The charts that matter: copper slides as trade war fears bite

Donald Trump has fired the opening shots in his global trade war. John Stepek looks at what that means for the charts that matter most to the world economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week's Money Mornings, here are the links you need.

Tuesday:All of us even the men can learn to be better investors

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wednesday:The most-hated metal in the world is due a comeback

Thursday:Why the US mid-term elections might spell good news for gold

Friday:The global trade war has kicked off

We haven't recorded a new podcast this week (Merryn's on holiday), but if you haven't listened to the most recent one, you'll find it here.

Over to this week's charts.

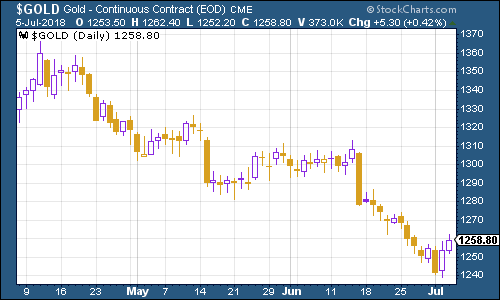

As I discussed in Money Morning earlier this week, gold has been struggling, although it did rebound somewhat from last week. The key for gold is for investors to expect inflation, but also to start expecting the US Federal Reserve to be more timid about raising rates than they currently believe it is.

(Gold: three months)

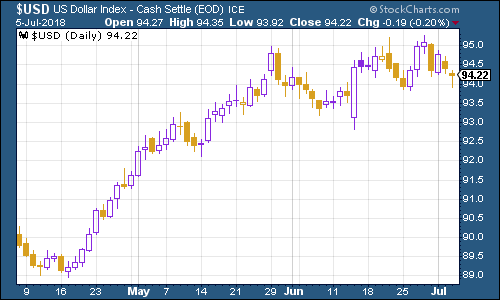

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners continues to be strong, but it weakened significantly this week. That's partly nerves over the prospects for the trade war worsening and also partly because the euro has strengthened this week (the euro is the biggest component of this particular dollar index).

(DXY: three months)

The yield on the ten-year US Treasury bond was again, virtually unchanged this week.

(Ten-year US Treasury: three months)

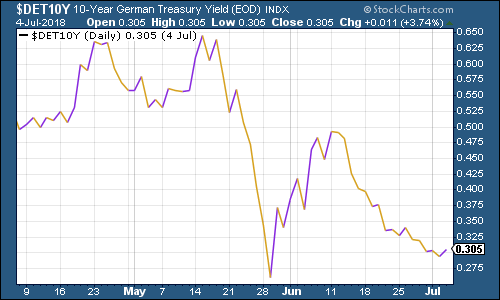

It was a similar story for the yield on the ten-year German bund (the borrowing cost of Germany's government, which is Europe's "risk-free" rate).

(Ten-year bund yield: three months)

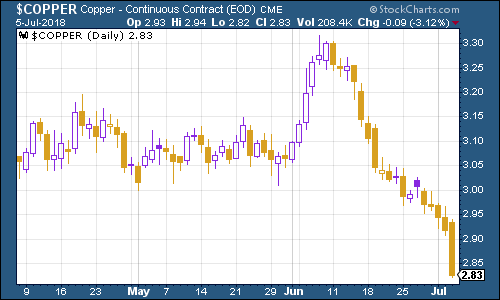

Copper just kept on sliding. Copper's nickname has long been "Dr Copper" (the metal with a PhD in economics). This isn't that reliable, in all honesty, but in terms of where concerns about the potential impact of the trade war on global growth are currently showing up, the chart below says it all.

(Copper: three months)

Bitcoin rebounded a little this week although I'm not sure you'd want to give it the benefit of the doubt yet. Capital flight from China appears to be the consensus opinion on the cryptocurrency's rally investors have been noting the decline in the yuan recently.

(Bitcoin: three months)

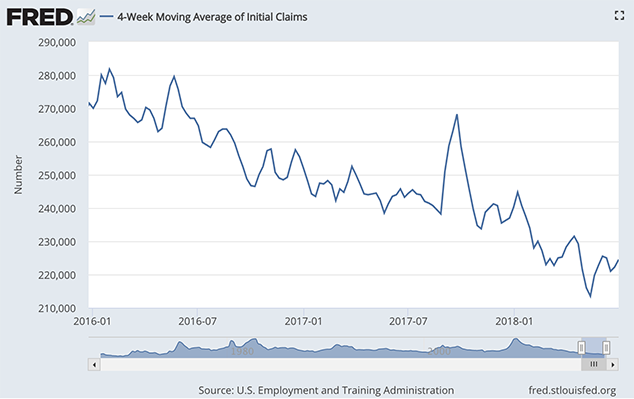

On US employment, the four-week moving average of weekly US jobless claims rose slightly to 224,500 this week, while weekly claims rose to 231,000. David Rosenberg of Gluskin Sheff reckons that on past history when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), then a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough about five weeks ago, so if there's anything to Rosenberg's observations (which are of course drawn from a limited pool of past cycles), then we should see the stock market hit new highs before this cycle is out.

