The charts that matter: Powell takes a telling from Trump

In a week when the US Federal Reserve turned dovish on interest rates, John Sepek looks at what that means to the global economy’s most important charts

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We have a new podcast this week, and exciting news the audio is now vastly improved. So if you haven't listened to it already (or gave up previously) then please do have a listen now. It's about 20 minutes of Merryn and I talking about the Brexit deal does it do what we want it to? And what happens if it doesn't get past parliament?

If you missed any of this week's Money Mornings, here are the links you need.

Monday: Britain is now uninvestable which probably makes now a good time to buy

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: Will Jerome Powell toss markets a bone, or leave them hungry?

Wednesday: Oil was my 2016 "trade of the lustrum" but should you keep holding on?

Thursday: This is the most important central bank story of the week so far

Friday: What could China and America's clash at the G20 mean for your money?

Don't miss this week's issue of MoneyWeek magazine in which we look at the state of global property markets if you're not already a subscriber, sign up here now.

And now over to the charts.

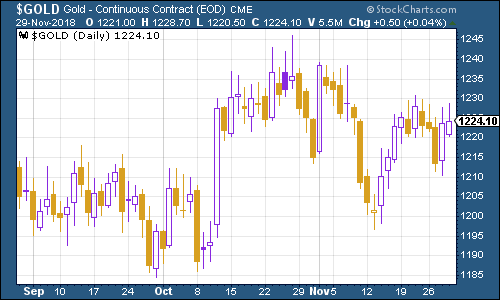

Gold (measured in dollar terms) remained around $1,220 an ounce. The big news this week was that the US Federal Reserve started to waver on raising interest rates. The trick for gold though, is when investors start to believe both that the Fed is going to go easy on inflation, and that inflation is also going to take off. They're not there yet. Instead, the idea that the Fed might stop raising interest rates earlier than expected has everyone worried about a slowdown or even recession.

(Gold: three months)

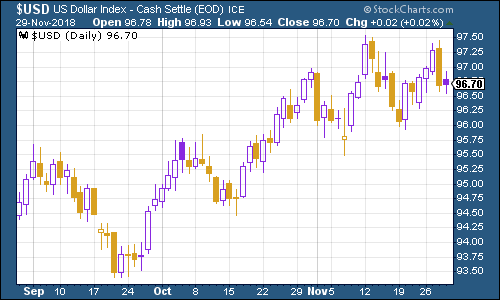

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell back as the Fed looked as though it might not go ahead with as many rate hikes next year as markets had previously expected.

(DXY: three months)

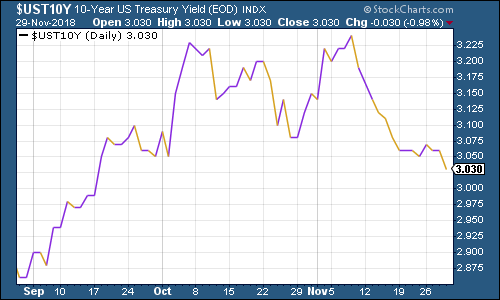

Hopes that the Fed will go easier on rate rises also saw the yield on the ten-year US Treasury bond decline, although it continued to hold out above 3%.

(Ten-year US Treasury yield: three months)

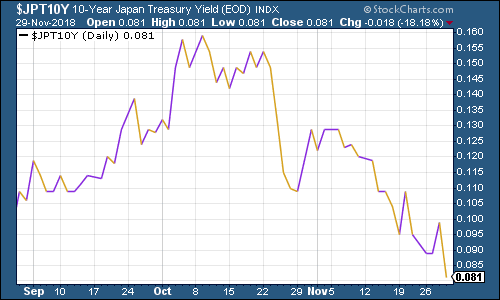

The Japanese government bond (JGB) yield headed lower too.

(Ten-year Japanese government bond yield: three months)

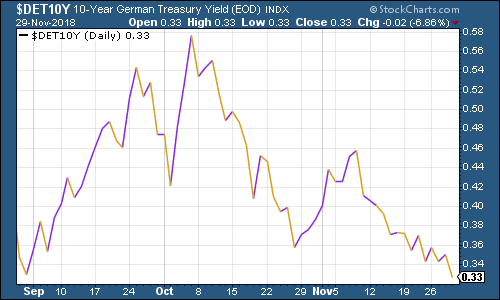

Ten-year German bund yields (the borrowing cost of Germany's government, Europe's "risk-free" rate) hit their lowest levels in months as eurozone inflation coming in lower than expected. On the upside, "lo spread" the gap between Italian and German bund yields slipped below three percentage points to the lowest level since early November. The market is now expecting Italy to compromise sufficiently on its budget to avert any major battles with the EU for now.

