Today, silver looks cheap compared to gold – but should you make the trade?

By historical standards, silver is incredibly cheap while gold is very expensive. So should you sell your gold and buy silver? Dominic Frisby weighs up the trade.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It has been many years since I last looked at this subject on these pages, but in today's Money Morning we put that right.

We turn our back on the political shenanigans at work in Westminster and Brussels, and the ensuing volatility in the currency markets.

Instead we focus on hard money gold and silver. Specifically, we look at the ratio between the two...

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The long and varied history of the monetary metals

What we are talking about here is the number of silver ounces it takes to buy an ounce of gold. If the gold price is $1,500 per ounce and the silver price is $15, then the ratio between the two would be 100.

Why is this ratio important?

Firstly, it enables an investor to gauge which of the two metals is cheap relative to the other. If the ratio is high, then silver is cheap and perhaps you should sell gold and buy silver. If the ratio is low, then gold is cheap and perhaps you should sell silver and buy gold.

But perhaps more significantly, the ratio tends to act as an indicator of what is happening in the credit markets. When the ratio is rising and gold is outperforming silver that is typically indicative of tightening, or, on occasion, even credit stress. On the other hand, when the ratio is falling, and silver is outperforming, the implication is that you are in a more benevolent, inflationary period of credit expansion.

Silver is roughly 17 times more common in the earth's crust than gold. So the natural ratio between the two is somewhere around that mark. In olden times, when precious metals were used as money, that ratio was often fixed officially. In Ancient Greece, for example, the ratio stood at 12.5. In the mighty days of Rome the fix was 12.

Even in late-19th-century USA, which was on a bi-metallic standard, the ratio between the two was 15. In fact, the ratio between the two was such a big discussion point that it would become one of the themes of L Frank Baum's children's story, The Wizard of Oz.

In the book, Dorothy wore silver slippers as she danced along the yellow brick road (aka the gold standard). It was only in the film that the colour was changed to ruby so that Hollywood could show off its new technicolor.

Moving into the 20th century, as gold and silver have been abandoned as money, we have seen the ratio creep higher. Gold has maintained its role as a store of wealth, whereas silver's main uses are industrial and so its perception as a precious metal has not been held by all.

All through the 1920s, 30s and early 40s the ratio crept higher, so that during WWII it hit 100. Gold was 100 times more expensive than silver! However, from the end of the war through to the end of the 1960s the ratio fell again, so that, shortly before the US abandoned the gold standard in 1971, it touched its long-term historical average below 20.

The 1970s saw it climb again above 40. When the Hunt brothers almost cornered the silver market in 1980, the ratio spiked back below 20, but then the climb began again until in 1991, it touched 100 again.

From that point on the ratio has ranged between about 45 and 90, bar a brief episode in 2011 when silver spiked to $50 and the ratio came down almost to 30. It didn't last.

Today, silver looks cheap compared to gold but it could stay like that

And here we are today, with gold at $1,300 and silver at $15.40. Gold is 84 times more expensive than silver. The ratio is high. By historical standards it's extraordinarily high. Geologically, as I say, the ratio should be at 17. If gold stayed at $1,300, that means silver should be $76. Either that, or gold needs to fall by a lot.

But I am afraid that modern markets in their current form do not care about the availability of silver in the earth's crust. One day they will, but today they don't. Silver for all its many wonderful properties (and believe me, silver has many wonderful, almost magical properties) is just an industrial metal that gets used in electronics, photography, mirrors, alloys, batteries and, of course, jewellery.

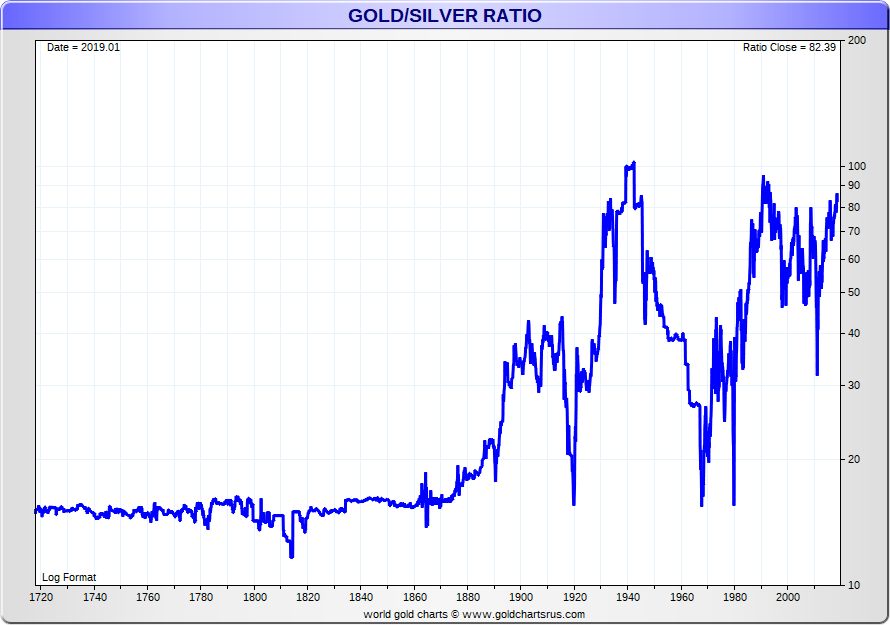

Here, courtesy of Nick Laird, we see the gold-silver ratio since 1720 how about that for some historical data?

On the basis of this long-term chart we are close to the top of the range and should be selling our gold and buying silver.

But I would not be in such a rush.

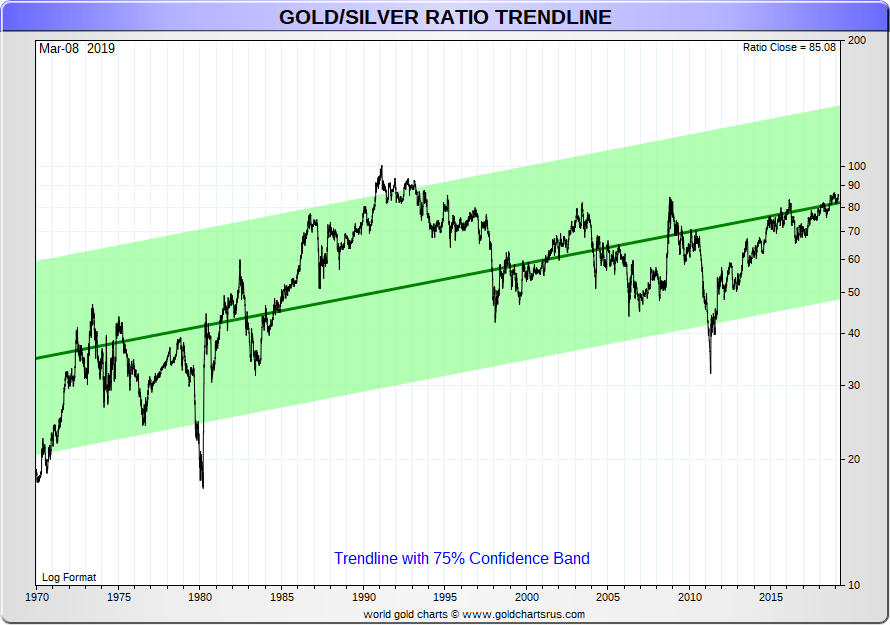

Here we see the ratio since 1970, along with a green trend line, which is rising, and a confidence band around that trendline.

You can see that, barring periods of extremity such as 1980, 1991 and 2011, the ratio has stayed within that band, and today at 84 we are right slap bang in the middle.

On the other hand, if you look at the same chart and strip out the green bands, you can also see that at 84, we are at the upper end of the range and it wouldn't take that much to take us back to around 45.

If we get close to all-time highs around 100, I'd be banging the silver drum and selling the golden one, but for now I don't see the need. The ratio is normalising at these higher prices in the 80s. Silver is not valued.

I can see us going to 100 and beyond way before we ever see the likes of 17 again.

I own silver. I love silver. If the ratio goes back to 17, I'll do just fine. But I'm not holding my breath. We live in a world in which the intangible is ascribed greater value that the tangible. The digital economy is worth more than the physical. Stuff is a pain, not an asset.

That's today's mentality. And that's why I think that if that ratio is going anywhere notable, it's higher. Though the more probable outcome is that we meander around the 80s. One day, Rodney, but not tomorrow.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge