What’s in your tracker funds?

A striking gap in the returns on Chinese index funds shows why you must be sure to know what you own. John Stepek explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A striking gap in the returns on Chinese index funds shows why you must be sure to know what you own.

China is set to become an even more significant force in global equity markets. By November, index provider MSCI will have increased the proportion of domestically listed Chinese stocks ("A-shares") in its emerging markets index from 0.71% to 3.3%, notes the Financial Times.

As a result, any funds that track the popular benchmark will have to buy more of the shares. Chinese stocks listed offshore in the US or Hong Kong already account for 31% of the index, so by the end of the year China's total weighting will be 34.3%. This is just one reason for this year's China market rally.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

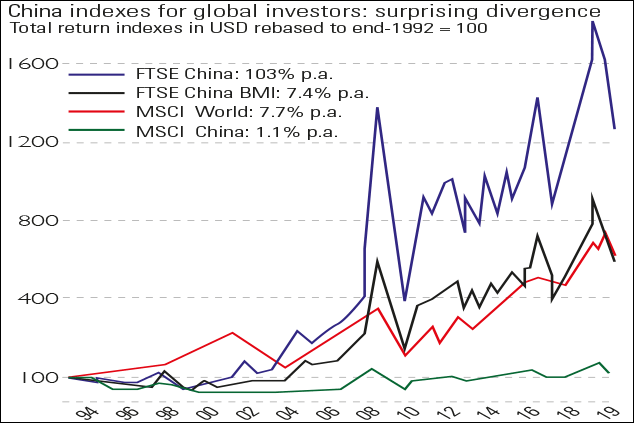

Yet for anyone considering investing in China, the latest Credit Suisse Global Investment Returns Yearbook (by professors Elroy Dimson, Paul Marsh and Dr Mike Staunton of the London Business School) has a useful warning know what you're buying. The researchers reviewed the performance of three key Chinese indices since 1993: FTSE China, MSCI China, and S&P China BMI.

All three, notes the yearbook, aim to measure the performance of Chinese stocks available for investment by foreign investors. Yet the returns were dramatically different. Over the period, the MSCI China returned just 1.1% a year. Yet the FTSE China index managed 10.3%, and the S&P BMI 7.4%.

That's a staggering gap. There's no great mystery to it there are several differences in calculation and categorisation that can account for the gap. For example, until 2013 the FTSE China index did not include certain Hong Kong-listed shares, while the MSCI China index excluded US-listed Chinese shares until 2015.

However, as an investor, if you'd been looking for a "China tracker" during this period, then you would have probably struggled to forecast (or even understand) the effect that their differing methodologies would have on your returns and choosing the wrong one would have cost you dear. The lesson is clear, and it'sone we've repeated over andover again here you always need to understand what you are investing in.The number of indices out there is now vast.

If you just want to buy UK shares, for example, you can probably rely on a plain vanilla FTSE All-Share tracker. But if you want to invest in specific emerging markets, or a tracker with a more exotic set of valuation criteria, then you have to look under the bonnet. If you can't understand what a tracker fund holds and why, or how those holdings might change over time, consider another route to investing in the sector. And if you're looking at China specifically, you might want to compare any passive funds you are considering with active alternatives.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how