Palladium’s rise has been epic – will platinum ever catch up?

Palladium, used in catalytic converters for petrol cars, has shot up in price. Platinum, used in diesels, has collapsed. The question now, says Dominic Frisby, is should you sell palladium and buy platinum?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today, we consider a stellar performer.

In a market in which precious metals have patently not shone over the past few years, this one has positively glistened.

In 2016, it rose some 45%. In 2017, it was up 60%. In 2018, it was up 15%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I'm talking about palladium.

The rise and rise of palladium

Palladium is a little known silvery-white metal categorised as a platinum group metal (PGM).

Its predominant use is in catalytic converters for cars. Catalytic converters account for around 80% of annual demand (excluding investment). The rest comes from electronics (it is used in ceramic capacitors in phones and laptops); jewellery (mostly as an alloy in white gold); in dentistry; and in the chemical industry (as a catalyst to separate hydrogen).

Annual demand is about seven million ounces. To put that number in perspective, annual silver demand is about one billion ounces, and annual copper demand is 24 million tonnes (there are over 35,000 ounces in a tonne).

It's a niche metal, in other words.

Russia is the world's largest producer, with just over 40% of annual global supply. Together with South Africa (just under 40%) they produce about 80% of global supply. I think it is fair to describe this concentration of production as "potentially problematic".

China is the world's largest consumer, requiring two million ounces in its vehicle industry alone, followed by Europe.

Palladium is traditionally seen as a cheaper alternative to platinum, though the evidence of the past few years is that this view is baloney. Platinum currently sits at around $850/oz, while palladium is almost 65% higher at $1,400.

The reason for this is perfectly simple. It goes all the way back to the Volkswagen diesel scandal of 2015 when it emerged that Volkswagen, and probably many more carmakers besides, had been understating the pollution emissions of their diesel engines. "Dieselgate" led to a sea change in attitude towards diesel, especially in Europe.

People no longer want diesel cars. Governments don't want diesel engines and so will tax them. Legislation has changed. Now the demand is for cleaner electric, petrol and hybrid alternatives.

Diesel vehicles' catalytic converters rely more heavily on platinum, and their sales have collapsed. Sales of petrol-fuelled cars have increased and the new emissions regulations have led carmakers to use more palladium.

Palladium, in other words, has been a regulation play. Will public opinion towards diesel change? Will regulation change? At the moment, it looks unlikely, but who knows what further scandals lurk under the surface.

Is it time to short palladium and go long platinum?

Most metals, be they precious or base, tend to trade together. If copper is in a bull market, for example, gold usually is as well. But palladium has always been its own animal. Between 1997 and 2001, for example, the palladium price went up nearly ten-fold (from $117 to $1,090/oz). The likes of gold and copper declined over the same period to 20-year lows.

When gold and copper had their day in the sun in the 2000s, palladium rallied too, but not by as much, and the highs were nothing like those seen at the turn of the century.

