If you’d invested in: Next and Superdry

Shares in clothing retailer Next soared last September after the firm reassured investors with a “modest” profit upgrade.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

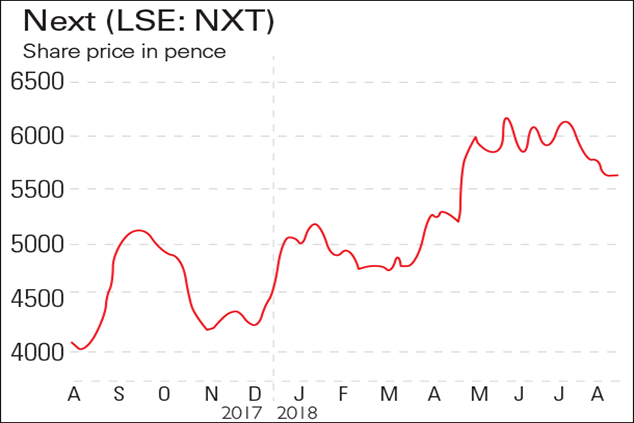

Shares in clothing retailer Next (LSE: NXT) soared last September after the firm reassured investors with a "modest" profit upgrade. They then slipped in October after Next warned that sales remained "extremely volatile" and would probably decline.

In May Next raised its full-year profit forecast from £705m to £717m as the sunny weather boosted quarterly sales; full-price sales in the 14 weeks to 7 May rose 6% as an 18.1% increase in online sales offset a 4.8% decline in stores. Still, Next doesn't expect to see similar growth rates again this year.

Be glad you didn't buy...

Superdry (LSE: SDRY)

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

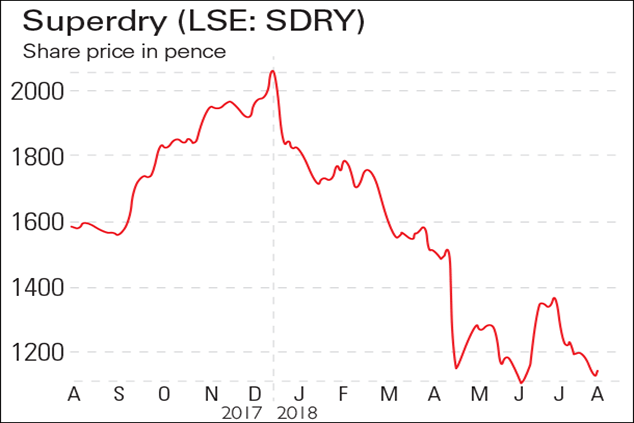

In May they fell again as Superdry revealed that sales in its shops fell 6% year-on-year to £86.1m in the three months to the end of April, partly because of cold weather. Investors were also spooked by the retailer's forecast of only "high single-digit" revenue growth in its new financial year; the firm has warned of "challenging conditions".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn