The charts that matter: crypto cracks

As the cryptocurrency bitcoin continued to crash this week, John Stepek looks at the charts the matter to the global economy to see where things might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

No new podcast this week, but if you haven't yet listened to the two from last week, now's the time to catch up Merryn talks to demographics and chemicals expert Paul Hodges about globalisation and the slide in the London housing market, and Merryn and I discuss China and globalisation here.

And if you missed any of this week's Money Mornings, here are the links you need.

Monday: Is this the beginning of the end for bond markets?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tuesday: The world's most important stocks are now in a bear market

Wednesday: Bitcoin will survive but it could easily fall to $3,000

Thursday: Watch the oil price closely it could herald a market rebound

Friday: What's next for Italy?

Don't miss this week's issue of MoneyWeek magazine (in which I've talked about how Brexit could affect your finances) if you're not already a subscriber, sign up here now.

And now over to the charts.

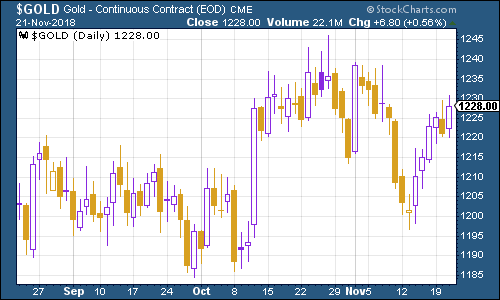

Gold (measured in dollar terms) has had a reasonable week, heading up to around $1,220 an ounce. The US Federal Reserve still shows few signs of wilting under market pressure, but investors are nervous enough to see gold as a worthwhile safe haven.

(Gold: three months)

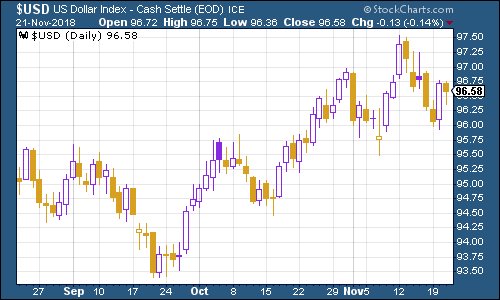

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners remained strong but relatively flat this week. Many in the markets are now hoping against hope that the Fed will turn from its relentless path of hiking rates - expect there to be much gnashing of teeth if they don't.

(DXY: three months)

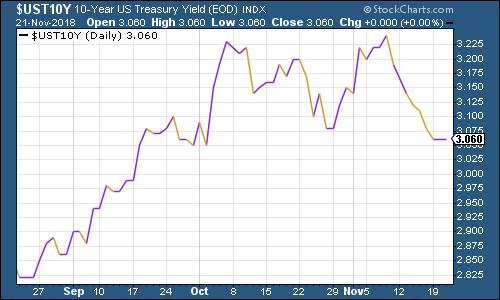

Markets jitters saw the yield on the ten-year US Treasury bond decline, although it has held out above 3%.

(Ten-year US Treasury yield: three months)

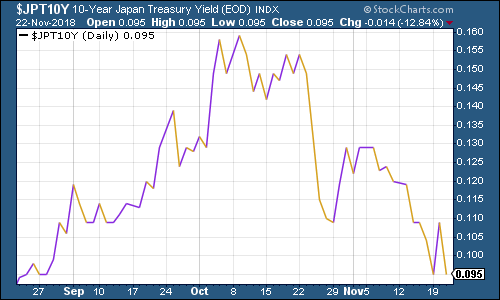

The Japanese government bond (JGB) yield headed lower as investors fled to safety from riskier assets such as equities.

(Ten-year Japanese government bond yield: three months)

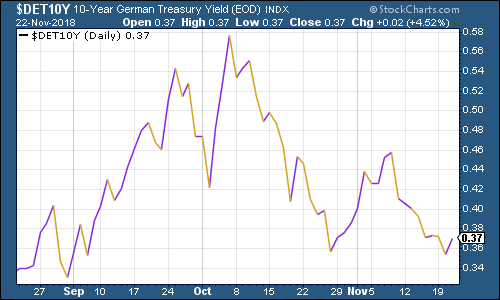

Ten-year German bund yields (the borrowing cost of Germany's government, Europe's "risk-free" rate) remained low amid tension over Brexit and general risk-averse behaviour in the wider market.

