Why we believe in convertible bonds for 2019

SPONSORED CONTENT - A convertible bond is a fixed-rate instrument that can convert into shares at a specific share price, which is preset by the issuing company at a premium over the current share price.

A convertible bond is a fixed-rate instrument that can convert into shares at a specific share price, which is preset by the issuing company at a premium over the current share price. The bond also has a coupon, but the interest rate is lower than a normal bond's, because the conversion feature gives it an equity upside.

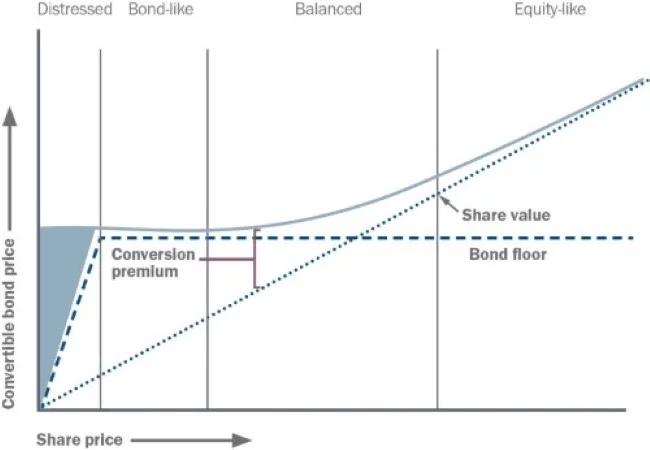

Convertibles therefore have an equity correlation and can move with the underlying share price, but also have a bond floor' i.e. a price below which they cannot fall (unless the company loses creditworthiness) due to the interest rate they are paying. This hybrid bond-equity make-up can shape convertibles into a flexible and attractive vehicle, providing excellent investor opportunities. It optimally protects an investor's initial investment on the downside but also lets them make the most of the upside as the company's shares increase in value.

Introducing different varieties of convertible

- Some operate way below the share price at which the bond converts and will behave like regular bonds, as the equity kicker is too far away to matter

- Some have become pure equity, as the share price has risen substantially

- Others are in between and trade with a mixture of both the bond and equity factors, known as the balanced' zone.

The graph below shows how this works.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What kind of returns do convertible bonds offer?

Historically, convertible bonds have returned as much as equities, but with about half the volatility. If that sounds too good to be true, there are a couple of caveats:

1. Interest rates and bond yields have dropped for decades, helping bond floors go up

2. The convertible market is much smaller than the equity markets, so you could never replace all the shares in your portfolios with convertibles.

However, when interest rates rise and equities feel nervous about how far rates will go, convertibles have often delivered a better risk/return ratio than a simple blend of equities and fixed income. That's why we believe they are a key investment theme for 2019.

Good convertible managers move from one bond to another and take advantage of market moves. The same managers can also move from one region of the world to another, or one credit rating to another, and hedge or not hedge the underlying currency of the bond. This creates a lot of variables for an active manager to play with.

An important investment theme for 2019

Properly managed, convertibles can give a great risk/return ratio and improve that ratio in a diversified portfolio, making them a valuable addition while equity markets continue to climb an ever-growing wall of worry. They are certainly an important theme that will be playing out in our client portfolios in 2019.

• For more of our investment ideas for 2019, visit our website.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

The information contained herein is based on materials and sources that we believe to be reliable, however, Canaccord Genuity Wealth Management makes no representation or warranty, either expressed or implied, in relation to the accuracy, completeness or reliability of the information contained herein. All opinions and estimates included in this document are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information contained herein.

Michel Perera

Chief Investment Officer

Michel is responsible for the investment process at Canaccord Genuity Wealth Management, with a specific focus on asset allocation and stock selection. He also works to maximise the potential of Canaccord Genuity's proprietary and industry-leading stock screening tool, Quest.

Michel is an experienced investment strategist having spent the past 19 years at JP Morgan Private Bank where he was the Chief Investment Strategist (EMEA) responsible for running investment strategy and overseeing tactical asset allocation decisions for discretionary portfolios within the region.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.