Trouble at the top of the market

Shares in asset managers have had a bad year, says Cris Sholto Heaton. That could be an early sign the long boom is over.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Shares in asset managers have had a bad year. That could be an early sign the long boom is over.

The adage "buy the manager, not the fund" usually implies you should look at the track record of the person who will be managing your money, rather than the record of the fund itself. The aim is to avoid being lured by funds with a good long-term record that have recently changed manager for the worse. But an equally logical interpretation might be to buy shares in investment managers rather than the funds they run. That's because a bull market will encourage more people to invest, which will be good for these firms' assets under management and their earnings. As a result, they should outperform the wider market during a boom.

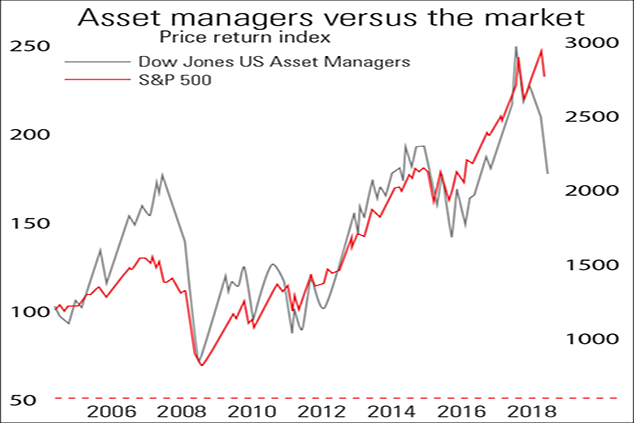

For example, the Dow Jones US Asset Managers index (most of the biggest listed asset managers are in the US) rose by almost 70% between the start of 2005 and the end of 2007, compared with a return of around 20% for the S&P 500. It was a similar story between 2012 and 2014. Meanwhile, these companies often lagged the index during the choppy phases we saw in the 2009-2011 recovery and 2015-2017 and they did much worse during the crash in 2008.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So it may seem odd that asset managers have performed so poorly over the past year at a time when markets, if not booming, have been fairly solid until recently. The Dow Jones US Asset Managers index is down by more than 20% so far, compared with a 2.5% gain for the S&P500.

The most likely explanation is that markets are increasingly worried about the long-term profitability of asset managers and for good reason. First, they are seeing downward pressure on management fees, as big institutional clients and retail distribution platforms demand better deals.

That's good news for investors, but bad news for shareholders. Second, investors are continuing to shift their money from traditional actively managed funds into passive trackers such as exchange-traded funds. Even at diversified firms such as BlackRock, that have huge passive divisions and may see overall assets grow as a result, the lower management fees passive funds command will mean pressure on margins.

But another possibility is that the weakness in asset managers' shares is a leading indicator that the bull market is running out of steam as was the case at the start of 2008. Certainly, recent results hint that investors are becoming less bullish. BlackRock's latest results showed inflows of $10.6bn into long-term funds last quarter, down from $75.8bn in the same period a year ago. It's too early to jump to conclusions but if you find yourself mulling whether it's time to sell asset managers, it's worth considering whether that's a signal you want to sell their funds (or other stocks) as well.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement today (3 March). What can we expect in the speech?