Berkshire Hathaway: don’t bet on a Buffett bounce

Warren Buffett’s Berkshire Hathaway has lagged the US stockmarket for years. Don’t bet on that changing, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Warren Buffett's Berkshire Hathaway has lagged the US stockmarket for years. Don't bet on that changing.

It's not easy having $114bn in cash. Not if your job is to invest the money in assets that will make any difference to the overall performance of your portfolio, at a time when lots of equally well-funded rivals are chasing the same deals. That's the problem besetting Warren Buffett, the world's most famous investor. As Buffett told the Financial Times last month, there are maybe 100 listed shares that are big enough for his conglomerate, Berkshire Hathaway, to even look at. You won't find any hidden gems there. "What we see in the way of marketable securities, everybody in the world knows about them."

As for big deals the "elephants" Buffett often cites there is so much competition from private equity firms, glutted with cheap debt, that "prices are sky-high for businesses possessing decent long-term prospects." This is one reason why Buffett has been reduced to investing in tech giant Amazon it's one of the few places where he can park his cash. This has all contributed to a long period of underperformance for Berkshire (see below). So here's what we need to know: is it due a turn? Or should you look elsewhere?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Buffett does have a great record. And his key strengths plenty of cash and the patience to exploit it appear to be intact. That might argue for buying in now, and hoping Buffett will make out like a bandit in the next (presumably inevitable) crash. Yet if you think the cycle is on the turn, there are better ways to play it. For one thing, Berkshire is just too big. Invest in a fund that can access tastier opportunities (Merryn has a few ideas in her interview this week). Buffett all but admits this when he tells the FT: "If you want to join something that may have a tiny expectation of better performance than the S&P, I think we may be about the safest."

Yet I'm not convinced that even this latter point is realistic. Succession risk looms large at Berkshire. Charlie Munger, Buffett's slightly-less-famous partner, is 95. Buffett is 88. Their likely replacements Ajit Jain and Greg Abel have not had much time in the spotlight. So without the Buffett and Munger double act, what does Berkshire become? Arguably just another conglomerate one which has been run in an idiosyncratic, Buffett-dependent way for decades.

As proxy adviser Glass Lewis notes, Berkshire "does not follow many governance best practices'". The adviser adds "we do not believe that shareholders have many concerns". But how long will that last if Buffett is replaced by a successor in whom investors, as yet, have no reason to deposit the same amount of faith? In short, as the FT puts it, "crises do not come along frequently, and when the next one does, someone else might be running Berkshire".

Berkshire Hathaway's long dry spell

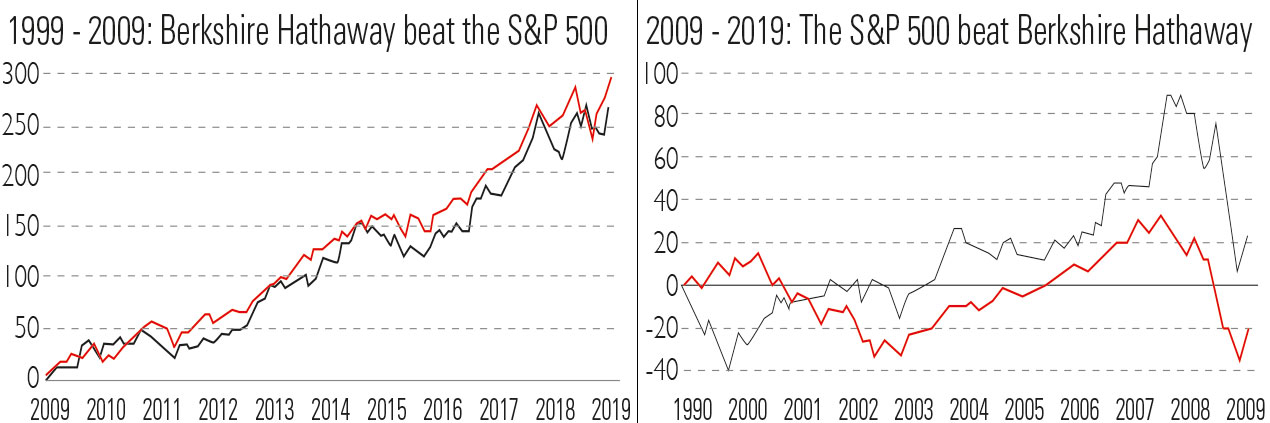

Warren Buffett's Berkshire Hathaway has a strong record of outperforming the US stockmarket. As the chart on the left shows, Buffett trounced the S&P in the decade from 1999 to 2009, which encompassed both the tech bubble and bust, and the financial crisis. Indeed, in the 30 years from 1979, Berkshire outperformed the S&P 500 by an average of around 12% a year, according to the Financial Times.

However, as the second chart shows, since the financial crisis bottomed out more than ten years ago, Berkshire Hathaway has actually underperformed the S&P 500 you would have been better with a simple US tracker fund (which merely aims to copy the underlying index, rather than beat it).

Of course, many "value" investors have struggled in the years since the financial crisis, partly due to the distortions caused by central banks' low interest rate policies. However, as noted above, Berkshire's sheer size increasingly works against it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how