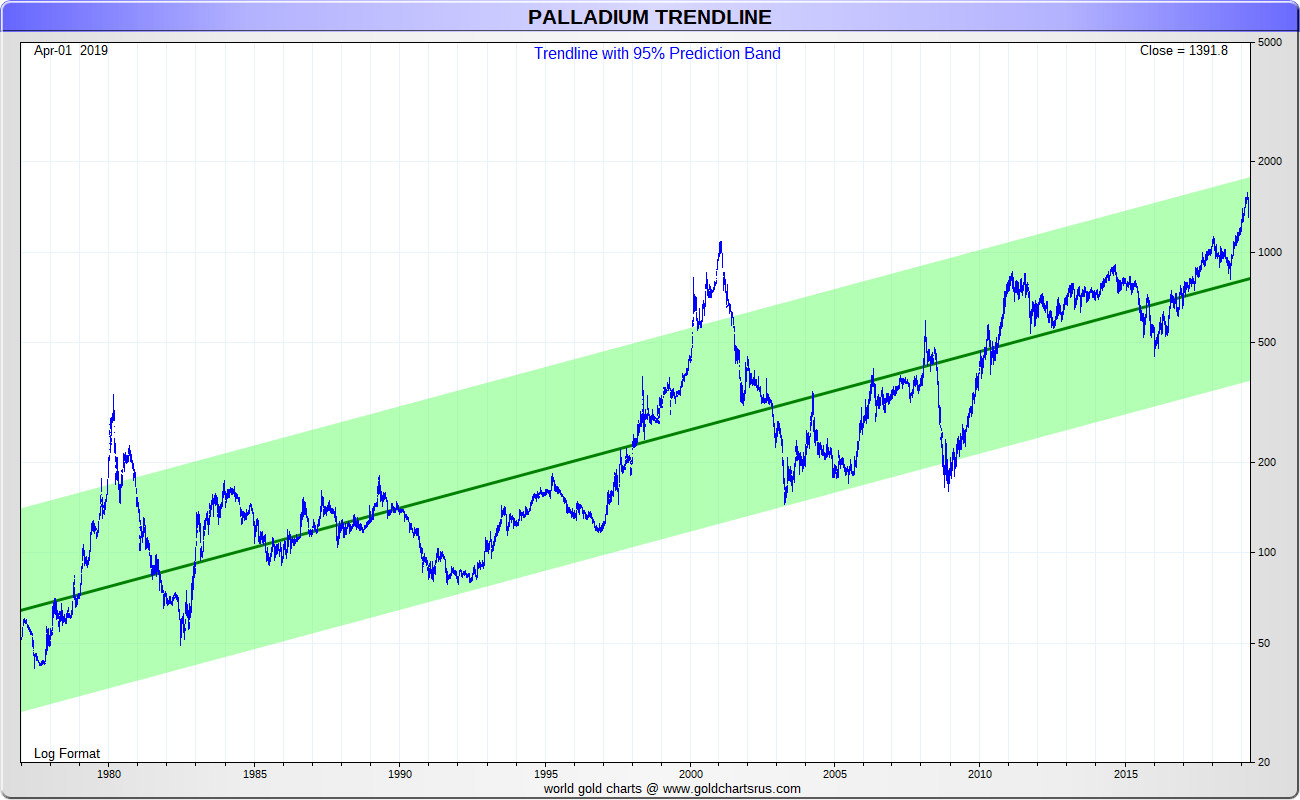

Here we see a very long-term chart of the palladium price going all the way back to the 1970s. Nick Laird, the chartist, has also plotted a green confidence band around the price 95% of the time palladium stays within that band. Just twice, around 1980 and then again around 2000/2001, has it gone above.

Maybe there is a 20-year cycle in palladium, and it's heading to a similar extremity around the 2020 mark. If so, you heard it here first.

For now, the price is extended. That happens in bull markets (and we will come to the current correction in a moment). But on the basis of a long-term historical comparable, there is still some room for further upside.

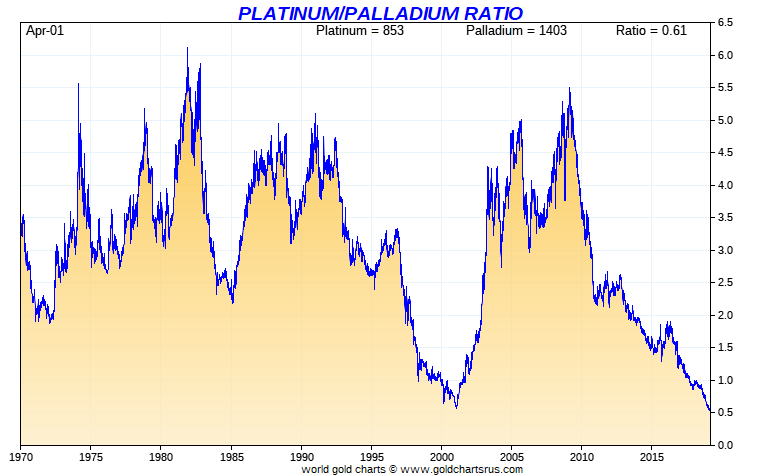

I sat on a panel at the UK Investor Show at the weekend discussing metals and mining, and I put it to the panel that the current trade should be long platinum and short palladium. My reason for that thinking was this: the ratio between platinum and palladium.

