Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

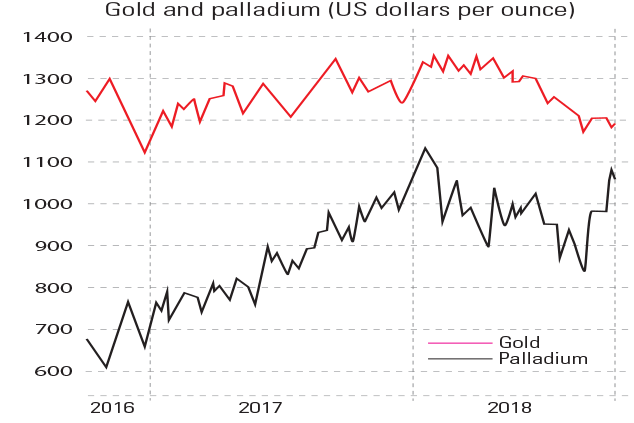

The price of palladium has had an impressive climb of nearly 30% over the past six weeks. The shiny metal "could become more valuable than gold for the first time in 16 years", says Myra P. Saefong in Barron's. Futures prices for palladium have jumped to $1,072 an ounce, while gold costs $1,188.

Palladium is used in catalytic converters in petrol-powered vehicles. Its sister metal platinum is more commonly used in catalytic converters for diesel engines. But demand for diesel cars has slipped in recent years owing to concern over pollution and the Volkswagen emissions scandal of 2015. Automotive demand for palladium, however, is expected to rise to a record high of 8.6 million ounces this year.

Viewpoint

We usually pay for what we consume. Yet this principle doesn't apply to flight tickets. If it did, they would be priced according to passengers' weight to reflect the space they take up, the burden they place on the plane, and the aviation fuel they consequently burn. It seems especially odd not to explore this idea when we pay for food, luggage and extra legroom already. These reflect various costs for the airline, but the biggest cost, transporting the human body, is not taken into account. Yet it's hardly an outlandish idea. People are already expected to take a degree of responsibility for their own body. In private health insurance those who choose to live a lifestyle that poses risks to their health pay higher premiums. And the technology is there. Software can gauge people's approximate weight based on their shoe and clothing purchases; Airbus holds a patent for a plane seat that can be adjusted for width.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Miriam Meckel, WirtschaftsWoche

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how