The charts that matter: the Bank of Japan shakes up government bonds

As Japan raises its cap on government bond yields, John Stepek takes look at how that affects the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

First things first if you're going to be in Edinburgh this month, don't miss the chance to see MoneyWeek editor-in-chief, Merryn Somerset Webb.

Merryn will be live on stage, debating everything from populism to economics to Brexit to Trump to Adam Smith, with a range of comedians, authors, and financial whizzes. Audience questions are actively encouraged, so book your tickets now (she's there from 16 to 25 August) before they sell out.

If you missed any of this week's Money Mornings, here are the links you need.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Monday:House prices aren't just slipping in the UK this is global

Tuesday:Big news even the Bank of Japan is starting to tighten monetary policy

Wednesday:The FAANGs are all different stocks but they'll all crash together

Thursday:Why you should give the US stockmarket the benefit of the doubt for now

Friday:A whole generation is about to learn that interest rates don't just go down

Merryn is knee-deep in planning her Edinburgh show right now, so we have no new podcast this week, but check out last week's if you haven't already particularly if you're not sure what a yield curve is or why it matters, or if you want to know what the real problem with British productivity is. Listen here.

And don't miss this week's issue of MoneyWeek magazine! If you're not already a subscriber, sign up here now.

And now over to this week's charts.

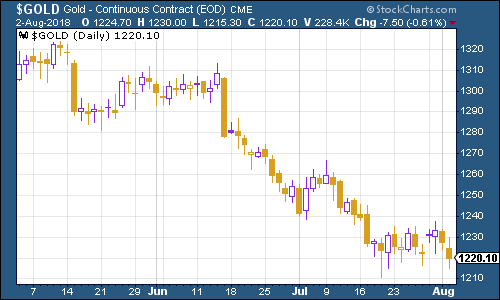

It's been another poor week for gold. Interest rates are rising around the world, and as long as that's happening while inflation remains relatively quiet, gold will struggle. I don't expect that to continue in the longer run, but we'll see.

(Gold: three months)

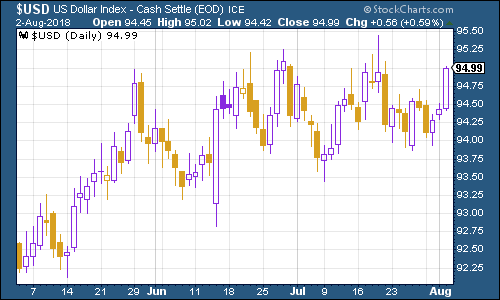

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners had another good week, what with the Federal Reserve remaining confident in the economy. Also, rising bond yields tend to attract more money to the dollar (due to the higher yield). More on that below.

(DXY: three months)

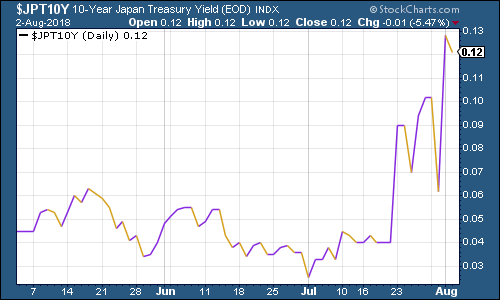

Again, this week, the Japanese government bond (JGB) yield was important. The Bank of Japan said that it will now allow the yield on the ten-year JGB to rise to as much as 0.2%, rather than the earlier cap of 0.1%. So of course, as you can see in the chart below, bond investors have immediately started to test that cap.

(Ten-year Japanese government bond yield: three months)

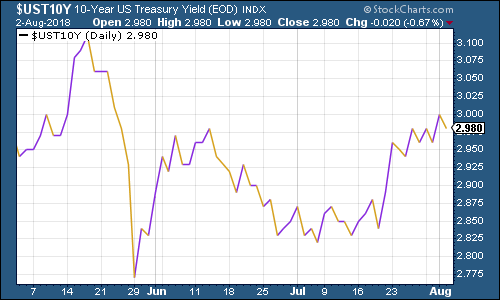

That's had a knock-on effect elsewhere in the world. The yield on the ten-year US Treasury bond perked up this week too briefly pushing above 3%.

(Ten-year US Treasury yield: three months)

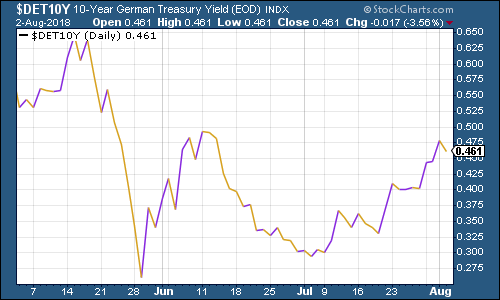

Meanwhile, the yield on the ten-year German bund (the borrowing cost of Germany's government, which is Europe's "risk-free" rate) also followed the US higher.