(Ten-year bund yield: three months)

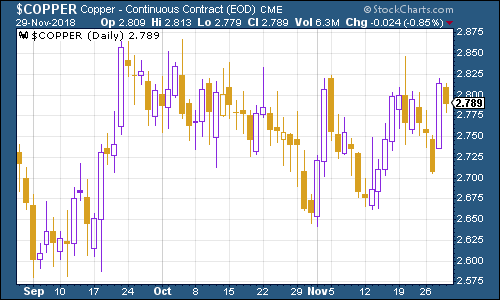

Copper is continuing to hold up. It'll be interesting to watch what happens to the copper price in reaction to the G20 meeting this weekend. I'd expect copper to do well if it looks as though tariffs are going to be lower than expected.

(Copper: three months)

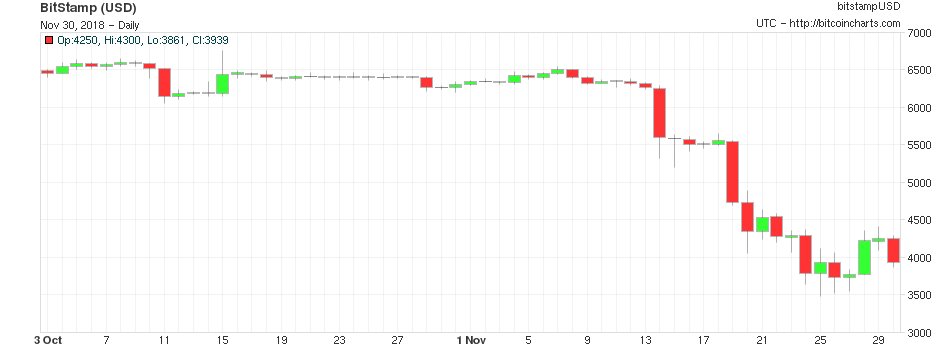

Cryptocurrency bitcoin showed some signs of rallying this week. I suspect it might be something to do with the general rally in risk assets, although I still would hesitate to say that I have any real idea of what drives the bitcoin price from one month to the next.

(Bitcoin: two months)

