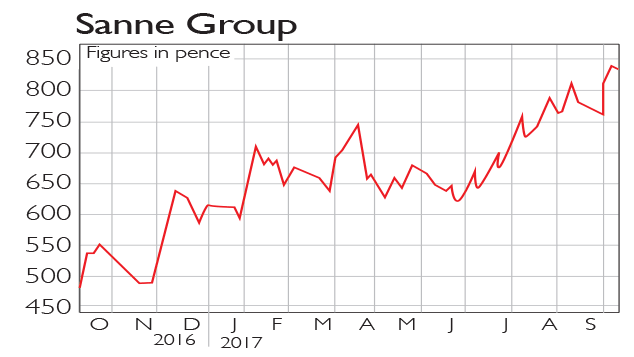

If you'd invested in: Nanoco and Nostrum

Manchester-based tech company Nanoco is flying, while oil producer Nostrum has had a bad year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

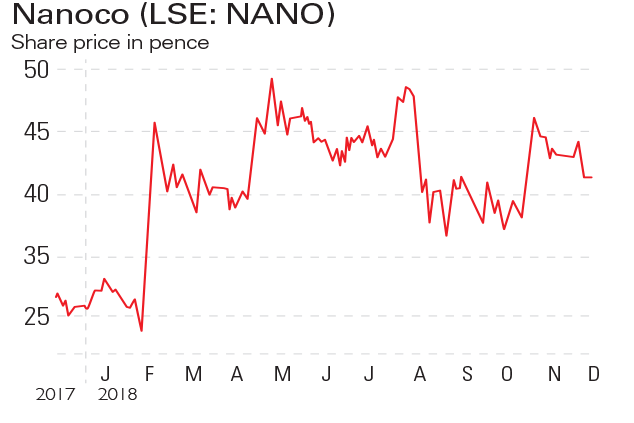

Nanoco (LSE: NANO) is a Manchester-based tech company developing the future of nanotechnology. It is working on quantum dots (tiny semiconductor particles) to improve everything from bio-imaging to the colours of LCD displays on your computer, TV or smartphone. "We've worked really hard to keep all costs within the business down," chief executive Dr Michael Edelman said after announcing a £2m rise in the group's cash position in the first and second quarter. Nanoco grew its revenues 150% last year and the stock has gained 50% in 12 months.

Be glad you didn't buy...

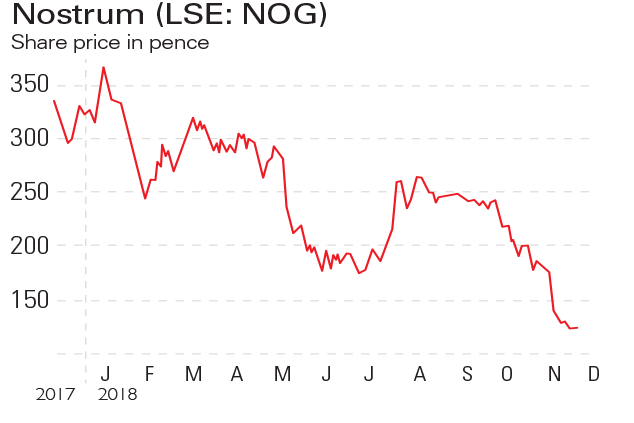

Nostrum (LSE: NOG) explores and produces oil and gas in the Pre-Caspian Basin of western Kazakhstan. The company hit trouble earlier this year when it faced "unexpected challenges", with water flowing into the wells along its gas-producing reservoir. Volatility in global oil prices has made matters worse. Nostrum announced plans last week to reduce the number of active drilling rigs from three to two. The past year has seen the share price slump by 63% as the group made a loss of $23.8m, while net debt has climbed above $1bn.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Madeleine is a journalist in based in Tokyo. She is a former contributor for MoneyWeek, covering stock markets, art and travel, and is a former investment writer for The Financial Times. Her work has appeared in titles including The Week, Investors Chronicle and the NME.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how