On a relative basis, platinum has never been this cheap, not even in 2001 at the peak of the last palladium mania. It is 60% of the palladium price. That is extraordinary. Not even a decade ago, it was 5.5 times the palladium price.

Andrew Monk, CEO of VSA Capital, who was sitting beside me, said, quite definitely: "yes, but not yet. Give it another year or 18 months."

I think he is probably right. We may well go back to platinum being two or three times the palladium price the historical average. With palladium at its current price of around $1,400, that would imply a platinum price above $3,000, some four times higher than it is today.

But for now the regulatory and legislative winds are blowing in the face of platinum. We need a major shift in attitude. Some new use needs to be found for platinum or some new tech needs to be proven ensuring cleaner diesel.

Or, for some reason, supply needs to dry up altogether. Given the current state of South African mining, the latter is the most likely, I'd say. For now, if anything, the supply deficit is more in favour of palladium than platinum.

Last week palladium began a fairly sharp sell-off, correcting from $1,600 to $1,350 in just a dew days, before rallying slightly to its current price of $1,400. That may be the start of something bigger or it may just be one of those corrections you get in bull markets.

I'm tempted to go short with a stop just above the old highs, but for now I'm staying my hand.

I notice, by the way, that investors in exchange-traded funds liquidated over half a million ounces of palladium in 2018. That was the fourth consecutive year of net redemptions. That is not something you would expect to see at or near market highs. You would expect to see investor buying.The contrarian trade is currently to be long.

It all makes me think Monk may be right. It's coming but we are not there yet.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The markets say sell, but should investors listen?

The markets say sell, but should investors listen?Analysis As fear grips markets around the world, investors need to have an honest conversation about what they’re comfortable with owning.

-

As global powers fight it out, commodity prices are set to rocket

As global powers fight it out, commodity prices are set to rocketAnalysis Commodity prices have been held down by globalisation. This trend is now rapidly reversing.

-

Is gold cheap relative to equities?

Is gold cheap relative to equities?Analysis Dominic Frisby looks at the Dow-gold ratio and explains why gold is starting to appear inexpensive compared to equities.

-

Are we heading for a commercial property crash?

Are we heading for a commercial property crash?Analysis The pandemic has reduced the demand for office spaces and permanently changed the office environment. But John Stepek says rising interest rates are a bigger threat to commercial property right now.

-

Is the oil market heading for a supply glut?

Is the oil market heading for a supply glut?Analysis Many people assume that the high oil price is here to stay – and could well go higher. But we’ve been here before, says Max King. History suggests that supply will increase to more than meet demand.

-

Why has the Terra stablecoin broken its US dollar peg and should you care?

Why has the Terra stablecoin broken its US dollar peg and should you care?Analysis The Terra stablecoin is supposed to match the value of the US dollar – but its value has crashed. John Stepek explains what it means for you and your investments.

-

Alphabet and Microsoft look like gems in the rubble of the tech sector

Alphabet and Microsoft look like gems in the rubble of the tech sectorAnalysis Tech stocks have fallen hard this, with the Nasdaq index down 22% since November. But both Alphabet and Microsoft are still both worth a look, says Rupert Hargreaves.

-

The UK’s new energy strategy has been revealed – here’s how you can profit

The UK’s new energy strategy has been revealed – here’s how you can profitTips The UK has just released details of its long-term energy strategy, which emphasises offshore wind power. Rupert Hargreaves explains how you can invest.