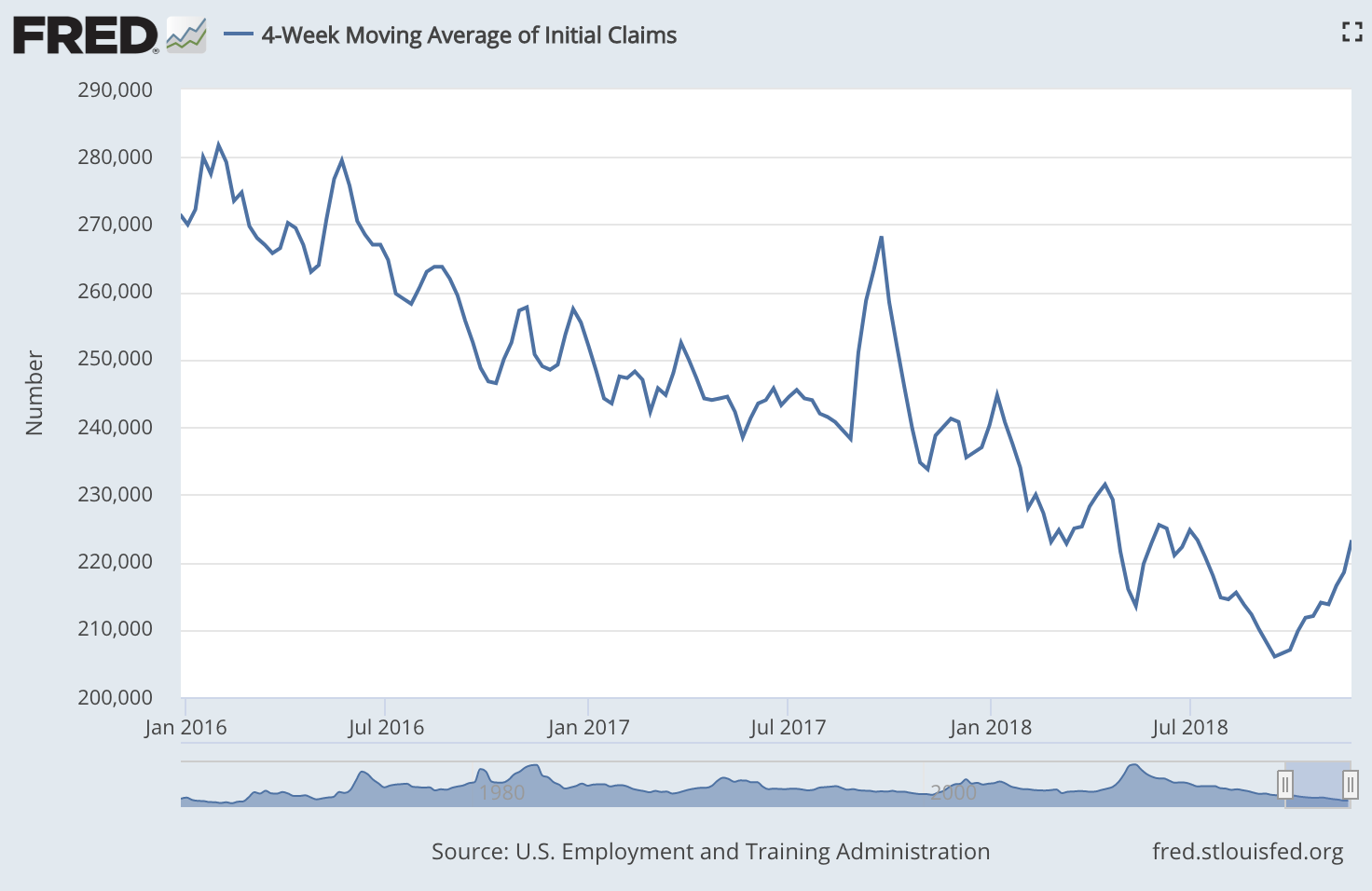

Hmm this next chart is getting interesting. The four-week moving average of weekly US jobless claims headed higher again, to 223,500, as weekly claims came in at 234,000. That was the highest level since May and it's the third gain in a row.

Now, there are good reasons to take this data with a pinch of salt. Thanksgiving is pretty disruptive for a start. And of course, there's Christmas shortly, too. So we shouldn't read too much into this data.

But it is starting to look like and I say this tentatively we might have reached a trough for this cycle. Maybe it won't hold, but let's watch this number really closely. It's important.

As David Rosenberg of Gluskin Sheff has noted in the past (admittedly reading from a small sample size), the stockmarket usually does not peak until after we've seen jobless claims (as measured by the 4-week moving average) hit rock bottom for a cycle. On average, the peak follows about 14 weeks from the trough for jobless claims. A recession follows about a year later.

So if mid-to-late September was the bottom, that would imply a market peak around late December, or the start of next year. Just enough time for a quick, Fed-inspired blast of exuberance in the run up to Christmas, then.

(US jobless claims, four-week moving average: since January 2016)

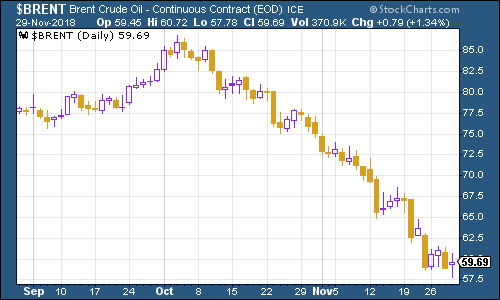

The oil price (as measured by Brent crude, the international/European benchmark) continued its descent. Dominic talked about the oil price in Money Morning this week he tipped it as one of his favourite trades for a five-year time horizon back in 2016. It was a good tip, but how is he feeling about it now?

(Brent crude oil: three months)

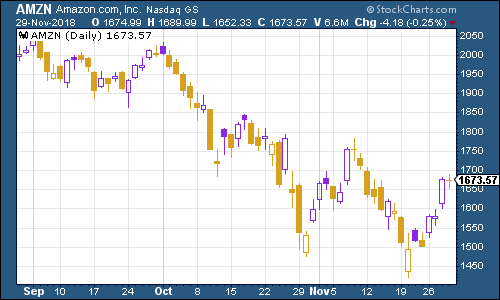

We saw a significant rebound for internet giant Amazon. The turnaround in the Fed's attitude definitely helped but the rebound was already underway as people who failed to get in before decided that now was their opportunity to "buy the dip" on the stock you won't get fired for owning.

(Amazon: three months)

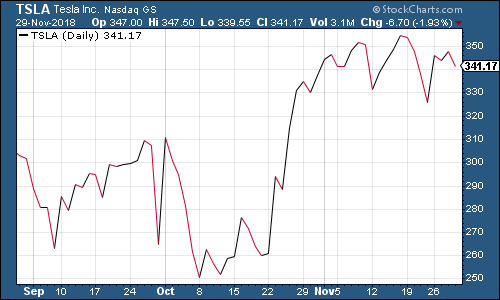

Electric car group Tesla is also still doing well. Investors are hopeful that the company can maintain production and profitability. What's interesting though is that its bond prices continue to struggle. Bond investors do tend to focus on risk rather than upside (mainly because unlike equity investors, their upside is fixed). Although that begs the question if you're focused on risk, why do you own Tesla bonds in the first place?

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how