Avon Rubber's share price will bounce back

Avon Rubber, the breathing and dairy farming equipment maker, has a promising future , says Richard Beddard.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Avon Rubber, the breathing and dairy farming equipment maker, has a promising future.

The first half of the financial year for Avon Rubber (LSE: AVON), which ended in March, saw a decline in revenue and a sharper decline in profit compared to the same period a year before. The company described the six-month period as "transformational".

This term is often used as a euphemism for drastic change forced on companies by events they did not foresee. Avon's transformation is less hurried and more certain, despite the end of a massive contract last year. That contract had made Avon Rubber the sole supplier to the US Department of Defence (DoD) of the M50 general protection mask forten years. The M50 is a gas mask that protects military personnel from chemical and biological hazards.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The agreement of the M50 contract over a decade ago marked a previous phase of transformation at Avon that left it with two specialist businesses: Avon Protection, which makes gas masks and breathing apparatus; and milkrite, subsequently joined by InterPuls to form milkrite/InterPuls, which supplies milking equipment to dairy farmers, principally the clusters and liners attached to cows.

Two new orders

Investors have been anxious to learn what will replace the lost business. Avon has announced two big new contracts lasting five years, also with its biggest customer, the DoD. The orders, for more specialised masks, means Avon Rubber will be sole-source supplier to the US Army, Navy, Marine Corps and Air Force. It has also recently become sole-source supplier of the new UK general service respirator.

Concerns that military revenues might decline as orders for the M50 fall appear to be mitigated by these new orders. Avon predicts order intake of between £53m and £80m a year for ten years from its current five biggest military money spinners, compared to total military revenue of £66m in 2019.

The US is the world's biggest military spender, so additional revenues from other countries will not come in such big lumps, but Avon believes there is a growing requirement in Europe to replace ageing kit.

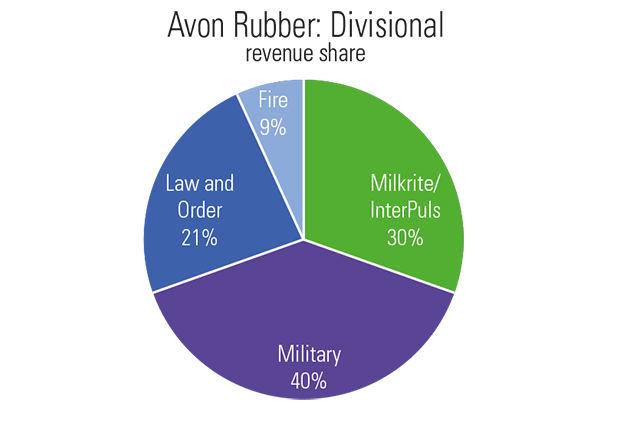

Meanwhile, it is bringing new products to market, growing its non-military respiratory protection business and developing the market-leading dairy businesses into a service provider by renting farmers the equipment they need. This part of the business is very profitable too. Though 80% of military revenue came from the US in 2018, making the DoD a very important customer, military revenue is only 40% of the total, mitigating some of the risk.

The dip won't last long

M50 shipments were down about 4% year-on-year and were more than offset by higher sales to the Norwegian military. The partial shutdown of the US government earlier in the year did most of the damage, delaying orders from US law enforcement and fire authorities, and delaying export licences for US-made products. Low milk prices also did their bit to reduce demand from cautious dairy farmers.

These problems are temporary. The US government has swung back into action (at least as far as Avon is concerned), the milk price has continued to rebound and Avon's order books are burgeoning. It expects to make good the deficit created in the first half of the year, grow revenue in "mid-single digits" over the full year to September 2019 and go into 2020 with a strong order book.

Military sales earn Avon the most money and it has largely conquered its biggest military market, so the company will grow steadily rather than rapidly in future. The shares are on a debt-adjusted price/earnings ratio of 20, reasonable for a company with unrivalled expertise and customer relationships in two distinct markets.

Avon is thinking ahead

Most companies brief analysts from brokers and investment banks on the day they publish results. They are not allowed to say anything significant that has not previously been published, but inevitably in the course of these briefings the executives pass on information that adds colour to the story.

Some companies are enlightened enough to invite private investors or allow them to participate remotely. Avon publishes a webcast comprising the audio of the meeting along with the slides presented by the directors.

Towards the end of the webcast following the results in May, chief executive Paul McDonald responded to a question about the products Avon is developing. He said the products it is bringing to market under new contracts in 2019 principally the M53A1 mask system (a derivation of the M50 designed for special operations) and the M69 aircrew mask system have been five years in the making, andwe will hear about further new products as the company gets closer to selling them.

Like many of Avon's senior managers, McDonald, who became chief executive in 2017, has been at the firm a long time. He joined 15 years ago and was formerly managing director of milkrite/InterPuls.

The signs are Avon prepared itself well for the end of its ten-year sole-source general protection mask contract, and it is still thinking ahead now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Beddard founded an investment club before joining Interactive Investor as an editor at the height of the dotcom boom in 1999. in 2007 he started the Share Sleuth column for Money Observer magazine, which tracks a virtual portfolio of shares selected for the long-term by Richard. His career highlights include interviewing Nobel prize winners, private investors and many, many company executives.

Richard is freelance writer who invests in company shares and funds through his self-invested personal pension. He has worked as a teacher and in educational publishing, and is a governor at University Technology College, Cambridge. He supports the Livingstone Tanzania Trust, a charity supporting education and enterprise in Tanzania.

Richard studied International History and Politics at the University of Leeds, winning the Drummond-Wolff Prize for "distinguished work in the field of international relations".