(Ten-year bund yield: three months)

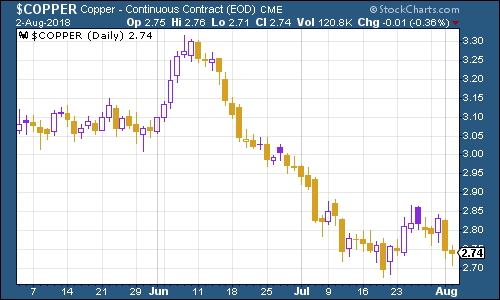

Copper fell back again this week and this is despite the fact that strike action at BHP's giant Chilean copper mine, Escondida, seems likely. It looks as though fear over a potential trade war between the US and China which just isn't going away is having a much bigger impact on the copper price right now.

(Copper: three months)

After bouncing back during July, August appears to be starting badly for cryptocurrency bitcoin. New York Times columnist and high-profile economist Paul Krugman argued that cryptocurrencies don't solve any problems for the monetary system and that it could collapse. That said, Krugman is famous for (slightly jokingly, to be fair) arguing that the internet would have no more economic impact than the fax machine.

(Bitcoin: three months)

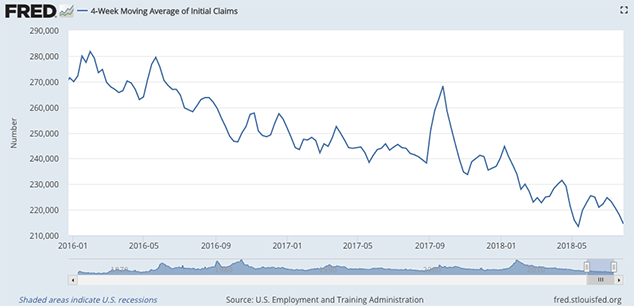

On US employment, the four-week moving average of weekly US jobless claims fell to 214,500 this week close to a new low for this cycle while weekly claims rose very slightly to 218,000.

David Rosenberg of Gluskin Sheff notes that, in the past, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), then a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough of 213,500 about two months ago, so if there's anything to Rosenberg's observations (which are of course drawn from a limited pool of past cycles), then we should see the stockmarket hit new highs before this cycle is out, and so far that's already happened with the Nasdaq index.

But given that we're down to 214,500 now, we could easily set a new trough soon.

(US jobless claims, four-week moving average: since January 2016)

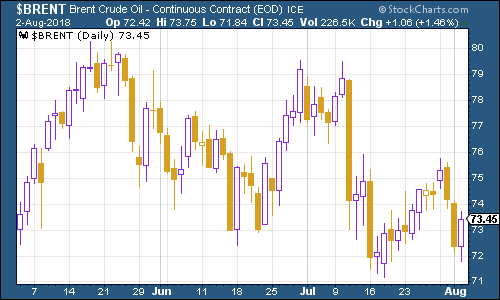

The oil price (as measured by Brent crude, the international/European benchmark) has been rattling around the low $70 a barrel this week. US inventories rose sharply this week, surprising investors. Russia and Saudi Arabia may also be under pressure to pump more to prevent shale producers from grabbing a higher export share.

(Brent crude oil: three months)

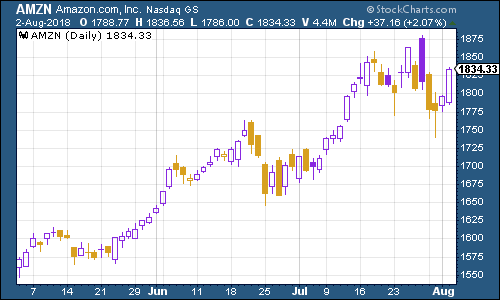

Internet giant Amazon this week officially lost the race to become the world's first $1trn market cap company that honour has gone to Apple. Still, Jeff Bezos won't be losing much sleep. He's still the richest person in the world.

And fascinatingly, as Bloomberg points out, his parents are almost certainly incredibly wealthy too, thanks to their son, who got them to invest nearly $250,000 in his company in 1995.

This came about as part of a series of meetings with family members and other potential investors that Bezos had in 1994, in an effort to raise $1m to start the company. He did warn his parents that there was a 70% chance that they wouldn't ever see the money again.

Anyway it's not necessarily a sensible way to invest (I'm hoping and assuming that they were already doing reasonably well in order to take a $250k angel investment punt on their son ruining your parents would make for some tricky future family gatherings) but it is a nice story.

(Amazon: three months)

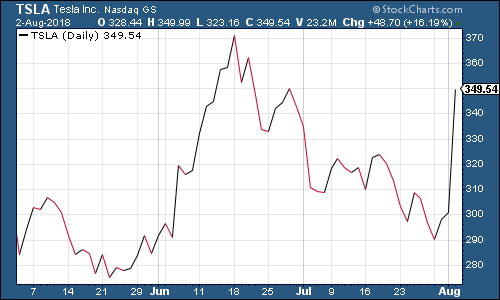

Electric car group Tesla recovered a lot this week as founder and CEO Elon Musk managed to behave himself during the company's second-quarter results. Musk apologised for being cheeky and evasive to Bernstein analyst Toni Sacconaghi on a previous conference call. Losses per share were higher than expected, but Tesla still expects to make a profit in the next two quarters, and also hopes to be producing 6,000 Model 3s by the end of the month.

I'm sceptical. But I wouldn't short Tesla. So many people are already doing it, that all it takes is for Musk to smile sweetly and doff his cap to a few analysts, and the share price rockets. He's a master showman, I'll grant him that.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge