Veni, vidi, Visa: profits from payment processing

Visa, the payment network giant, is a highly profitable operator dominating the global market.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

What could be better than making money every time someone walks into a shop and buys something? This is how it must feel owning shares in payment technology giant Visa (NYSE: V). By the time you've read this paragraph, it will have carried out 75,000 transactions for people and businesses all over the world using bank cards to pay for anything and everything.

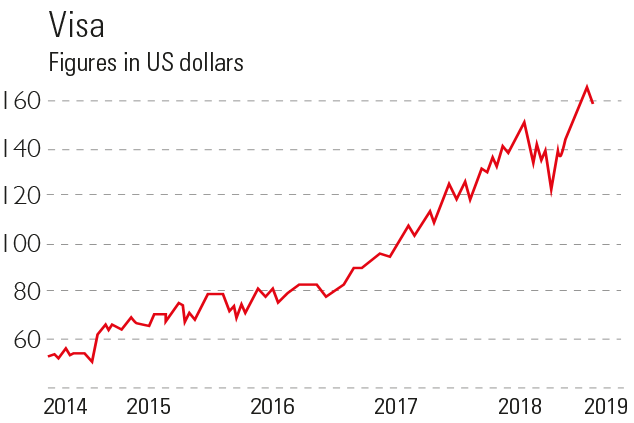

Whether online or in person, each transaction moves money from customer to merchant, and, as the middleman, Visa takes a cut. It soon mounts up: in the first three months of this year, revenues were $5.5bn with operating profit margins above the typical eye-catching 60% level. Over the decade since it came to the market, sales have risen 12% and earnings per share nearly 22% a year.

With these numbers in an expanding global market, competitors should be all over it. After all, it's a relatively straightforward business processing, verifying and settling transactions for a fee. Indeed, Visa hardly gets its hands dirty. It's never issued a credit or debit card, so it doesn't have to deal with millions of customers, and it doesn't lend any money, which means it bears no bad debt risk. Its clients are mainly banks they provide Visa-branded cards (there are 3.3 billion of them) to their customers and the funds to cover their spending while taking the interest.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Two key strengths

This leaves the job squarely with the incumbents, making them an "oligopoly" a few businesses dominating a market resistant to new entrants in which participants generally aren't competing on price. This isn't great news for consumers, but for investors, it's the place to be. As John Authers notes in the Financial Times, the card processors are "as well-protected an oligopoly as it is possible to imagine".

An impregnable oligopoly

Meanwhile, a portion of Visa's fees are linked to transaction amounts, which, reassuringly, means revenues are hedged against inflation and bolstered by overall GDP growth. And that's before its crucial role in the ongoing expansion of e-commerce; the uptake in card usage in countries including emerging markets around the world; and an ongoing shift from cash to cards. Global non-cash transactions are expected to expand by an annual 13% over the next three years. Demand for payment processing will keep climbing and, as one fund manager put it, far from being pushed aside, Visa will remain a principal toll-booth through which ever-rising numbers of transactions must pass.

Visa: a heavyweight exploiting global trends

What he also said, however, was that when a deep and wide moat exists, investors can begin to lift the price at which they are prepared to pay for value. Visa currently trades on a forward price/earnings (p/e) ratio of around 26 and the yield is less than 1%. This buys investors an extremely compelling business model and outlook in which earnings could rise for approximately 20% a year near-term.

It has a strong record of growth and there are few clouds on the horizon. It is at the centre of major global trends: urbanisation, rising middle class populations, the switch from cash to card use, and the accelerating uptake and ease with e-commerce and mobile payments. The principal risks tend to be regulatory, system failure or outage, data protection, and security lapses.

There are few stocks that combine a strong track record, a healthy balance sheet, quality management, double-digit growth, limited threats from outsiders and a demonstrably effective competitive advantage. Visa is one company that brings all these traits together.

Two to three years out the p/e ratio falls to just under 20. However, the stock has rarely traded below 25 historically, and so while 12-month price targets tend to be around $180, a case can certainly be made for a price between $250-$300 over the next couple of years. That would surely put shareholders well ahead of the market as a whole in a company that should still be at the forefront of its industry.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.