The pound’s wild week

The pound hit four-month lows against the dollar last week amid another bout of political turbulence at Westminster.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

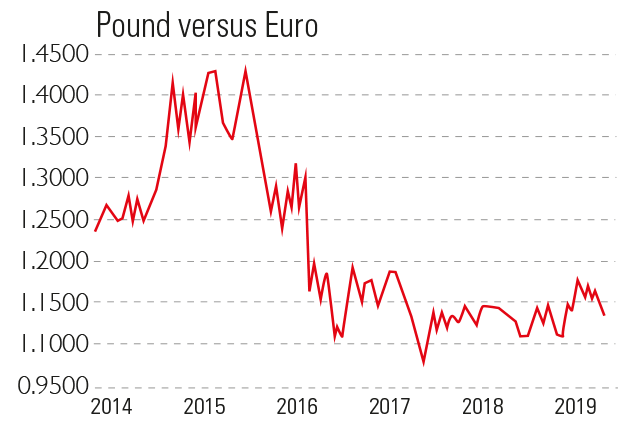

The pound hit four-month lows against the dollar last week amid another bout of political turbulence at Westminster. Sterling fell to $1.26, its lowest level since January, before recovering slightly after Prime Minister Theresa May announced her resignation. It also fell as low as €1.133 against the euro.

May has been one of the worst months since 2016 for sterling, which has shed more than 3% as traders unwound bets that politicians would eventually agree on a Brexit deal. The pound which tends to be a "risk-on" trade has also been hit by the wider flight from risky assets as trade tensions mount, writes Katie Martin in the Financial Times, leaving many investors sitting on the sidelines.

A hard Brexit instigated by current Tory leadership favourite Boris Johnson is seen as "the worst-case scenario" by markets, says Anooja Debnath on Bloomberg. Yet traders have not quite made up their minds about Johnson's intentions, and the chance of a snap election all make the outlook even "murkier".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

With the path towards a Brexit resolution no clearer than it was three years ago, the real surprise is that the rout in the pound has not been worse, says David Smith in The Sunday Times. Dean Turner of UBS thinks a no-deal would see sterling plunge to $1.15 and €0.97, while a reversal of Brexit could see a "swift rebound" to $1.58. Yet whoever becomes prime minister next will "find themselves in exactly the same position" as May, says Karen Ward of JP Morgan, hampered by Parliament's unwillingness to back a deal or to allow a no-deal.

"The last word" is with Parliament, agrees Jon Sindreu in The Wall Street Journal. "As chaotic as a Johnson-led government could be," the most likely outcome is still a customs union or another form of "soft" Brexit. For all the "gyrations", sterling is basically in the same place against the euro as it was two years ago. "The latest move likely won't mean much in the long run."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn