The conditions are ripe for a spike in the price of this metal – here’s how to invest

Zinc is in short supply. And that could mean a big price rise. Dominic Frisby looks at the fundamentals, and picks some of the best ways to invest.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Zinc is the subject of today's Money Morning.

We consider the metal, its uses, the state of the market and we end with some possible ways to play the market, including two speculative miners.

Why zinc specifically? Because there is a potential shortfall in supply which could lead to a spike in the price.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Why is zinc in the doldrums?

Let's start with the metal itself. After iron, copper and aluminium, zinc is the fourth most used metal in the world. Its main use is in the construction industry: the frames of buildings, bridges, roofs, staircases, beams and piping all contain zinc. A coating of zinc over iron or steel protects the metal beneath from rusting.

It is also used in alloys (brass and bronze), in compounds with a range of applications, particularly in batteries from everyday AAs and AAAs to silver-zinc batteries in aerospace and, increasingly, in fertiliser.

The market for zinc is worth around $35bn a year. Numbers like that can be difficult to fathom, so to put $35bn in some kind of perspective, that's around double the size of the lead and silver markets, but about a fifth of the size of the copper market.

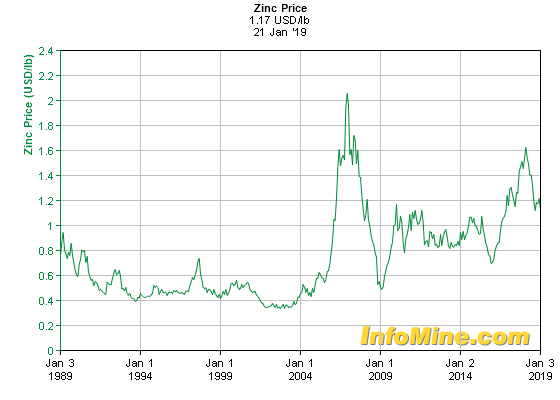

Here, for your information, is a chart showing 36 years of zinc prices.

Just over $2/lb was the all-time high in 2008. You can see the barren commodities depression of the 1990s, by the end of which zinc had slid below $0.40/lb; the boom of the 2000s; then more depression between 2011 and 2015.

2016 and 2017 were good years for zinc, but 2018 was not. It began the year just below $1.60/lb, peaked in February and ended the year at just below at $1.15/lb, meaning falls of around 28%. It fell pretty much in tandem with emerging markets, as is often the way.

The low for the year came in September at just above $1, at which point it was down by more than 30% on the year. Today it has rallied a little and sits at $1.17.

Much of its poor performance can be explained by its ties with steel. Zinc was caught in the crossfire of trade wars and, in particular, the tariffs on steel products.

The latest Bank of America Merrill Lynch fund manager survey shows that, of late, fund managers have been strong buyers emerging-market equities, while avoiding developed market regions. After many years of developed-market outperformance, the inference is that a cyclical turn may be at hand. If so, zinc may be a beneficiary.

The fundamentals look good for zinc

The fundamentals are certainly there.

According to the International Lead and Zinc Study Group (ILZSG) "the global market for refined zinc metal was in deficit by 326,000 tonnes over the first 11 months of 2018, with total reported inventories decreasing by 161,000 tonnes over the same period".

At around 120,000 tonnes, London Metals Exchange stocks are at levels not seen since late 2007. The less stock there is, the less supply. The last time it was this low, zinc's spike to $2/lb quickly followed.

Meanwhile Chinese smelter production is also in decline as a result of two factors: poor economics and an environmental crackdown, both of which have resulted in closures.

The question is whether smelters will be able to complete environmental upgrades and then get production levels back to where they were in 2015-2016. The jury is still out on that one, but for now Chinese stocks are depleted.

At current rates of global consumption, there is only about a week's worth of zinc supply held in visible stockpiles. That is quite something.

World zinc mine production rose by about 1.7% last year, says the IZLSG, mainly due to increases in European production, especially in Finland, Greece, Macedonia and Russia. Output was lower in Canada, China, India and Mexico (which are among the larger producers).