(Ten-year bund yield: three months)

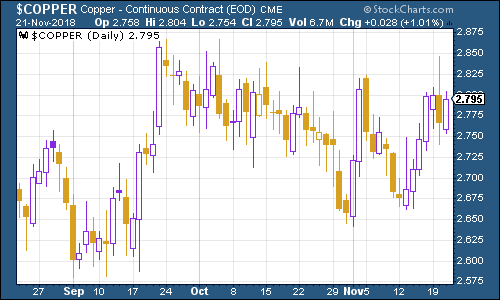

Copper is continuing to hold up, which is intriguing, given that lots of other economically-sensitive assets have gone over the cliff edge in the last few weeks. Perhaps it's because copper slid first, but its resilience over the past few weeks is something to keep an eye on.

(Copper: three months)

Cryptocurrency bitcoin continued to crash this week. My colleague Dominic Frisby - who knows more about bitcoin than most - noted this week that this sort of crash has not been unusual in the short lifetime of the asset. Read more here.

(Bitcoin: three months)

On US employment, the four-week moving average of weekly US jobless claims headed higher again, to 218,500. Meanwhile weekly claims came in at 224,000, the highest level in about four months.

As David Rosenberg of Gluskin Sheff has noted in the past, the stockmarket usually does not hit its peak until after we've seen jobless claims (as measured by the 14-week moving average) hit rock bottom for a cycle. You can't read too much into this because of the small sample size, but Rosenberg has observed that the stockmarket peak usually follows about 14 weeks from when jobless claims bottom, and a recession follows about a year later.

In other words, if we've already seen the bottom for this cycle in mid-to-late September then that would imply a market peak around late December, or the start of next year. Worth keeping an eye on - and maybe we've already seen it, although I'm not 100% convinced of that as yet.

(US jobless claims, four-week moving average: since January 2016)

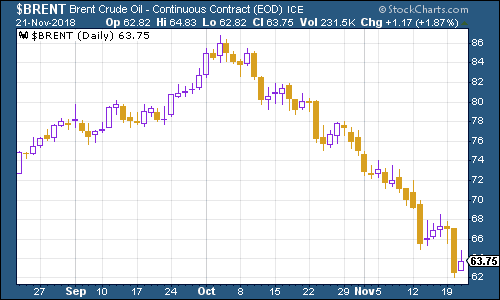

The oil price (as measured by Brent crude, the international/European benchmark) continued to fall. We talked about this earlier this week, but the short version is that markets have U-turned from worrying about the supply of oil drying up to fretting that there's now a glut of it. If the price falls a lot further from here I'd expect that story to change.

(Brent crude oil: three months)

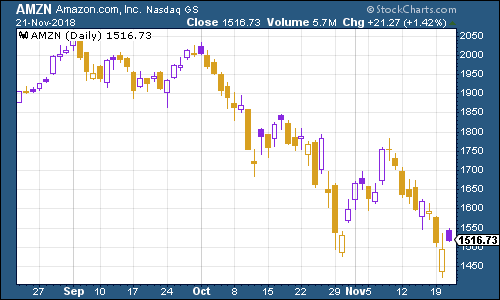

Internet giant Amazon continued to fall as FAANG stocks remained out of favour. They have been the market leaders and now that sentiment has turned, they're among the hardest hit stocks. Don't be surprised if people start "buying the dip" though, as there will be a fair few investors out there who missed their chance to get in and will see this as an opportunity.

(Amazon: three months)

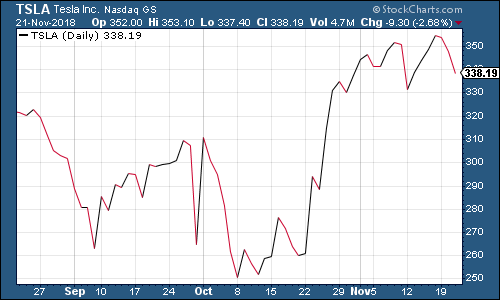

Electric car group Tesla remains popular, despite the tech crash. It's another fascinating example of how markets can change their minds about a stock practically overnight.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how