollar (USDCNY) has behaved itself this week. The crucial number we are looking at here is 7.0 if the yuan weakens past that level then it suggests that the Chinese have given up defending the currency's value, which could be extremely deflationary.

(Chinese yuan to the US dollar: three months)

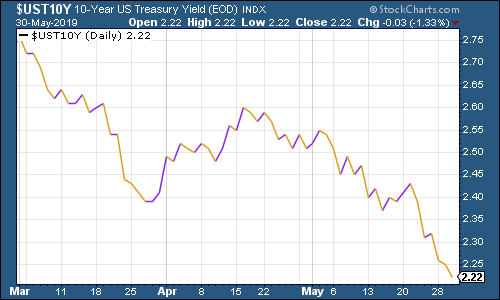

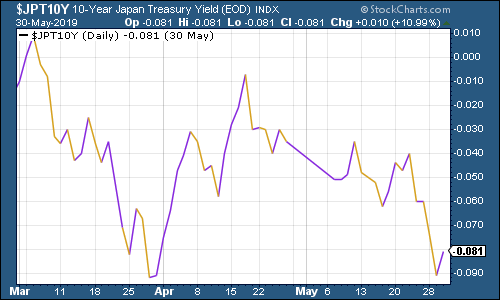

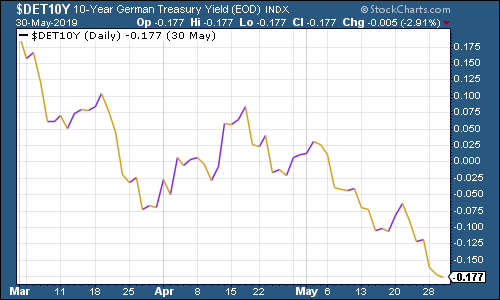

Ten-year yields on major developed-market bonds slid even further this week as Donald Trump's trade war escalation took investors by surprise (he's turned his attention back to Mexico). The yield on the German bund is now at a record low, yielding a negative 0.2% (that's right you have to pay to own a German government IOU quite something, eh?).

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

Copper continued to fall, as you'd expect, given worsening trade wars and a deteriorating outlook for the economy.

(Copper: three months)

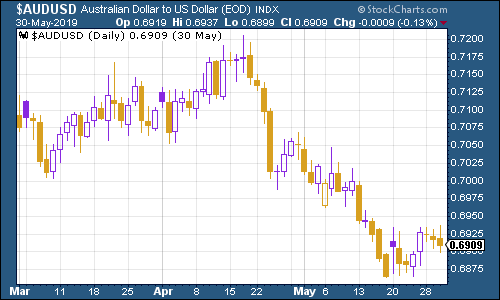

The Aussie dollar our favourite indicator of the state of the Chinese economy managed to regain a bit of ground this week, though it's still wedged below the $0.7 mark.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin managed to spike above $9,000 before slipping back a bit, what with the excitement of escaping "crypto-winter".

(Bitcoin: ten days)

