Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

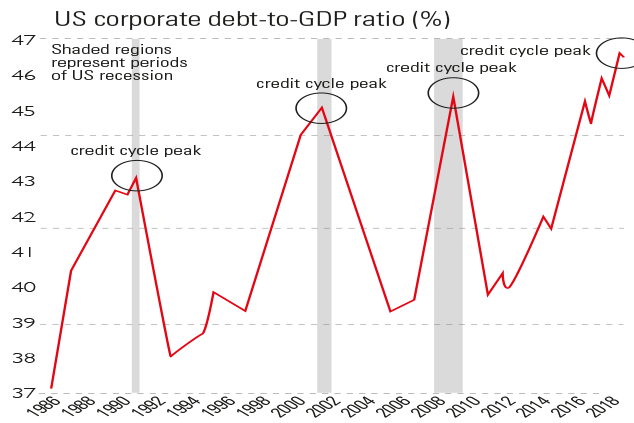

Not for the first time, America has "fought a debt bubble by adding on more debt", says David Rosenberg of Gluskin Sheff. Consumers delevered a tad after the financial crisis, but the state and corporations went on a binge.

Total US non-financial corporate debt has hit a record of more than 46% of GDP. Indeed, the chart of corporate debt-to-GDP this cycle looks "a lot like the mortgage debt-to-GDP ratio of a decade ago". And just as we saw with the mortgage market, the "junky nature" of company debt is a major worry.

Half the $6trn investment-grade corporate paper market is made up of BBB-rated debt the lowest level before it officially becomes junk. The value of the BBB segment has soared fivefold in a decade.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"The current system of business rates is crushing the life out of the high street while handing a big competitive advantage to online retailers with littlein the way of a physical presence.This imbalance needs correctingto my mind the best response to the challenges of the digital age would be to shift from a tax based on property to one levied on sales. Today's savvier retailers are often a mix of online and physical,in symbiotic relationship with one another. A small levy at point of sale, or alternatively with online sales at point of delivery, would allow similar levels of revenue to be raised at local level for local use. In any case, the tax treatment of Amazon and the high street would end up exactly the same. Can a government paralysed by Brexit be persuaded?Don't hold your breath."

Jeremy Warner, The Sunday Telegraph

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how