Chinese imports of zinc contained in zinc concentrate rose by 21.3% on the previous year, and its imports of refined zinc were up around 7%.

Given all this, zinc "should" be priced higher. One can only assume either tariff concerns have suppressed the price, or perhaps increased mine supply or considerable growth in Chinese smelter production is anticipated. Nevertheless, the conditions are certainly there for a potential spike in the price. Who knows, perhaps a softening of the aggressive tariff narrative could be the trigger.

How to invest in zinc

There are a range of ways to play zinc. ETF Securities offers London-listed ETFs under the tickers ZINC, or you can spreadbet the price (which has its own considerable risks attached, and I'd avoid doing so unless you know what you are doing).

The large miners are another option, but none are pure plays. BHP Billiton (LSE: BLT) is the world's largest producer of zinc, while other large producers include Anglo-American (LSE: AAL), Vedanta (LSE: VED) and KAZ Minerals (LSE: KAZ).

I own shares in two zinc exploration and development plays (juniors are another level of risk in themselves). One has been an utter dog - that's dual-listed Solitario Zinc (NYSE: XPL; TSX: SLR). It has good high-grade projects in Peru and Alaska, both in partnership with majors, as well as other exploration assets in Peru and a 10% interest in zinc explorer, Vendetta, operating in Australia.

The management team has kept the share structure tight, and at 9% ownership, has plenty of skin in the game. The cash position is about US$12m, and has been well preserved. Yesterday it announced US$600,000 of revenue from two royalty deals. At US$0.27, it has a market cap of US$16m, so to my mind, it is an extraordinary value proposition at the moment. You're getting its assets for around US$4m. But beware: Solitario has been a proven value trap.

My other zinc junior is Tinka Resources (TSX: TK), which appears to have made a major discovery in Peru. It's currently at C$0.34, which gives it a market cap of C$90m. This was an C$0.80 stock last year and could easily be so again, if zinc gets up off the floor and the good drill results keep coming. There is a high expectation that this will eventually get bought out.

Just to be clear again, for full disclosure, I own shares in both Solitario and Tinka.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

These 2 stocks are set to soar

These 2 stocks are set to soarTips The returns from these two aluminium and tin stocks could be spectacular when the commodity cycle turns says David J Stevenson.

-

The best ways to buy strategic metals

The best ways to buy strategic metalsTips Weaker prices for strategic metals in the alternative-energy sector are an investment opportunity, says David Stevenson. Here, he picks some of the best ways to buy in.

-

A lesson for investors from a ill-fated silver mine

A lesson for investors from a ill-fated silver mineAnalysis Mining methods may have changed since the industry’s early days, but the business hasn’t – digging ore from the ground and selling it at a profit. The trouble is, says Dominic Frisby, the scams haven't changed either.

-

The natural resources industry is in a tight spot – which is bad news for the rest of us

The natural resources industry is in a tight spot – which is bad news for the rest of usOpinion The natural resources industry is in a bind. We need it to produce more energy and metals, but it has been starved of investment, plagued by supply chain issues, and hobbled by red tape. That’s bad news for everyone, says Dominic Frisby.

-

How to invest in the copper boom

How to invest in the copper boomTips The price of copper has slipped recently. But that’s temporary – the long-term outlook is very bullish, says Dominic Frisby. Here, he explains the best ways to invest in copper.

-

Why investors should consider adding Glencore to their portfolios

Why investors should consider adding Glencore to their portfoliosTips Commodities giant Glencore is well placed to capitalise on rising commodity prices and supply chain disruption, says Rupert Hargreaves. Here’s why you should consider buying Glencore shares.

-

How to invest in the multi-decade boom in industrial metals

How to invest in the multi-decade boom in industrial metalsTips The price of key industrial metals has already begun to rise. The renewable energy transition will take them higher, says David Stevenson. Here's how to profit.

-

Avoid China’s stockmarket – here’s what to invest in instead

Avoid China’s stockmarket – here’s what to invest in insteadOpinion China’s stockmarket is not a good place for investors to be. But you can't just ignore the world's second-largest economy, says Dominic Frisby. Here, he picks an alternative China play.