If you’d invested in: Johnson Matthey and Randgold Resources

Johnson Matthey is a platinum chemicals specialist and last September, its shares soared.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

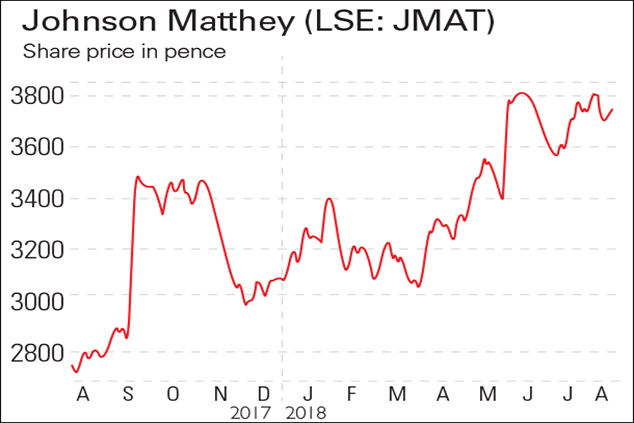

Johnson Matthey (LSE: JMAT) is a platinum chemicals specialist. Its shares soared in September as the firm, which generates 60% of its sales from making catalysts for car exhausts, revealed plans for a £200m investment in battery technology for electric vehicles.

In May the group reported that full-year pre-tax profit fell 31% to £320m after £90m of costs related to restructuring and a £50m charge to settle a legal dispute with a US carmaker. The shares rose nonetheless as investors concentrated on the firm's increased focus on electric-car batteries.

Be glad you didn't buy...

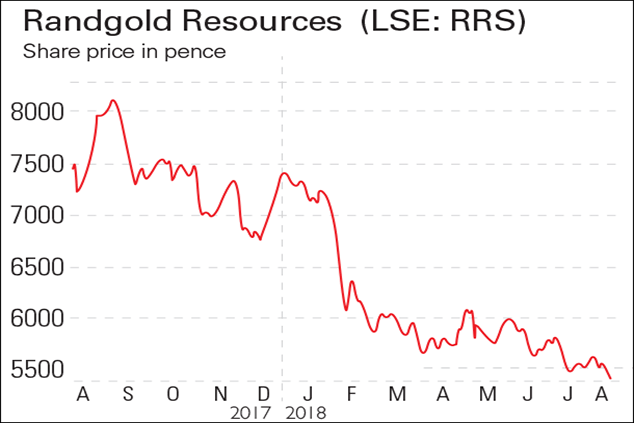

Randgold Resources (LSE: RRS) is the biggest gold miner listed in London. In February it said it would double its dividend after it saw a 5% annual increase in production to 1.32 million ounces of gold in 2017. Profits also rose by 15% to $335m.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yet the shares crashed as CEO Mark Bristow said the firm was prepared to take legal action if a new mining code in the Democratic Republic of Congo becomes law. Under the new code, which has now been approved by the country's parliament, miners will be subject to new royalty charges as well as a 50% super-profits tax.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how