The charts that matter: the trade war roars back with a vengeance

John Stepek looks at what the renewed threat of a US/China trade war means for the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you haven't yet read our new weekly column, Currency Corner (in association with currency specialists OFX), then check it out now. Every Friday, Money Morning regular Dominic Frisby takes a look at the big trends and the big news stories moving the foreign exchange markets. This week Dominic's been writing about the pound.

My sincere apologies we don't have a new podcast for you this week problems coordinating our schedules but do catch up with Merryn's interview with India expert David Cornell here if you haven't already.

A quick heads up for an event you might be interested in this week I'm going to be at the Mello investor event in London on Friday coming (17 May), talking about contrarian investing. I may mention my book, The Sceptical Investor, in the process. Oh, and while we're on the topic, if you haven't yet bought a copy of that, you can get it right here (in print, ebook, or even audio now) should you feel like doing so

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

(If already own it then, first of all, thank you very much and I hope you enjoyed it; and second, if you feel like leaving a review at Amazon, that'd be really appreciated.)

Meanwhile, if you missed any Money Mornings this week, here are the links.

Tuesday: What Trump's trade tweets mean for your money

Wednesday: Gold could stagnate for several years but don't make Gordon Brown's mistake

Thursday: Investors beware: central banks won't be able to prop up markets forever

Friday: Never mind tariffs here's a scary thing that happened to markets this week

And if you don't already subscribe to MoneyWeek, do it now you get your first six issues free when you sign up.

Now let's turn to the charts.

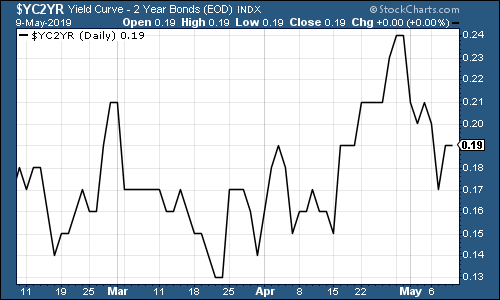

The yield curve (remind yourself of what it is here) dipped this week as ten-year US Treasury yields slipped (despite disappointing bond auctions). Inflation data suggested that wholesale (pipeline) inflation is moderating (so there's less pressure on the Federal Reserve, America's central bank, to raise interest rates), while revived tension between China and the US helped to drive demand for "safe" assets.

The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted, which almost always signals a recession (although perhaps not for up to two years).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

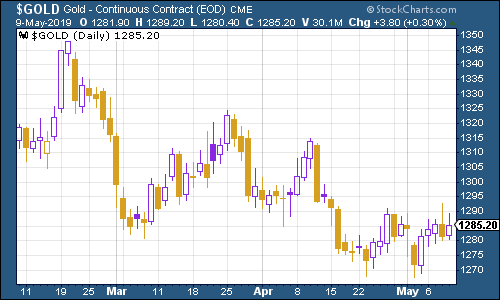

Gold (measured in dollar terms) rebounded somewhat as geopolitical tension grew, what with rising trade tension and North Korea deciding to test some more missiles.

(Gold: three months)

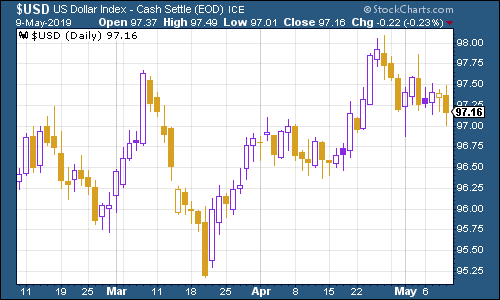

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell back this week, despite all of these reasons for investors to be seeking "safe havens". Which is interesting.

(DXY: three months)