Meanwhile, the monthly payrolls data came out on Friday afternoon. It showed that US employers added 219,000 staff to their payrolls last month, more than expected. And yet, average hourly earnings growth came in a little below expectations, at 2.7% (rather than the anticipated 2.8%).

The slow gains in wage growth are interesting, and increasingly hard to marry up with other data. For example, the "quit rate" the proportion of workers jacking in one job because they can find a better one elsewhere is now at its highest level since 2001. As The Wall Street Journal reports (and as you'd expect) those who switch jobs also enjoy bigger pay rises than those who stay in post.

This all points to a tight labour market. And it's certainly impacting on some employers. The WSJ highlights one packaging company that raised average pay by about 5% in order to hang onto staff. Others are having to recruit staff from outside their industries (and we're talking decent jobs here, like electricians) and train them up, simply to meet demand.

This is all good stuff. Higher wages are good news for both employees and the wider economy. But it does also point to higher inflation. This really is the number to keep your eye on over the coming months, and I would be surprised if we don't see it beat expectations handily at some point in the coming months.

(US jobless claims, four-week moving average: since January 2016)

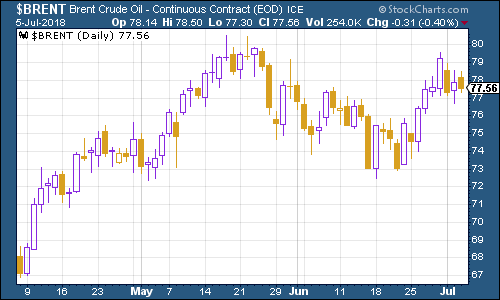

The oil price (as measured by Brent crude, the international/European benchmark) has remained around the $77 a barrel mark. The issue is this: Trump wants to completely shut Iran out of the global oil market. But he doesn't want the oil price to stay high ahead of the US mid-term elections. So he wants Saudi Arabia to pick up the slack.

Can Saudi do it? Will China and India agree to shut Iran out or will they take the opportunity to pick up barrels of Iranian crude on the cheap? It's another intriguing facet of the global trade tensions we're seeing right now and it's hard to see how that plays out.

(Brent crude oil: three months)

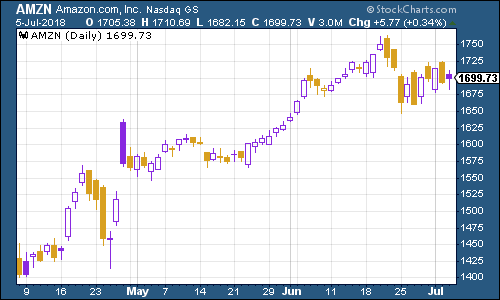

Amazon had a relatively quiet week. There's still talk of it perhaps one day becoming the first $1trn market cap company in the world.

(Amazon: three months)

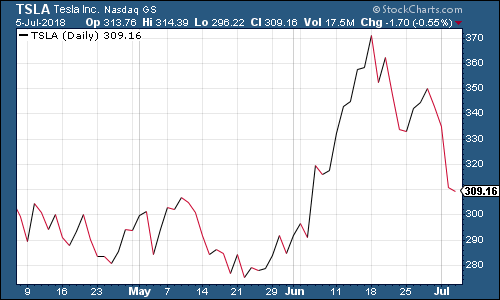

Electric car group Tesla had a pretty grim week share-price wise. The company managed to hit its target of producing 5,000 Model 3 sedans in a week. But there are a lot of concerns that it won't be able to sustain that. So basically, it was your standard "buy the rumour, sell the news" story.

On top of that, Elon Musk went off on one again about journalists being nasty to Tesla. To be clear, I am no die-hard defender of my own profession the vast majority of news is irrelevant, unnecessary mental clutter, and opinioneering is even worse. It's empty intellectual calories and consuming too much of it makes your brain feel bloated and distracted.

(Tesla: three months)

However, the tiny nuggets of genuine information, sound analysis, and truth-telling within this mountain of dross make it a necessary evil. And management teams in trouble have a long history of blaming "the media" and "short-sellers" most of those that do so end up proving the sceptics right.

By the way, on the electric car front, oil giant BP last week made an interesting move. It bought Chargemaster, which is the UK's biggest network of charging points for electric cars. It plans to add charge points to all of its petrol stations too.

You could argue that this still falls into the category of PR spending for BP it cost £130m, and forms part of the company's plan to invest around $500m a year into low-carbon investments. And it's true that making money from providing charge points, given that they're slow and that people would generally rather charge at home, is no easy thing. But combined with BP's investments in battery tech, you never know. At least they'll be in a better place to compete when and if the oil age finally comes to an end.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how