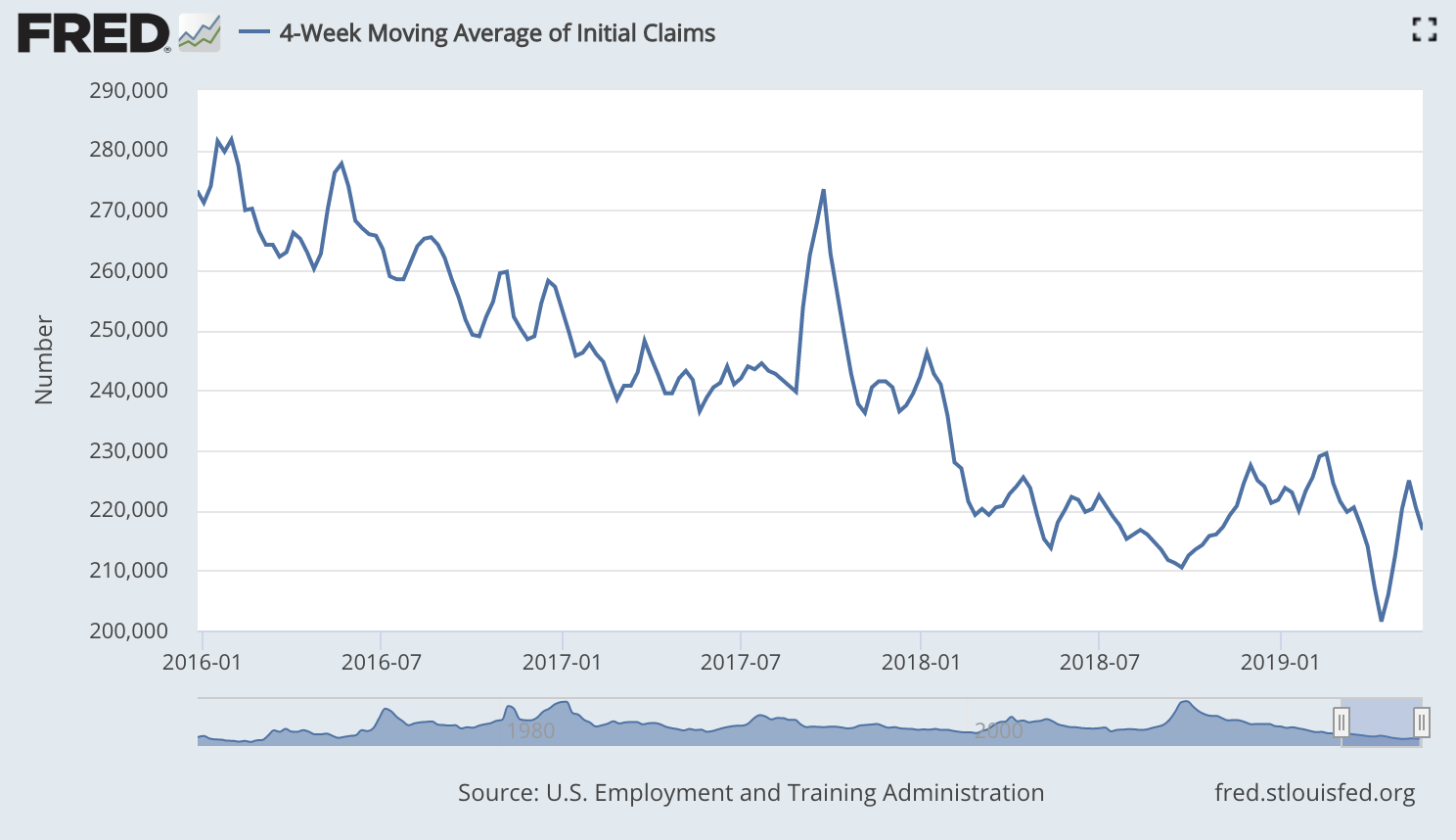

Six weeks ago, US jobless claims hit a fresh low on the four-week moving average measure, dropping to 201,500. They jumped over Easter, but have eased since. This week, the moving average fell to 216,750, while weekly claims rose to 215,000.

US stocks typically don't peak until after this four-week moving average has hit a low for the cycle, and a recession tends to follow about a year later (although of course this is from a tiny sample size, as discussed by David Rosenberg of Gluskin Sheff a while back).

Clearly, jobless claims could hit another trough. That said, this is a lagging indicator and also one of the few unequivocally positive ones about the US economy right now. So I'm not confident of predicting an outcome either way.

(US jobless claims, four-week moving average: since January 2016)

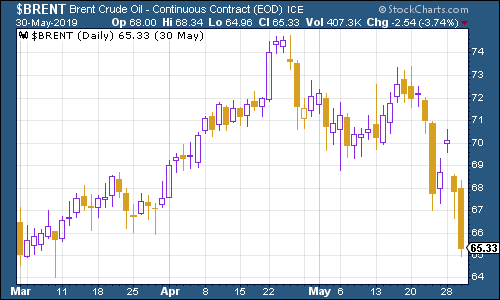

The oil price (as measured by Brent crude, the international/European benchmark) slid again this week on concerns about global growth and trade.

(Brent crude oil: three months)

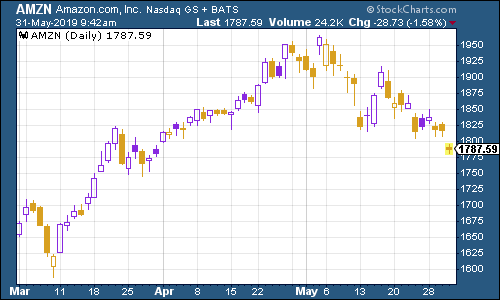

Internet giant Amazon again moved in line with the wider market.

(Amazon: three months)

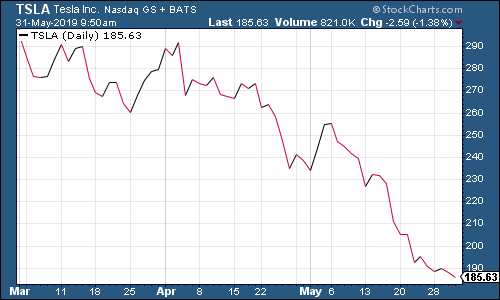

The reality that the car industry is a tough place to make money still appears to be sinking in for investors in electric-car group Tesla the share price continued to slip back this week.

(Tesla: three months)

That's all for this week have a great weekend, and don't forget to sign up, to hear all about the MoneyWeek Wealth Summit!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.