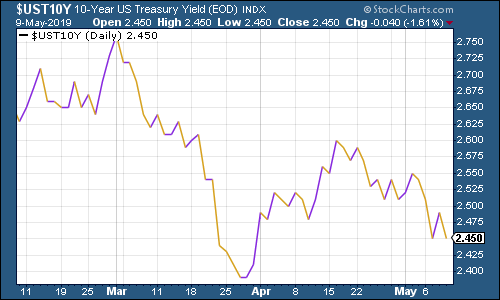

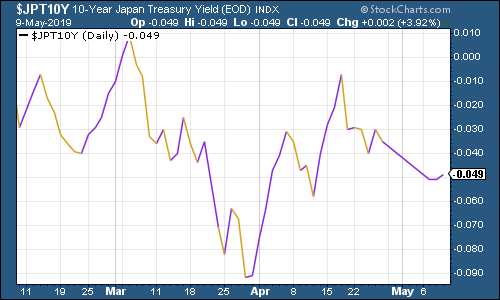

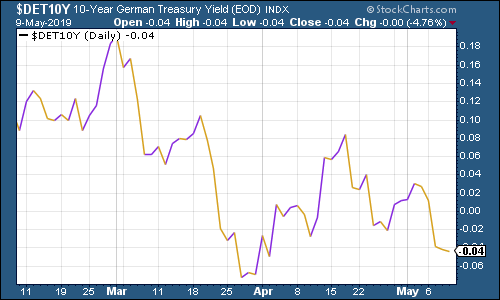

Ten-year yields on the world's major developed-market bonds were lower as inflation came in lower than expected and fears for growth grew amid the trade war heating back up.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

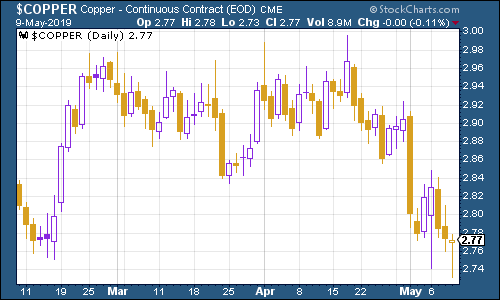

Copper slid further again this week as hopes of an imminent deal between the US and China were dashed.

(Copper: three months)

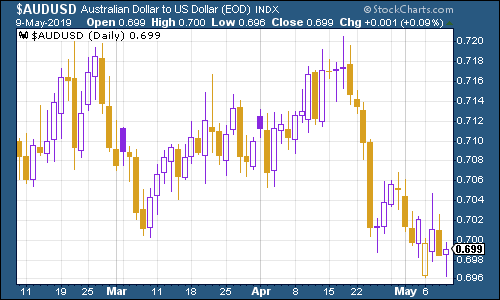

The Aussie dollar our favourite indicator of the state of the Chinese economy slid hard this week too, partly because of the ailing Chinese deal, partly because the Aussie economy isn't in great nick either, and finally, because it has breached a previous floor at the US$0.70 level (that was a key technical level which means chartists keep an eye on it).

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin increasingly looks to be back in fashion. I should've bought some back when I started feeling bullish on it. Ah well, story of my cryptocurrency life.

(Bitcoin: ten days)

