Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

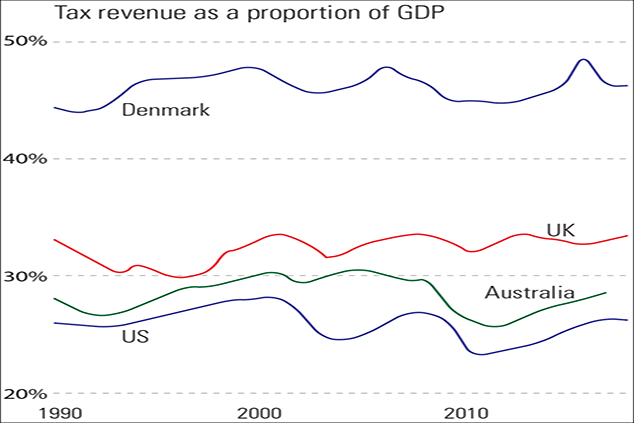

When it comes to taxation, our approach resembles our geography: we are somewhere between Europe and the US. The UK has the 22nd-highest tax-to-GDP ratio out of 80 countries, according to data from the OECD, an association of developed countries. In 2016, total tax revenues in the UK came to 33.2% of GDP; the range was 10.8% to 45.9%.

This means the UK had a higher tax burden than the United States, Australia and Canada. Many European countries' ratios eclipse ours, led by Denmark (45.9%), France (45.3%) and Belgium (44.2%). Taxes on income and profits make up 11.9% of our GDP. Levies on goods and services comprise 10.7%, national insurance 6.3% and taxes on property 4.2%.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.