XP Power has plenty in the tank

The slump in XP Power's share price is absurdly overdone. Investors should seize this buying opportunity.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investors should never pay too much attention to short-term share price movements. But in the case of XP Power (LSE: XPP) it is hard to ignore the slump from £36 in July, when the company reported half-year results, to roughly £22 today. This decline is an absurdly harsh verdict on a growing, highly profitable business, cementing its foothold in its industry.

XP Power's market value has dropped by more than a third, apparently because of a temporary shortage of components for the power converters it manufactures. These include industrial versions of the AC/DC power adapters used in electrical goods, and converters that increase or reduce the DC power in industrial equipment. Not only is XP paying more for parts, but it is also buying more of them to make sure it can meet demand.

Small hiccup

Even in the short-term, the impact of the increase in costs is likely to be muted, easily absorbed by XP Power's fat profit margins and growing revenues. The company expects to wind down the extra inventory over the next six to nine months, and on a like-for-like basis, ignoring the positive contribution from two acquisitions and exchange-rate movements, revenue for the first nine months of the current financial year was 11% higher than the same period in 2017. XP Power also took 8% more orders, like-for-like, in this period.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

For an investor to be greedy when others are fearful requires a high degree of confidence in a business and the way it is being managed. XP Power does not publicise the names of its customers, but ask the company quietly and it will reveal dozens of large multinationals. It says it is the market-leading supplier of power converters to industrial and medical equipment manufacturers in the USA, where it had 11% of the market in 2017, and Europe, where it had 11%.

Because XP already imports directly from Asian factories into a warehouse in Germany, the impact of potentially greater trade friction between the EU and the UK post Brexit should be minimal.

XP's strong market position is all the more remarkable because over the last decade it has changed business model. Before 2006 it was a distributor. The company opened its first factory near Shanghai in 2009 and a second in Ho Chi Minh City in 2012, where it is building a third factory on the same site. Today, 78% of sales stem from products XP Power designed to be small, so they are easy to fit in machines, and efficient. Efficiency not only reduces the running costs of equipment, it improves reliability because efficient power converters do not require fans to cool them. Since fans are mechanical parts, they are prone to failure. Reliability is critical because component failure could interrupt an operation or halt a production line.

Highly profitable business

By designing new product lines and acquiring manufacturers of different kinds of power supply, XP Power has earned an average return on capital of 30% over the past decade, and average profit margins of 15%. The trick has been to supply more converters to the same large customers.

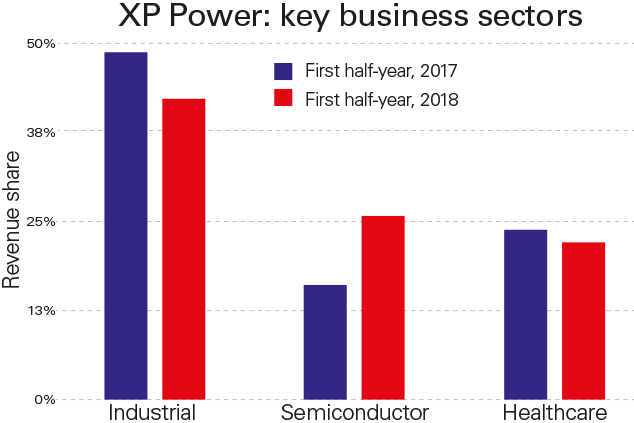

The company's latest acquisitions mostly supply producers of semiconductor manufacturing machines, an industry with a cyclical reputation. XP's exposure to this industry has thus risen rapidly in the past year (see below).

However, several factors shield XP Power's profitability from swings in demand. It can take two or three years to design an adapter for a machine, test it and approve it, so once a manufacturer has given an XP Power adapter the nod, it is unlikely to swap the product for a cheaper alternative.

What's more, the semiconductor cycle has hitherto tended to follow product launches rather than the overall business cycle. That prevents XP's sales and earnings becoming too volatile. The impact of individual products such as smartphones may be falling anyway as semiconductors become ubiquitous in factories and homes. Demand from healthcare, meanwhile, is stable. At £22, XP Power is valued at about 15 times earnings in the year to December 2018, after adjusting for the small amount of debt it carried at the year end.

Kicking the tyres... clear communication convinces

On the face of it, XP Power should be a difficult company for private investors to get to know well. The products are embedded in equipment manufactured by other firms, and to attend the annual general meeting you would have to travel to Singapore, where the company is domiciled.

Fortunately XP Power explains itself very clearly in publications such as the annual report. As all writers know, to explain something clearly you must first understand it, so clarity is a good sign management are on top of things. But clarity tells us more than that. A company confident enough to expose its strategy to competitors probably believes the strengths on show will discourage copycats, rather than show them how to compete. Given XP Power's commitment to quality, it may be possible for another Asian manufacturer to run factories more cheaply, for example even though XP-Power manufactures exclusively in low-cost economies. But could this rival also set up a global technical sales force sufficient to elbow XP Power which boasts 32 offices around the world out of customers' factories?

XP Power's marketing brochures, published on the company's website, are imbued with the same clarity. Investors seeking to know it better will find much to reassure them in what the company tells its customers.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Beddard founded an investment club before joining Interactive Investor as an editor at the height of the dotcom boom in 1999. in 2007 he started the Share Sleuth column for Money Observer magazine, which tracks a virtual portfolio of shares selected for the long-term by Richard. His career highlights include interviewing Nobel prize winners, private investors and many, many company executives.

Richard is freelance writer who invests in company shares and funds through his self-invested personal pension. He has worked as a teacher and in educational publishing, and is a governor at University Technology College, Cambridge. He supports the Livingstone Tanzania Trust, a charity supporting education and enterprise in Tanzania.

Richard studied International History and Politics at the University of Leeds, winning the Drummond-Wolff Prize for "distinguished work in the field of international relations".

-

How should a good Catholic invest? Like the Vatican’s new stock index, it seems

How should a good Catholic invest? Like the Vatican’s new stock index, it seemsThe Vatican Bank has launched its first-ever stock index, championing companies that align with “Catholic principles”. But how well would it perform?

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up