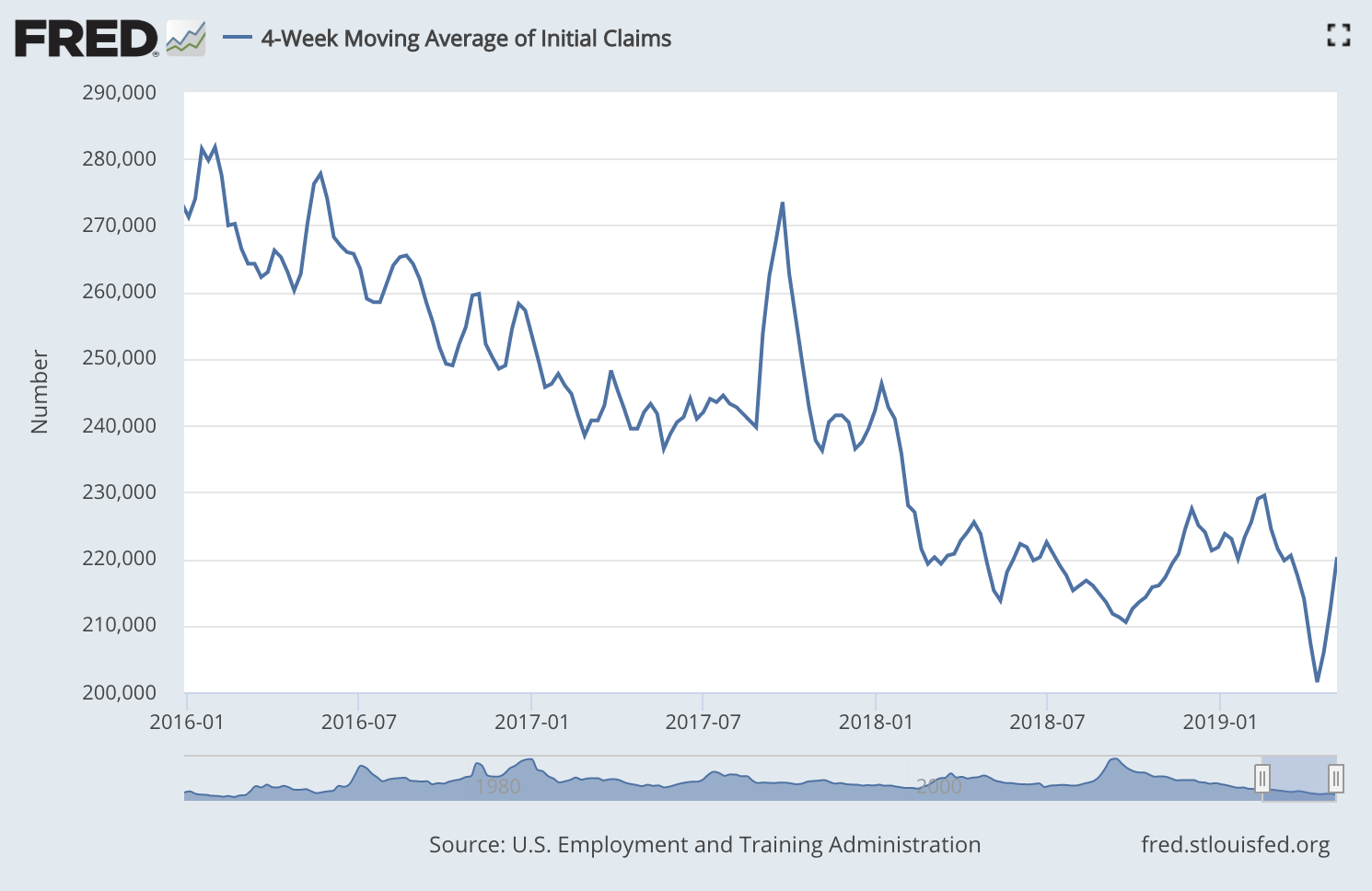

Three weeks ago, US jobless claims hit a fresh low on the four-week moving average measure, dropping to 201,500. This week they were up to 220,250, as weekly claims came in at 228,000.

The moving average matters because as David Rosenberg of Gluskin Sheff has noted in the past, US stocks usually don't peak until after this four-week moving average has hit a low for the cycle. A recession tends to follow about a year later (bear in mind, judged on a tiny sample size).

What's interesting is that we made a new low, and then we made a new peak in stocks, and now we're looking wobbly again. Was that the trough we just saw? I certainly wouldn't want to call it yet, but let's see what happens.

(US jobless claims, four-week moving average: since January 2016)

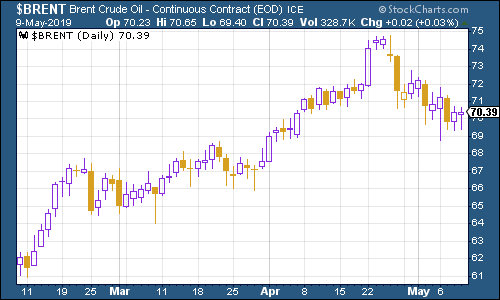

The oil price (as measured by Brent crude, the international/European benchmark) continued to slip back from its recent highs as fears over the impact that trade wars might have on growth hit sentiment.

(Brent crude oil: three months)

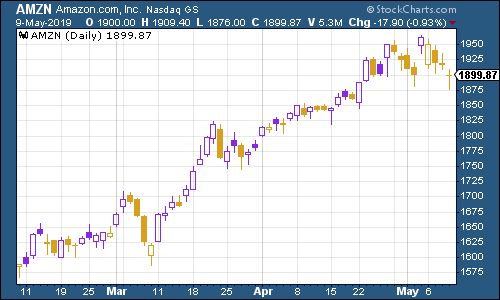

Internet giant Amazon fell back in line with the wider market this week...

(Amazon: three months)

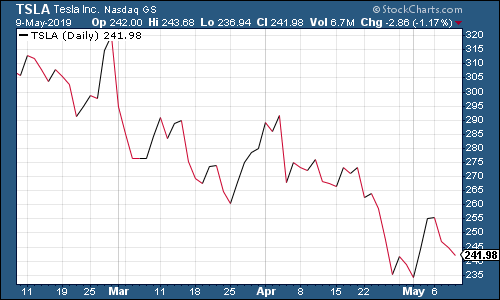

As did electric-car group Tesla.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how